2015 didn’t end quite the way the bulls wanted it to. The month of December saw the S&P 500 decline nearly 1 percent as a weak santa claus rally gave way to the bears.

One sector that gets a lot of publicity for large cap momentum names like Amazon (AMZN) and Starbucks (SBUX) is Consumer Discretionary. But there’s more to the consumer than just a few select growth stocks.

One ETF that offers some good insight is the Consumer Discretionary ETF (XLY), which comprises retailers where consumers make “mostly” discretionary purchases.

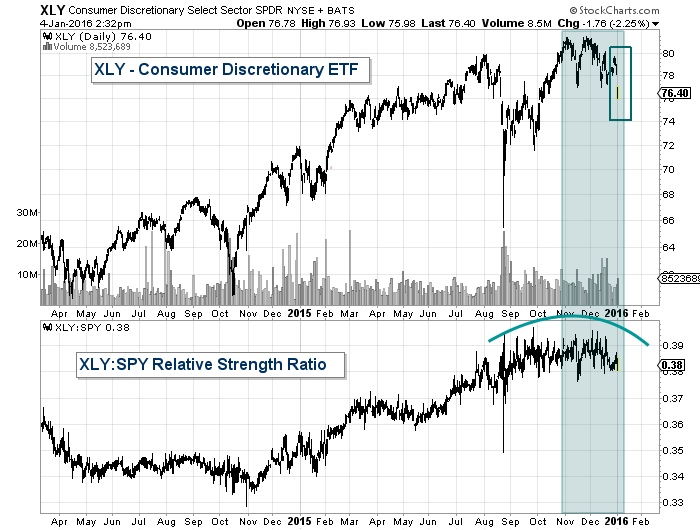

If we look at a chart of the Consumer Discretionary ETF (XLY), we can get a better idea of how healthy the consumer is from a broader equity perspective. Especially on a relative strength basis.

But first, let’s see look at some consumer stocks that are holding within this ETF.

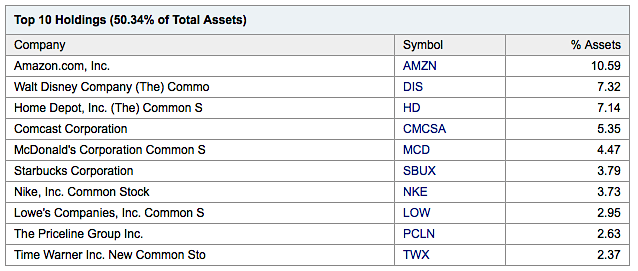

Below are the top 10 holdings of the Consumer Discretionary ETF (XLY). The list is a popular who’s who in the retail sector and, in addition to Amazon and Starbucks, includes names like Nike (NKE) and Priceline (PCLN):

Source: Yahoo Finance (as of November 29, 2014)

If we turn to the charts (see below), you’ll notice that the “discretionary” Consumer started to show weakness during the 4th quarter. As early as November, the XLY was showing cracks. Perhaps this was the markets way of hinting that higher rates wouldn’t set well with the consumer. The jury is still out on that, but boy do the charts look ominous.

Below is a two-pack of charts highlighting the weakness in the Consumer Discretionary sector. The first chart is of the XLY and shows what appears to be a near-term topping formation. The second chart shows the sectors relative strength in comparison to the S&P 500 (SPY). Here we also see a topping formation and some serious warning signs during the fourth quarter.

As most traders and active investors know, one indicator or sector does not tell the whole story. But this is definitely one to put on your radar if you have any lingering concerns about Q1 2016 (or beyond). Thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.