The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- S&P 500 EPS growth for Q2 2023 is set to come in at -5.2%, the lowest rate in nearly 3 years and the third consecutive quarter of negative earnings growth

- Potential surprises this week: UPS

- This is the final peak week of Q2 earnings season with nearly 3,000 companies expected to report

A better-than-expected report from Amazon saved a sliding market late last week. After notching three consecutive days lower, the S&P 500 rebounded on Friday after a stellar earnings report from the tech behemoth. Booking Holdings also impressed investors Thursday after-the-bell with a Q2 report that showed the demand for travel amongst US consumers remains strong. And while Nonfarm Payrolls came in light, average hourly wages notched higher, increasing 0.4% for the month and 4.4% YoY, just above analyst estimates.

The overall S&P 500 blended EPS growth rate improved to -5.2% from -7.3% the week prior, according to FactSet data. This would still be the lowest growth rate since Q3 2020, but it’s a marked improvement from the prior two weeks.

Potential Earnings Surprises this Week – UPS

This week we get results from a number of large companies on major indexes that have pushed their Q2 2023 earnings dates outside of their historical norms. Four companies within the S&P 500 confirmed outlier earnings dates for this week, all of which are later than usual and therefore have negative DateBreaks Factors*. Those four names are Coterra Energy (CTRA), Celanese Corporation (CE), Insulet Corporation (PODD) and United Parcel Service (UPS). According to academic research, the later than usual earnings dates suggest these companies will report “bad news” on their upcoming calls.

United Parcel Services (UPS)

Company Confirmed Report Date: Tuesday, August 8, BMO

Projected Report Date (based on historical data): Tuesday, July 25, BMO

DateBreaks Factor: 3*

UPS is set to report Q2 2023 results on Tuesday, August 8. This is nearly two weeks later than expected, which doesn’t bode well for the logistics giant. Since 2006, UPS has reported Q2 results in the 30th or 31st week of the year, typically from July 23 – July 30. This would be the first report in the 32nd week of the year, and the latest report date in our 17 year history.

Academic research shows when a corporation reports earnings later than they have historically, it typically signals bad news to come on the conference call. We also see date changes as a sign of uncertainty, a company is seeking clarity on some item and therefore wants more time before sharing information with the public. It’s likely that UPS moved their earnings date back as uncertainty loomed around an impending worker strike. However, on July 25, UPS and the Teamsters union reached a preliminary agreement that included raises for both full-time and part-time workers. While a potential strike was avoided for now, one that would have wreaked havoc on the US economy by crippling parcel shipments, nothing is a done deal as of yet. On Thursday, August 3, UPS workers began voting on their tentative contract agreement. Investors will be looking to hear updates from UPS when they report on Thursday.

On Deck This Week

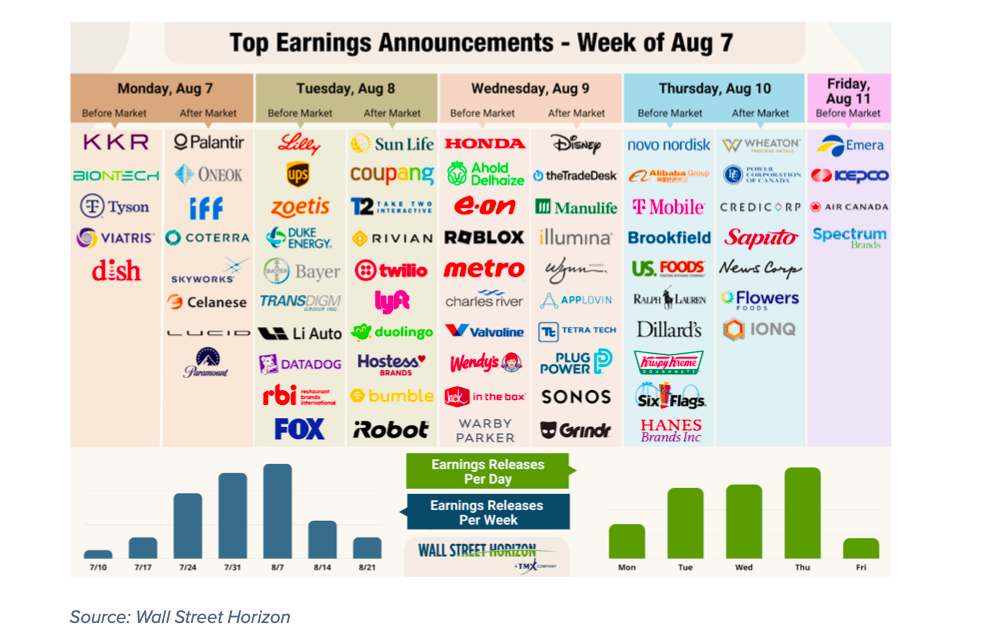

This week marks the third and final week of peak earnings season where we expect to see 2,977 companies (out of our universe of nearly 10k) report. We will get a smattering of reports across industries, from industrials (UPS, LYFT) and internet/software names (TWLO, DDOG, PLTR, BMBL, DUOL) to health care (LLY, ILMN) and media (DIS). We also get an early peek from retail and apparel when Ralph Lauren (RLL) and Dillard’s (DDS) report.

Q2 2023 Earnings Wave

The busiest day during the last peak week of Q2 earnings season will be Thursday, August 10 with 932 companies anticipated to report. Thus far 81% of companies have confirmed their earnings dates and 48% have reported (out of our universe of 9,500+ global names).

Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.