Macro View

With earnings season heating up (179 companies in the S&P 500 report this week), investors are likely to be focused on the ability of companies to beat or exceed earnings for the first quarter, as well as any available guidance for coming quarters.

The earnings season is off to an encouraging start even with expectations for the quarter elevated. With 17% of S&P 500 companies having reported earnings, 80% have exceeded expectations and the reported profit margin above11% is the highest in the decade that FactSet has been tracking this data.

The focus on coming quarters could grow more intense with both bond yields and commodity prices moving to new cyclical highs last week. The yield on the 10-year T-Note moved to its highest level since 2014 and the CRB commodity index moved to its highest level since 2015. Rising commodity prices could pressure profit margins, and surging gasoline prices could weigh on both consumer confidence and economic activity. Combined with a sustained move higher in bond yields, this could signal building inflation pressures and lead to an accelerated pace of rate hikes by the Fed.

The impact this has on economic growth and corporate earnings remains to be seen.

Market Thoughts

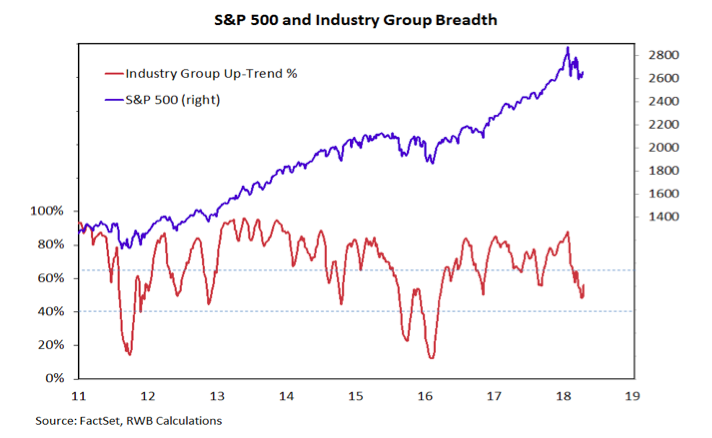

The April rally on the S&P 500 ran into downtrend resistance last week, but not before the advance-decline line for the index moved to a new all-time high. Based on this measure, breadth would appear to have made a significant improvement. However, in both of the last two cyclical bear markets (2011 and 2015), the S&P 500 advance-decline line made a new high after the index itself had peaked. To gauge the health of the broad market, we continue to keep a close eye on the percentage of industry groups in up-trends (which have bounced off of their recent lows but hardly argue for strength) and are on the lookout for evidence of a change in the broad market momentum dynamic.

Since the consolidation began in January, the market has experienced six days on which downside volume has outpaced upside volume by better than 9-to-1. It has yet to record a single instance where the opposite has taken place. We likely need this, or similar evidence of breadth thrusts, to signal improving broad market trends.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.