Unfortunately, the body of economic evidence over the past 5 years would lead most (including myself) to say “probably not”. And this would likely be correlated to the fact that this hasn’t been a vibrant, feel good, post-financial crisis recovery. It’s been mired in fits and starts.

But at the same time, it also wouldn’t be fair to say that the US consumer hasn’t been resilient.

Especially of late.

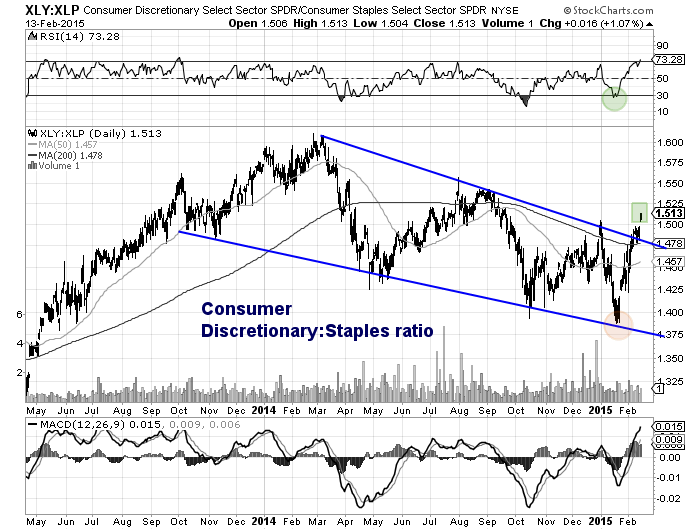

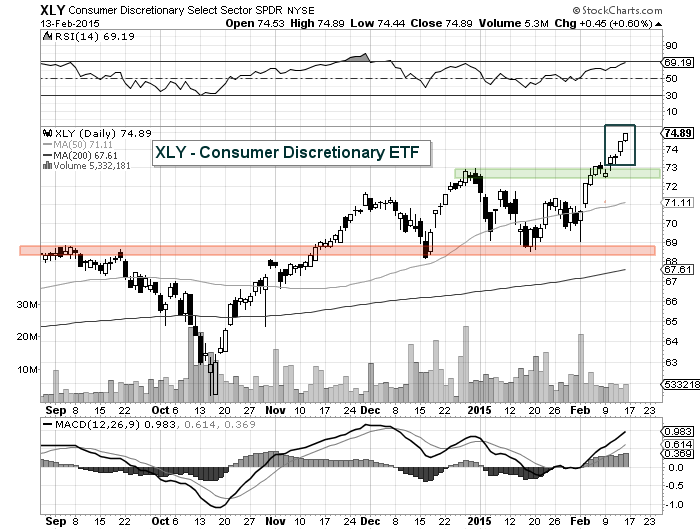

One way to illustrate this is through the relationship of the two major Consumer Sectors: Discretionary vs Staples. I tend to think of Consumer Discretionary as cyclical and high beta (things we “want”) and Consumer Staples as dependent and steady (things we “need”). The Consumer Discretionary Sector ETF (XLY) consists of holdings like Disney (DIS), Nike (NKE), Starbucks (SBUX), and Amazon (AMZN) to name a few. The Consumer Staples Sector ETF (XLP) consistes of holdings like Proctor and Gamble (PG), Colgate-Palmolive (CL), and Walmart (WMT) amongst others.

In short, when Discretionary is performing well, the consumer is generally upbeat (or simply spending more) and when Staples are outperforming, the consumer is usually reflecting uncertainty.

The chart below shows the ratio of Consumer Discretionary (XLY) to Consumer Staples (XLP). And as you can see, Discretionary has begun to perk up. In fact, it’s been so strong that it’s nearing overbought on the ratio (and by itself). This seems to fit with the broader strength seen in the stock market of late. Perhaps this is another false start. We’ll have a better idea over the coming weeks.

Consumer Discretionary (XLY) vs Consumer Staples (XLP) Ratio Chart

Consumer Discretionary (XLY) Chart

Follow Andy on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.