The price of copper has long been a bellwether indicator of the U.S. economy. Rising copper prices signified economic growth (industry) and often tied to interest rates and potential inflation.

That said, globalization, deflationary forces (the rise of technology), and falling interest rates have taken a bit of the luster out of Copper’s economic indicator role… until now.

COVID lockdowns, followed by domestic economic re-openings, and now overheating sentiment and inflation concerns have put copper back in the spotlight.

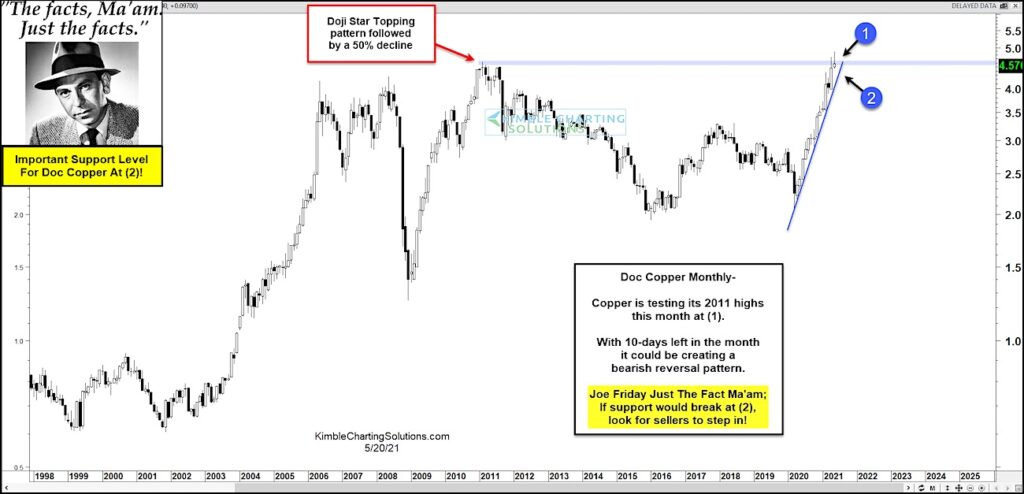

And Joe Friday says “Put Copper On Your Radar!”. Why? The price of copper made a higher low during the COVID market crash. And the ensuing rally has pushed copper +100% higher to the $4.50 to $5.00 area at (1) which is also where copper peaked in 2011.

And, like 2011, copper is forming a doji star reversal candle for the month of May. With 10 trading days left in the month, investors would be wise to monitor this to see if this bearish reversal pattern sticks.

As Joe Friday says, “The facts, Ma’am. Just the facts”. In 2011, this bearish reversal pattern lead to a 50% decline. It also coincided with a stagnant economy and low interest rates. In 2021, we can see the steep up-trend at (2) that Copper has followed into the important resistance area.

Breakout above (1) and it may means a strong economy and attempts to control inflation… breakdown below (2) and it may mean that the economy is over-rated and Copper is about to fizzle. Stay tuned!

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.