As the Thanksgiving holiday shopping season approaches, we will look at our Big View leading sector ETFs and the current tug-of-war between Consumer Discretionary (XLY) and Consumer Staples (XLP).

The chart displays the price spread between Consumer Discretionary (XLY) over Consumer Staples (XLP). Consumer Staples leads as the ratio price declines, as above.

Staples are viewed as needs, and consumer discretionary are more discretionary purchases.

The spread between these two sectors points to a rotation away from buying Teslas or luxury watches and more towards fast food, groceries, and living necessities.

When others fear the consumer sector, we see consumer staples as an opportunity to benefit from economic uncertainty while providing value.

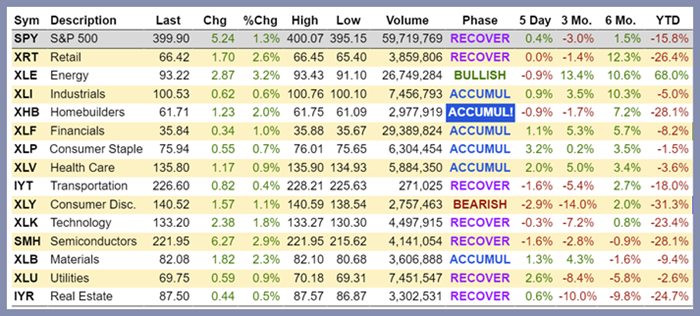

The Energy market has been strong alongside Retail and Industrials over the last six months, as shown above.

Currently, Consumer Staples and Utilities lead in the previous five trading days indicating risk-off.

The strong trend in Consumer Staples over Consumer Discretionary is demonstrated over the past five days, three months, six months, and year-to-date performance.

Consumer Staples have decreased by 1.5% year to date, while Consumer Discretionary has decreased by -31.3%.

If you want to stay in tune with the primary market trends and invest only passively, following the ETF leaders on a six-month basis will be helpful.

Using our Phases and five-day and three-month percentage sector changes can assist more active traders.

Our analytics spot sectors and subsectors that are heating up or cooling down so that you can make informed trading decisions.

If you’re looking for a more hands-on approach to tactical trading, our Big View Research Service can help.

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 396 support and 403 resistance

Russell 2000 (IWM) 182 support and 186 resistance

Dow Jones Industrials (DIA) 337 support and 343 resistance

Nasdaq (QQQ) 282 support and 287 resistance

KRE (Regional Banks) 60 support and 66 resistance

SMH (Semiconductors) 217 support and 225 resistance

IYT (Transportation) 223 support and 229 resistance

IBB (Biotechnology) 132 support and 137 resistance

XRT (Retail) 64 support and 68 resistance

This article was contributed to by Keith Schneider and Wade Dawson.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.