Closed-end funds, also known as CEFs, offer a unique combination of growth and income in a liquid and diversified investment vehicle that are most suited for high yield investors. CEFs are similar to exchange-traded funds in that they are structured as a basket of underlying securities that is traded throughout the day. However, most of the comparable characteristics end there.

Closed-end funds, also known as CEFs, offer a unique combination of growth and income in a liquid and diversified investment vehicle that are most suited for high yield investors. CEFs are similar to exchange-traded funds in that they are structured as a basket of underlying securities that is traded throughout the day. However, most of the comparable characteristics end there.

CEFs are created by an initial public offering that raises money to seed the fund with a set number of shares similar to a public company. It is then actively managed according to the constraints of the prospectus and managers’ security selection preferences. Because CEFs have a fixed number of shares, they can therefore trade at a premium or discount to the fund’s net asset value. This can be a blessing or a curse depending on the market environment, volatility, and sentiment towards an individual fund.

One of the benefits of closed-end funds is that the manager is able to use leverage and non-traditional strategies, such as options and hedging, to enhance their returns over time. In addition, they do not have to sell distressed securities to meet investor redemptions because the number of shares does not fluctuate.

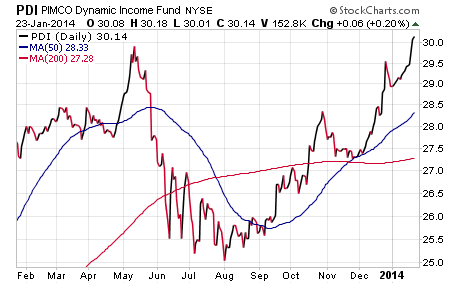

There are hundreds of closed-end funds available to individual investors representing billions of dollars in total assets. However, if pressed to choose my favorite core holding for clients in my actively-managed CEF Income Portfolio, it would be the PIMCO Dynamic Income Fund (PDI). This fund was launched approximately 18 months ago and has total asset of over $1.3 billion.

PDI is managed by Dan Ivascyn and Alfred Murata of PIMCO who just recently won Morningstar’s 2013 fund manager of the year award for the fixed-income category. PDI had a total NAV return of +16.60% last year and has a current distribution rate of 7.62%. The fund is currently trading at a 2.75% discount to its NAV according to recent Morningstar data.

The portfolio of PDI is primarily made up of non-agency mortgage backed securities and corporate bonds, however it was the managers use of leverage and hedging strategies that allowed them to achieve such strong returns last year in the face of rising interest rates. While PDI still experienced its share of volatility, its underlying securities were able to achieve a strong income stream and extremely low effective duration of less than 3 years. In fact, the fund over-earned its regular distribution schedule in both 2012 and 2013, which led to special year-end dividends for shareholders.

The question that you should ask yourself is whether or not closed-end funds are right for your risk tolerance, time horizon, and investment experience. I think that PDI represents an excellent core holding for aggressive income seekers that are looking for a high dividend stream and manager expertise in security selection. Those that aren’t comfortable with leverage might want to consider the open ended PIMCO Income Fund (PONDX) which implements a similar strategy in a more conservative manner.

If you do decide to research and invest in this fund, it may be wise to do so with a sell discipline to limit your downside risk. That way you have a defined exit point in the event that any unforeseen events lead to a decline in fund’s price. This is especially important with a closed-end fund that can trade higher or lower based on investor demand rather than strictly underlying NAV performance.

Twitter: @fabiancapital

Author currently holds a position in PDI at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.