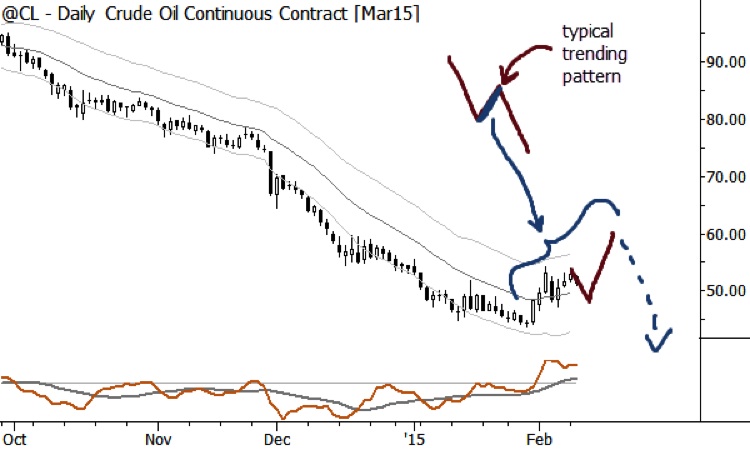

One of the biggest lessons of technical analysis is that it is important to understand how markets usually move. If we can do that, then it becomes possible (in some cases) to identify what the most probable future price path is for any market. Let’s consider crude oil in this context:

Crude Oil Corrective Retracement?

In trends, markets typically move in alternating bouts of with-trend strength, interspersed with retracements (or consolidations) against that trend. That’s essentially a principle of market behavior, and is one of the most common trending patterns. Crude oil has been in a substantial downtrend since at least October 2014, and perhaps longer, depending how you define the trend. The recent Crude Oil bounce appears to have suckered in a lot of buyers, since under $50 crude appears to be a “bargain” to many players. Furthermore, strength in crude is being offered as an explanation for recent strength in stocks. All of this could be very dangerous.

There is a high probability that this bounce is nothing more than a retracement in an intact downtrend. Look at the chart above, which makes this clear. Even more dangerous would be another small bounce in crude oil, perhaps extending another week or so. (This is fairly likely.) Even with that second bounce, we will still probably have only outlined a larger Crude Oil bounce against the trend, and there’s a good chance this market will turn lower again.

Understanding market structure like this can help you put your trades in context. If you are a short-term trader, there’s probably nothing wrong with buying oil here, but where is your stop? It doesn’t need to be under the January lows – that’s more of a profit target for bears. Conversely, if you are short here, you probably need to be prepared for the possibility of another Crude Oil bounce, perhaps even to stand ready to short into that bounce, with appropriate stops and risk controls. Understand your market. Know your risk. Plan your trade, and trade your plan.

Follow Adam on Twitter: @AdamHGrimes

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.