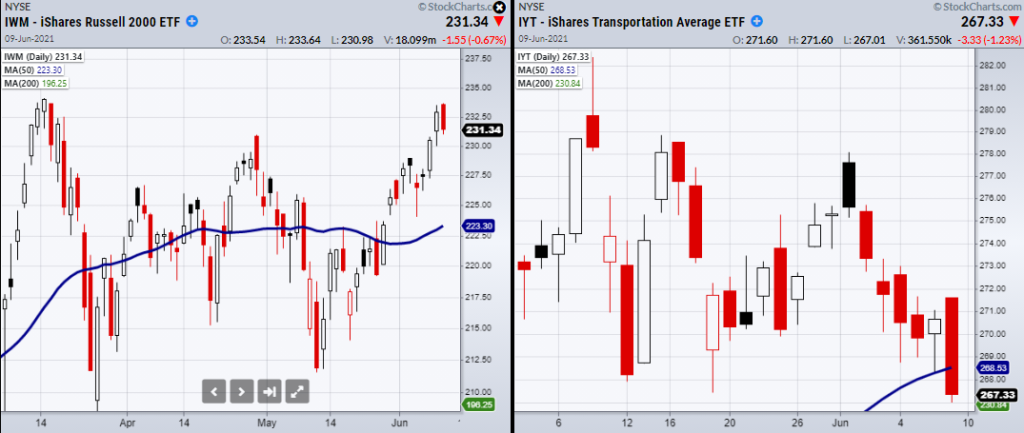

The S&P 500 Index ETF (SPY) and Small-caps Russell 2000 Index ETF (IWM) are lingering near all-time highs.

This looks like a great setup for a rally past resistance and into higher territory.

However, there are two potential problems to consider.

The first is that the Transportation Sector ETF (IYT) has broken its 50-Day moving average. And a second daily close below its major moving average would confirm a cautionary phase.

In the past, we have watched Transportation stocks and IYT as an indicator of underlying market strength. If IYT continues lower it could be signaling a weakening market picture.

If the stock market continues to pause or stall out at these pivotal breakout levels, investors/traders could grow restless and begin to sell if they perceive weakening market momentum.

The second problem comes from this morning’s Consumer Price Index report along with Jobless claims. Both reports will be released at 8:30 ET and could either boost or hinder bullish price action.

On the brighter side, we are continuing to see signs of economic improvement as U.S wholesalers sales rose +0.8% in April. Additionally, in May, inventories of wholesale stock were also up +0.8%.

This shows that certain supply chains are beginning to strengthen as the economy continues to pick up the pace.

With that said, we could be seeing a divergence of investors sentiment in the Transportation sector and the general market. This means we should stay cautious if IYT continues to break down and watch how it affects the small-cap Index (IWM) along with the S&P 500.

Follow Mish on Instagram (mishschneider) for daily morning videos!

To see updated media clips, click here: https://marketgauge.com/media-highlights-mish/

Stock Market ETFs Analysis and Trading Summary:

S&P 500 (SPY) 422.82 needs to clear and hold.

Russell 2000 (IWM) 234.53 high to clear.

Dow (DIA) 351 resistance. 342.43 support.

Nasdaq (QQQ) 338.19 resistance area.

KRE (Regional Banks) Broke 70.00. Next support 68.80.

SMH (Semiconductors) 244.81 support. 258.59 resistance.

IYT (Transportation) Broke 268.53 the 50-DMA.

IBB (Biotechnology) 159.30 new support to hold.

XRT (Retail) Needs to clear 96.27 and stay over.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.