Bank stocks have been hit hard in April. And, until we see a strong bounce, there is not much to get excited about.

BUT, we must point out the potential for a bottoming pattern… even if early.

It’s in its infancy, but still worth noting as the selloff is getting oversold.

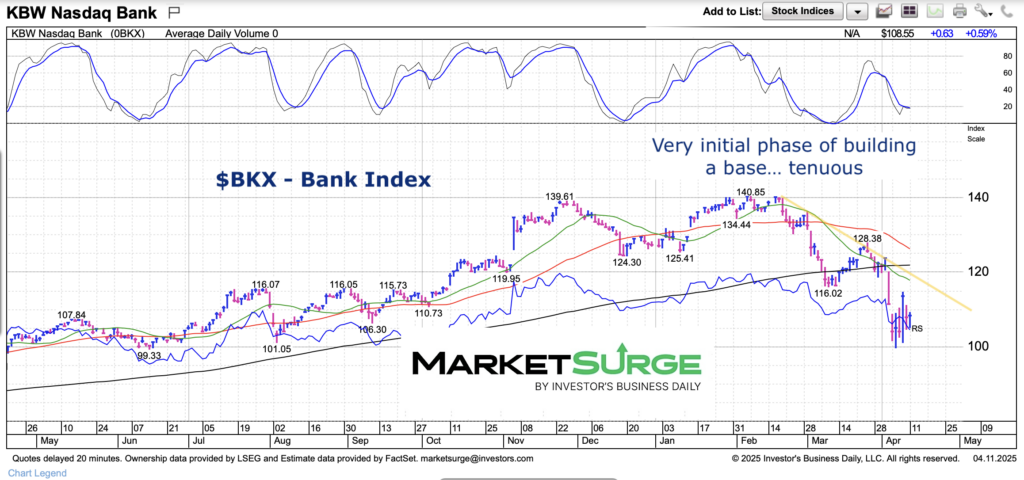

Below is a chart of the Bank Index (INDEXNASDAQ: BKX), highlighting the potential bottom consolidation.

Note that the following MarketSurge charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$BKX Bank Index Chart

To be fair, the index is still trading well below its 3 main moving averages. However, it is consolidating and oversold (and trying to put in a higher low on its momentum indicator (upper pane).

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.