On January 15, 2014, the Chinese Yuan (CNY) pivoted and started to weaken against the US Dollar (USD). The currency markets didn’t appear to be concerned at the time, as it appeared to be a “normal” corrective move. However, roughly a month later, the USD-Yuan took off like a rocket ship and sent some serious tremors across the financial landscape.

On January 15, 2014, the Chinese Yuan (CNY) pivoted and started to weaken against the US Dollar (USD). The currency markets didn’t appear to be concerned at the time, as it appeared to be a “normal” corrective move. However, roughly a month later, the USD-Yuan took off like a rocket ship and sent some serious tremors across the financial landscape.

As a pattern recognition trader, I understand price movements. In terms of fundamental analysis, I defer to other experts in the field. In that vein, Forbes does an excellent job of summing up the fundamental backdrop to the Chinese Yuan.

But as a trader with interest in the Forex, I know this: The currency markets are HUGE with trillions of dollars exchanged each day. I often refer to it as the land of the gorillas juggling dynamite. While the infatuation with Facebook (FB), GoPro (GPRO), Google (GOOG), Apple (AAPL), etc. is constant; the currency markets are truly global and massive. Therefore, active investors can benefit by paying attention.

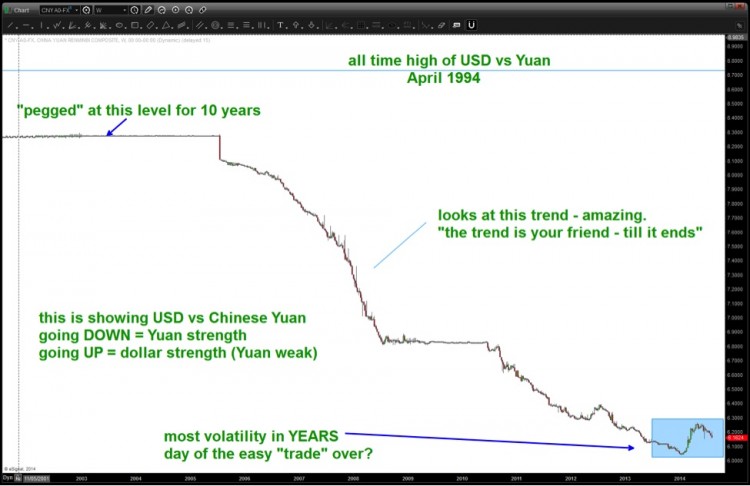

Before we look at why the Chinese Yuan may be poised for further depreciation, let’s back up and take a look at a longer term chart of the US Dollar versus the Chinese Yuan:

As you can see, it’s been a straight ride down (denoting Yuan strength) with years of consolidation at times. Note the blue shaded rectangle – that’s where we are, and that’s where I’ll be focusing my analysis. During the straight ride down, some exotic financial instruments were created to take advantage of this “no-brainer” trade. It all seemed so easy to predict that the Yuan will appreciate versus the dollar until…. chinese intervention?

Perhaps Chinese intervention added to the Yuan’s weakness. See the chart below again.

So, the question remains: Is this the end of the “no-brainer” trend or was it simply a warning shot across the bow? I won’t pretend to know the answer for sure, but I realize that this move is a “big deal.” And it requires more pattern analysis.

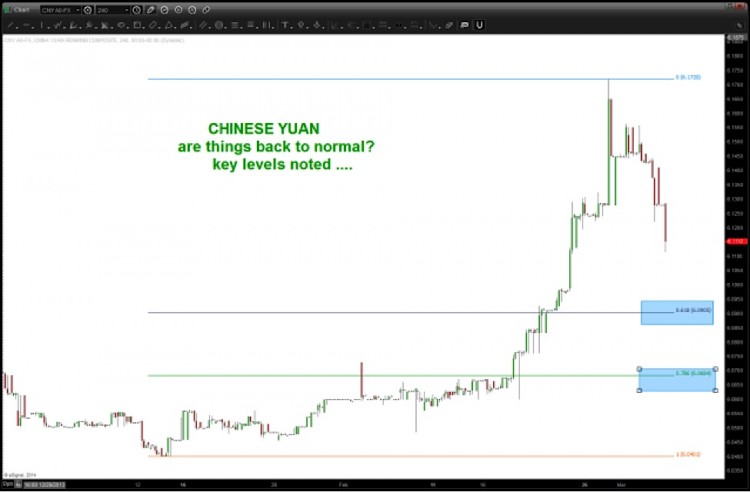

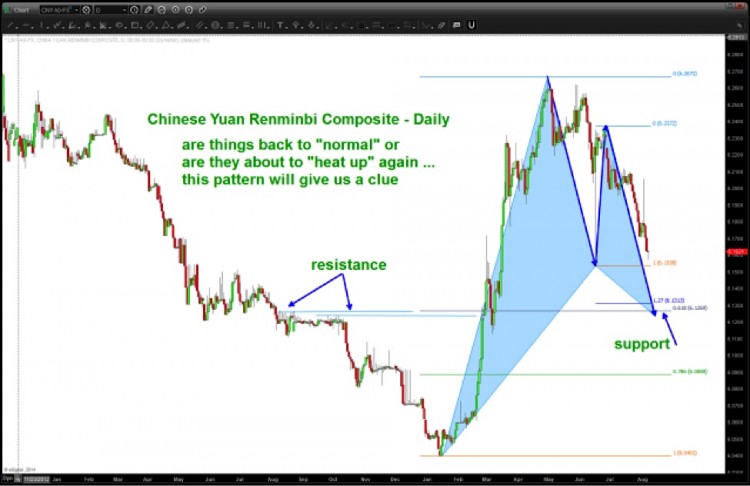

But how do patterns work if the Chinese Yuan isn’t “free floating”, you ask??? Well, check out the series of charts below taken from my archives in chronological order:

USD – Yuan 2014 move higher chart #1

USD – Yuan 2014 move higher chart #2

USD – Yuan 2014 move higher chart #3

US Dollar – Chinese Yuan Technical Support Levels 2014 (early August)

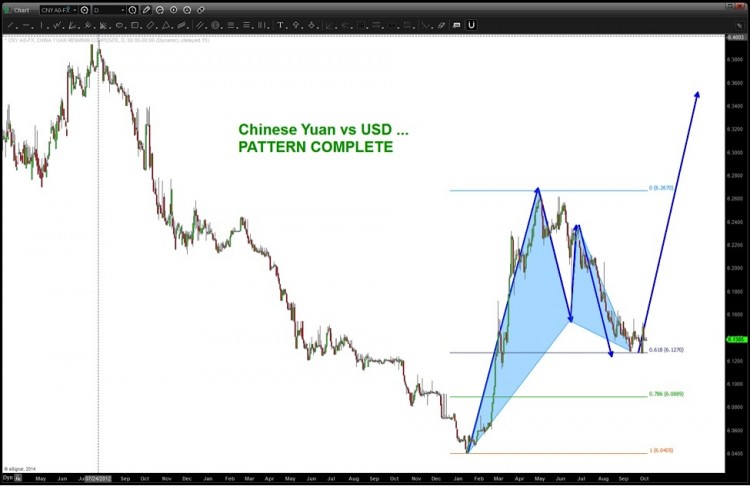

Somehow, sitting in Leesburg, VA during a beautiful fall day, the PATTERNS have been able to guide us EVERY step of the way with regard to the next move in the Chinese Yuan. What they say is not good for the 100’s of billions of dollars of exposure institutions have in this neck of the woods.

The pattern in the next chart (see below) is as of the close on Friday. It’s a buy pattern for the US Dollar vs CHINESE YUAN) and if it works then this continued move UP (YUAN depreciation) will accelerate and it will be time for an unwind …

Here’s the chart showing what I believe is the completion of the pattern:

Enjoy the marvel that is FB, GPRO, AAPL, NKE for they are amazing companies and built on vision and passion. But, at the same time, DO NOT forget the “big picture” and the importance of the currency markets. Thanks for reading.

Follow Bart on Twitter: @BartsCharts

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.