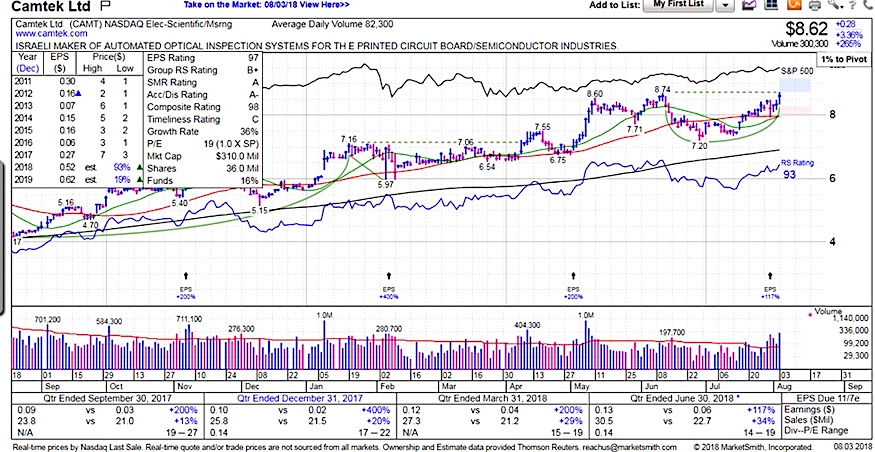

Camtek (NASDAQ: CAMT) is a small cap that continues to show up on my bullish technical and fundamental scans.

This $305.5M provider of inspection and metrology solutions to the semiconductor industry trades at 14.3X Earnings, 3.07X Sales, and 3.5X Book with a 6.5% dividend yield and a strong debt-free balance sheet. Camtek (CAMT) also trades at just 6.5X cash value.

CAMT is projected to reach 29% topline growth this year, best in over a decade and 91.5% EPS growth.

The longer term forecast is for $0.88 EPS and $155M in Revenues for 2020, a strong move from 2017 levels of $0.27/$93.5M.

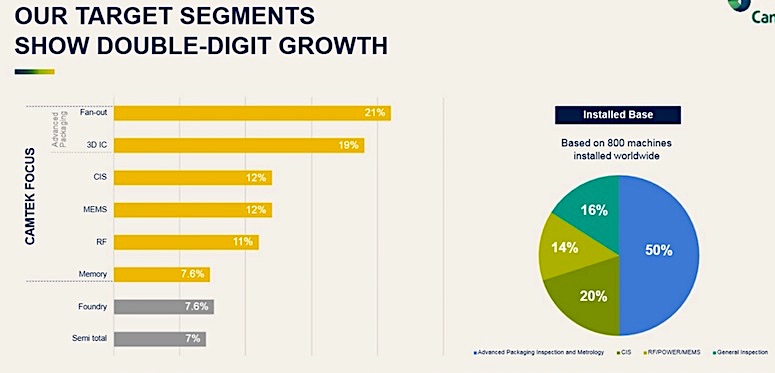

Camtek is coming off a record quarter for the company as it focuses on the fastest growing segments of the semiconductor market, notably advanced packaging. The company is also capturing market share in 2D inspection applications.

Camtek customers include Texas Instruments, SanDisk, SK Hynix, Infineon, Samsung, Micron, NXP Semi and others. The company already has its highest ever level of backlog and is seeing improved profitability, while the excess supply expected in 2019 as Semi memory Companies expand capacity should benefit its demand.

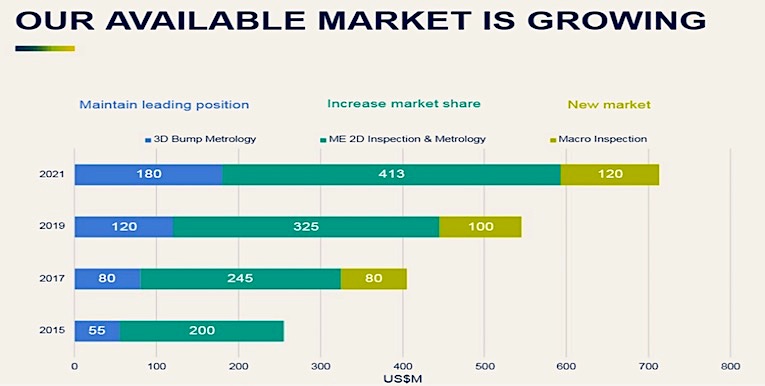

Camtek (CAMT) also expects to continue to see positive margin improvements while penetrating new markets and launching new products, forecasting revenues doubling again in the next 3-5 years. It sees growth drivers like 5G, Cloud, AI & Machine Learnings, Blockchain, Autonomous Driving, VR and AR, and Digital Healthcare that calls for increased need for RF Filters, MEMS, Advanced Packaging, and Procession Power. In the future it expands to expand into the Chinese growth market as well.

On a technical level CAMT shares are nearing a range breakout that targets a move to above $10. The stock chart provided is courtesy of MarketSmith and shows how fund ownership remains low at just 16% while it grades strong on Accumulation.

In closing CAMT is a strong combination of expanding margins, exposure to large and growing markets, expanding its available market, and strong profitability. Rudolph Tech (RTEC) is a small cap competitor with a $900M market cap, and trades at similar valuation levels while having much weaker growth while CAMT can close the margin gap.

Twitter: @OptionsHawk

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.