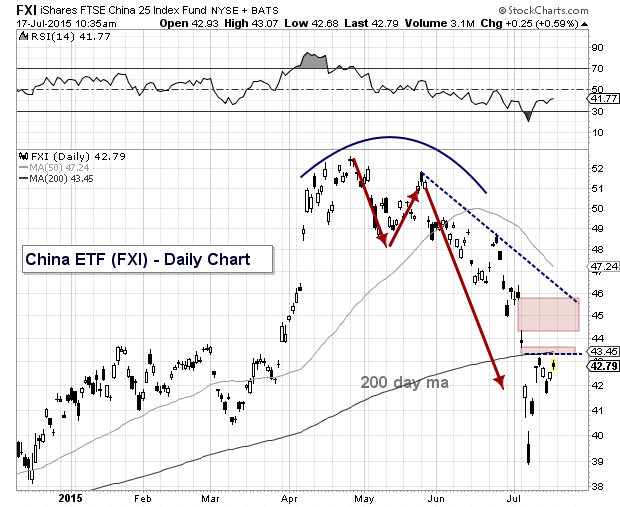

The collapse in the Chinese stock market also took down its U.S. traded ETF, the iShares China (FXI). And following a breathtaking drop, a sharp FXI rally has unfolded. Is this a V bottom, or a sharp bear rally? I’d lean with the latter, but following the price action and behavior at key levels should help traders navigate the days/weeks ahead.

The collapse in the Chinese stock market also took down its U.S. traded ETF, the iShares China (FXI). And following a breathtaking drop, a sharp FXI rally has unfolded. Is this a V bottom, or a sharp bear rally? I’d lean with the latter, but following the price action and behavior at key levels should help traders navigate the days/weeks ahead.

To recap: After a huge parabolic-like FXI rally that left several open gaps, the ETF slowly turned lower, sucking in some traders looking for bullish consolidation. But the FXI put in a rounded top and turned lower. And fast. From intraday high to low, the FXI corrected 26.3 percent.

Now let’s look at the FXI rally…

From the July 8 lows, the current FXI rally has gained over 10 percent. It’s currently bumping up against important near-term price resistance. And how it reacts here will determine whether the rally dies now or lasts for another week or so.

As you can see in the chart below, the FXI is bumping up against a confluence of short-term price resistance. This includes:

- Its initial reaction highs (43.21).

- Its 200 day moving average (43.45).

- An open gap zone from July 6th/7th.

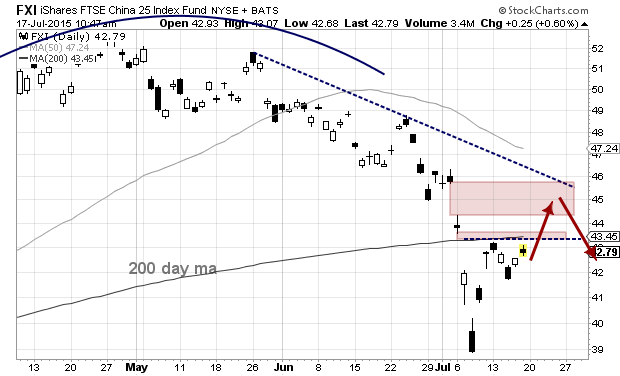

A breakout above the 200 day moving average could push the FXI rally into the next open gap zone (July 2nd/6th). But the downtrend resistance line would be waiting around 46.

iShare China ETF (FXI) Daily Chart

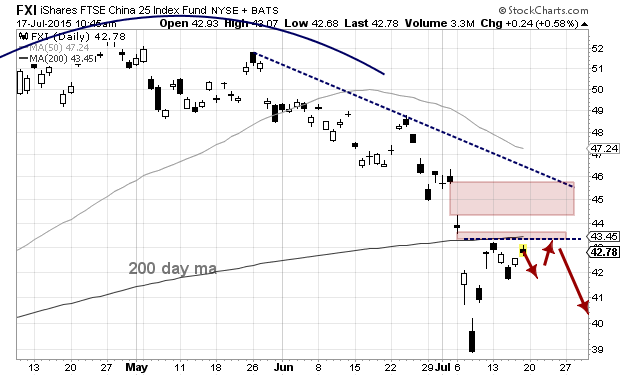

Here are a couple macro level scenarios for the FXI over the coming week. Note that the devil is in the details – government intervention and overnight risks during deep selloffs are real in today’s markets.

Scenario 1 – The rally dies here…

Scenario 2 – Rally continues into next week…

Considering the overnight risk due to time zone differences (see the open gaps on the chart), it might be best to avoid this one all together until things settle down. This type of volatility is hard to trade, and any positions require a plan/discipline.

Bottoms take time to set up. And “trading” bottoms are significantly different than “intermediate term” lasting bottoms. Careful here. Thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.