Higher stock prices and a reversal lower in US Yields (from prior highs) are putting bearish pressure on the US Dollar.

Further weakness in US yields may further weaken the US Dollar versus select commodity currencies which appear to have very strong upward momentum.

USDCAD is coming down in the 4-hour chart as expected but notice that we are still observing wave C or 3 with room down to 1.2200/1.22560 area to complete the current five-wave cycle of the lower degree. However, there can be some pullback later this week for another recovery within a downtrend. Strong resistance levels are at 1.24 followed by 1.2495.

USDCAD 4h Elliott Wave Analysis

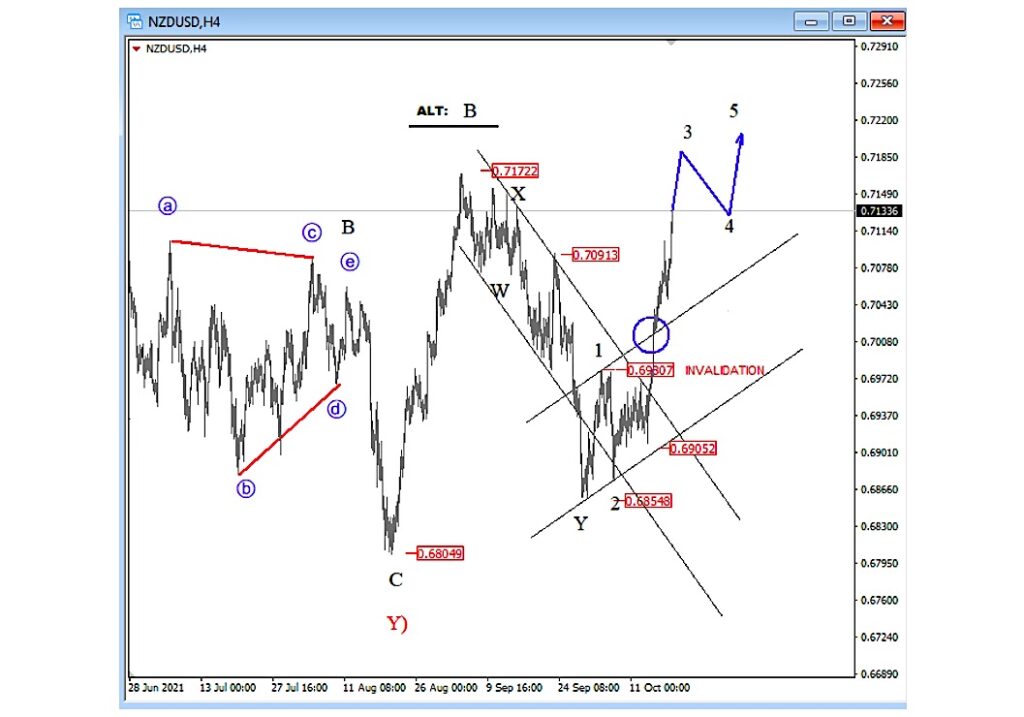

NZDUSD is nicely and impulsively recovering as expected after we noticed a big and complex W-X-Y corrective decline. It appears that a new five-wave bullish cycle is now in progress that could send price back to September highs and 0.72 – 0.73 area. So, more upside likely. Be aware of a pullback in wave 4 before the uptrend for wave 5 resumes.

NZDUSD 4h Elliott Wave Analysis

Twitter: @GregaHorvatFX

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.