There’s been an assumed rotation out of some of the best performing internet stocks of 2017, seeing several decline by double digits over the past two weeks. And it is this selling that has given some traders a reason to pause.

However, looking at the index of Internet stocks, the up-trend still appears to be intact.

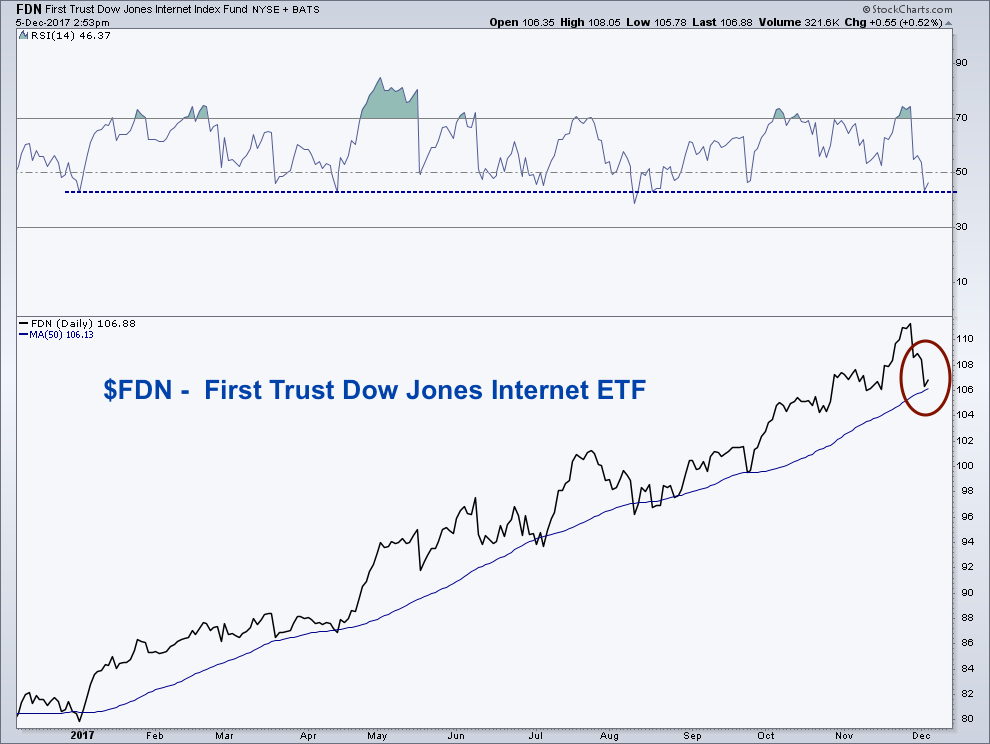

Below is a daily chart of the First Trust Dow Jones Internet ETF (NYSEARCA:FDN). Some of its top holdings like Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB), PayPal (NASDAQ:PYPL), Netflix (NASDAQ:NFLX), Alphabet (NASDAQ:GOOGL), and Salesforce (NYSE:CRM) have been the culprits of recent selling, so it makes for a good place to turn when evaluating the health of this pocket of the market.

The Dow Jones Internet ETF (FDN) has found continued support at its 50-day Moving Average throughout 2017. And, low and behold, this is where we currently find the ETF as of Tuesday, with traders stepping in to buy shares intraday as the 50-day MA is tested.

Turning the focus to the top panel of the chart we have the Relative Strength Index (RSI), a momentum indicator. Despite recent weakness, momentum has remained in a bullish range, holding above its prior lows during this recent spate of selling. The RSI indicator has recently come off an ‘overbought’ reading and with Tuesday’s bullish move in price, has once again bounced at the 45 level, which is where prior lows have been put in several times this year.

Several individual internet names have experienced large downside pressure but when we look at the group as a whole, the trend appears to still be holding strong with both price and momentum holding above support. If these support levels break in the near future, then the trend in this area of the tech sector may in fact be shifting, but as of today the trend is bullish until proven otherwise.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog.

Twitter: @AndrewThrasher

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.