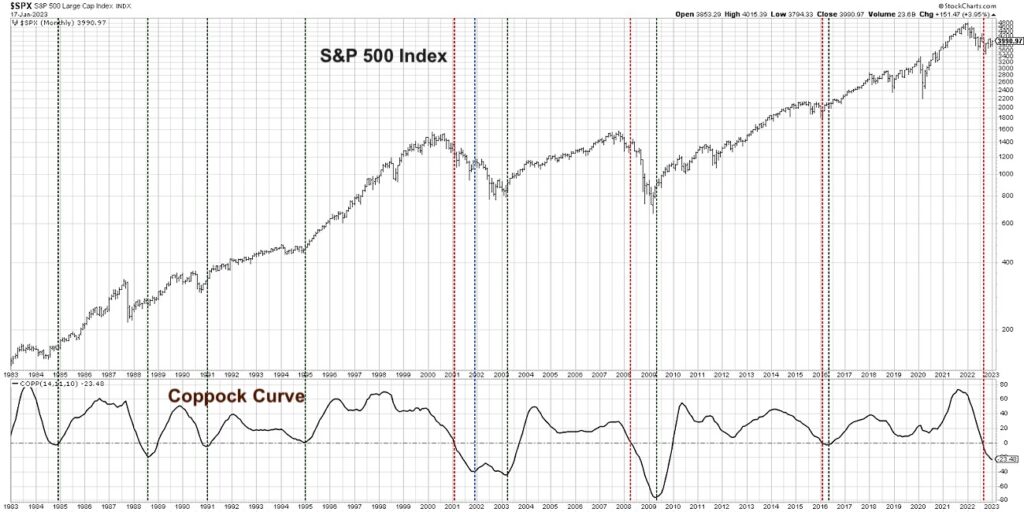

The Coppock Curve is a long-term trend-following strategy created by market strategist Edwin “Sedge” Coppock in the 1960s. It has become one of the most widely recognized long-term signals of market trend, and the most recent monthly signal says “not yet” for market bulls.

The origin story for this technical indicator is truly one of the more esoteric. Supposedly, Coppock asked an Episcopal priest how long it takes family members to mourn the loss of a loved one. The priest responded that the average time was between 11 and 14 months.

So Sedge Coppock took that information and designed a long-term trend-following device, based on monthly closing data, to determine when the market was entering a “mourning” or bearish period. The same indicator would then indicate when the mourning period was over, and the bull market would most likely resume.

The Coppock Curve registered a bearish signal in the 3rd quarter of 2022, when the indicator dipped below the zero line for the first time since 2016. For now, it’s all about the Coppock Curve rotating from a downward slope to an upward slope, suggesting a rotation to a period of accumulation.

In today’s video, we’ll break down the origins of this technical indicator, review key buy and sell signals over the last forty years, and share what it’s saying now about the S&P 500 index.

- How can we use monthly S&P 500 data to create a very long-term trend-following device, and how has that indicator handled previous bear cycles?

- What does the Coppock Curve tell us about the current market environment, and what would we need to see to turn more constructive after this strong move off the October lows?

- How can we confirm signals of the Coppock Curve using other technical indicators like MACD or PPO?

VIDEO: A Closer Look at the Coppock Curve

Twitter: @DKellerCMT

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.