Around this time last year, most European banks couldn’t get out of their own way, down day after day after day.

This included names like Credit Suisse, Monte Dei Paschi and others I will not pretend I can pronounce. The one I want to focus on today is Deutsche Bank (NYSE:DB).

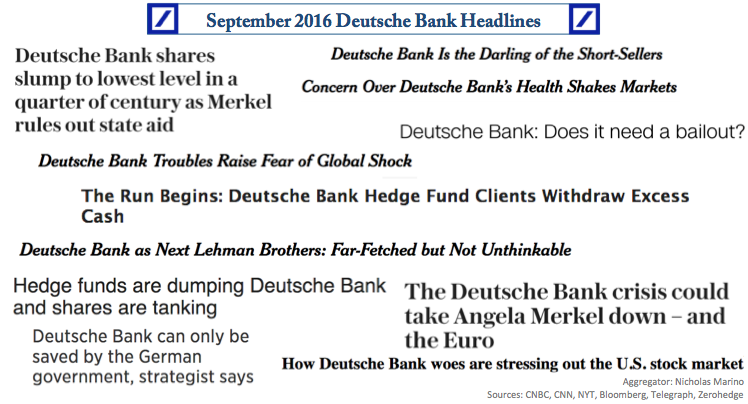

The onslaught culminated in a fury of end of the world type headlines.

Here’s sampling of some related to Deutsche Bank (DB):

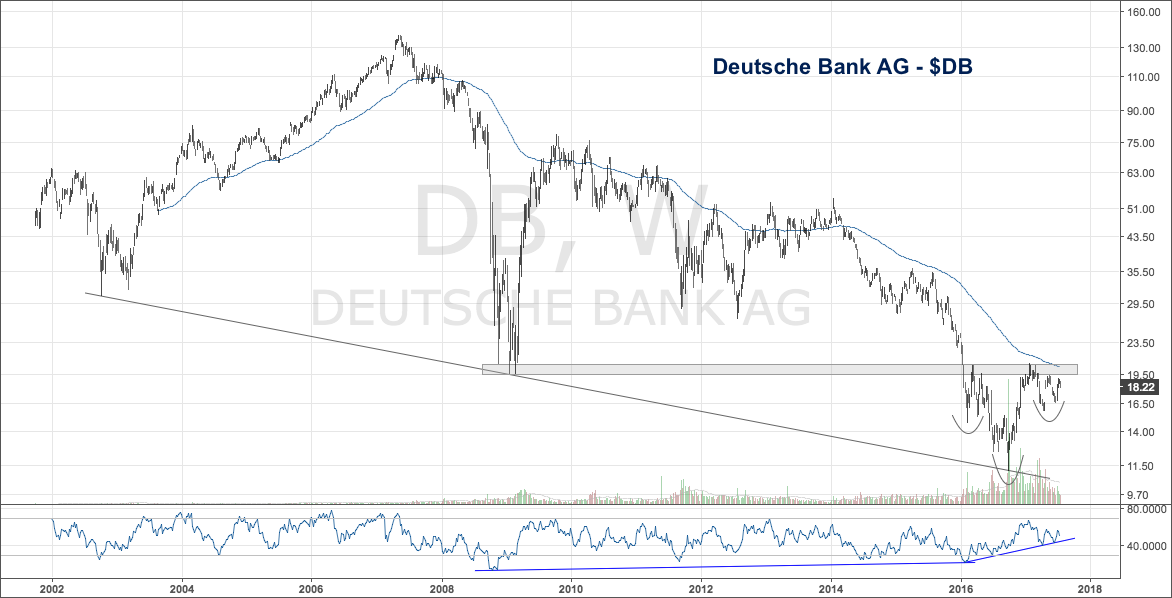

Taking a look at the chart of Deutsche Bank below, it’s safe to say this called the exact bottom. Deutsche Bank is up 50% since. The most important question we should now be asking ourselves is: Does this chart resemble a top or a bottom?

What is Deutsche Bank telling us about risk appetite? Is that a head and shoulder bottom forming? Maybe, maybe not but either way something is brewing in Deutsche Bank down here with a strong momentum divergence.

While I wouldn’t choose to put my hard earned capital into Deutsche Bank over stronger stocks in established uptrends, I do feel this chart gives investors another night to rest easy proving to be another example of fear and greed in the stock market.

Where do we go from here? My bias is higher. As long as Deutsche Bank isn’t crashing I will be happy. If we cannot break on through 2009 lows then that will be a cause for concern. Time will tell.

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.