One way to gauge the health of the economy and stock market is by following the core consumer sectors: Consumer Discretionary (XLY), Consumer Staples (XLP), and the Retail Sector (XRT).

Today we look at the SPDR Consumer Discretionary ETF (XLY) as it highlights how much additional cash consumers are willing to part with (above and beyond their spending on “Staples”.

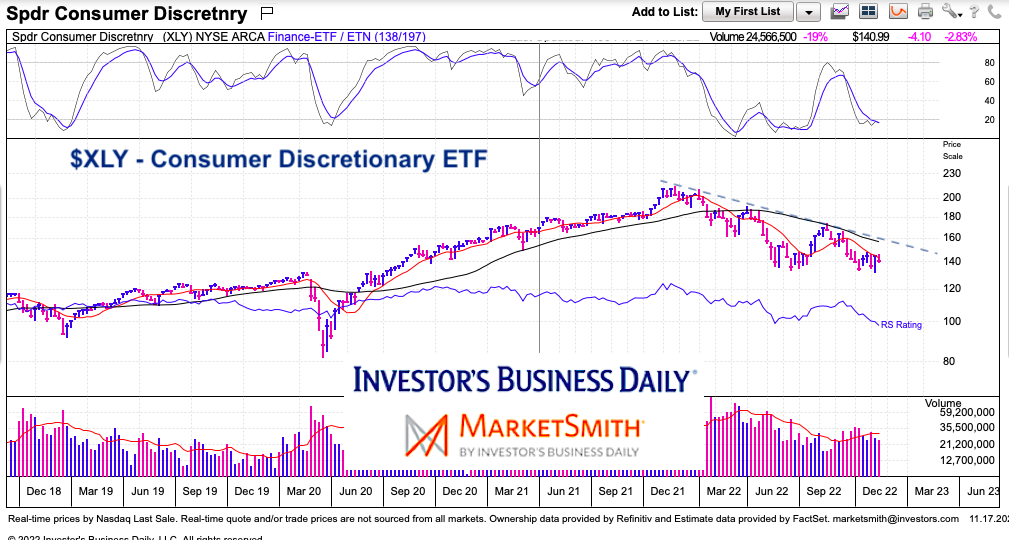

In short, when the economy is vibrant and consumers are confident they spend money en masse… and $XLY outperforms. Over the past year, however, the consumer has been filled with uncertainty and economic constraints so the $XLY has underperformed. Today, we look at a longer-term “weekly” chart of the Consumer Discretionary Sector (XLY) and highlight current status and what to look for.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

$XLY SPDR Consumer Discretionary ETF “weekly” Chart

Looking at the chart, it’s apparent that the economy and stock market have been in a downtrend for several months. Inflation, supply issues, a cooling housing market, war abroad have all caused the consumer to tighten up.

Technically speaking, XLY’s price is below its 10- and 40-week moving averages. It appears that the 40-week is the most important to watch, as it also coincides with the downtrend resistance line. That comes into play around $155-$160 and will offer significant resistance. Price is trying to consolidate after holding $130 (support) on two occasions.

A move over $160 would be positive for bulls, while remaining in the narrowing range would be neutral within a downtrend, and a move below $130 would be strongly bearish.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.