It has been almost one year since my last article, and it is probably a good thing I did not write much because any thoughts I might have laid out before March of this year would now be obsolete.

If you compare the price of the S&P 500 Index today (~$3000) versus a year ago (~$2900), you would think markets have taken a year-long nap.

Unfortunately, that is far from reality, and market prices today may be redefining the notion that one cannot judge a book by its cover.

Perhaps the best reference point to describe the magnitude of the change is that not even the March plunge and the subsequent dizzying recovery do it justice. If that were all that happened, we could write off the price volatility and VIX Volatility Index movement as just another one of the many panicky events we saw since the end of the Great Financial Crisis (GFC).

But what price levels do not show is that Covid and the subsequent reaction by corporations, have structurally changed what has been driving stocks since March of 2009.

The GFC, and, before that, the stock plunge which followed the blow up of the internet bubble and 9/11, ended when corporate credit markets re-opened and companies were again able to sell bonds to buy back stocks and engage in M&A and other types of financial engineering.

Based on data from the Federal Reserve Z.1 Flow of Funds Release (Table F.223), between 2009 and 2019, corporations were the ONLY NET BUYERS of stocks, to the tune of more than $4T. Every other market participant – hedge funds, individuals, pension funds, foreigners, anyone you can think of – in the aggregate did not increase their exposure to stocks.

This dynamic was the force behind the relentless 10-year equity bull market that no one believed in and many despised. And at the risk of triggering some people, if you are thinking that it was all about the Fed, QE and other conspiracy theories…as my daughter is fond of saying, “it’s between you and Darwin”.

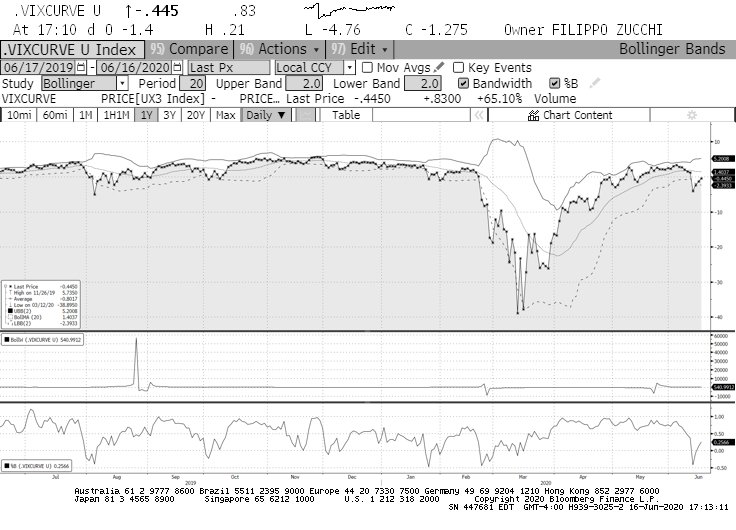

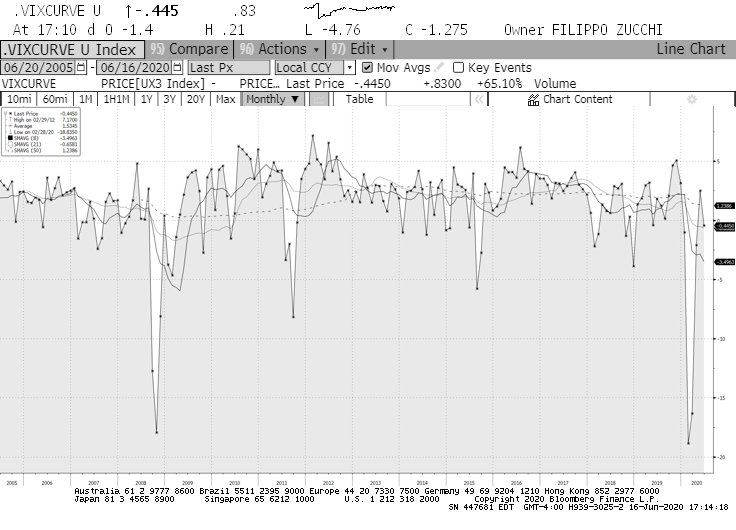

In any event, that dynamic changed overnight when the Covid panic hit. March 2020 was without a doubt the most violent period for the financial markets in the current lifetime, and perhaps ever. I will offer the chart of the 3-month VIX curve as one of the many examples of how the panic around a near financial collapse made ’08-’09 seem like a child’s game, and the latter was anything but.

To summarize the sea-change… from March 2009 to February 2020:

– Stock buybacks, M&A, and other financial engineering drove stock prices;

– The above were funded by cash flows and the sale of corporate bonds;

– Stock buybacks were the backstop to equity prices for every crisis the market encountered since 2009 – the near EU meltdown, the China rout, the collapse of energy, etc. During every single one of those events, the credit markets bent, but never broke. That was the real “put” under equities.

When COVID hit:

– Funding markets disappeared. Even the Treasury market nearly ceased to function.

– The Fed intervention saved what we have come to accept as “civil society”; feel free to disagree with me, but you will not convince me otherwise. The prices, and the speed of the moves I watched on my screens for the better part of March are stubborn facts, and nearly impossible to shape into subjective narratives;

– The Fed backstop and the $1T plus of dry powder in the hands of private equity funds allowed the debt markets to re-open, so much so that since March 1, 2020, companies have sold $1.1T of new bonds. By the end of June, total bond issuance will be within a whisker of all of 2019’s sales.

– But with the exception of a handful of companies, buybacks have disappeared. None of those bond proceeds will go toward buybacks and/or backstopping future equity air-pockets; even pre-announced buybacks have been shelved. Between 2017-2019 annual new buyback announcements averaged $711b, which translated in ~ $600b of net equity bids per year. That buying power, the ever present put that sustained the market for 25 years, vanished (probably for a long long time) in a matter of days. Excluding Apple’s $50b add-on to its program, since April 1, total new announced buybacks are an insignificant $4.1b.

– For the foreseeable future, bond sales will continue because companies need cash to survive, but juicing stock prices is now an afterthought. And I will not even touch on how buybacks have become a politically toxic subject.

So, who will replace the companies’ stock bid? Anyone? If not, what will move stocks in a post-Covid world? I will not venture a guess. The framework that guided equities for the last 25 years revealed itself over a long stretch of time. I believe the new blueprint will take just as long before it will be understood.

However, some of the tells I will be focusing on are:

– Credit spreads: they will not help to fund buybacks, but they absolutely will inform us of the broader level of risk for equities, especially after companies have gorged on trillions of new debt.

– Micro and Macro fundamentals: what often frustrated fundamental investors (not to mention value investors) for decades is likely to become very relevant again. Once the aftershocks of the March crash subside – valuations, earnings, cash flows, balance sheets, growth rates, etc., may again rise to the top of what moves a stock. And all those who for years screamed that the markets were “rigged” because they did not reflect the “real economy” may get their chance to say “I told you so”. Better later than never I suppose.

– Government Policy/Inflation: Todd Harrison recognized way ahead of anyone I know that the internet would be the greatest deflationary force ever. The political and social drive toward globalization added its own crushing blow to pricing power as competition literally went global. Fast forward to the current populist/protectionist/nationalistic wave going around the world and the backlash against “big tech”. If the pendulum swings the other way, it is easy to envision costs of goods (especially labor inputs) rising fast, and decreased competition putting even more upward pressure on prices. Add a swelling money supply, and you have all the ingredients for a bad bout of inflation. Let me be clear: inflation is not today’s worry; but any whiff of it down the road would throw markets for a loop.

The above are all “big picture” / long term thoughts. I am deliberately avoiding guesses as to where stocks will be in a month or two or three (I am trading what is in front of me with no bias), because, the way I see it, COVID is the equivalent of a financial asteroid hitting the planet. The blast may have dissipated but the damage will prove profound. Assimilating the changes such damage will bring about will prove much more profitable than guessing the direction of the next 10% move.

Twitter: @FZucchi

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.