I’ve been hearing a ton about the magnificent 7 (stocks) this year. Yep, 7 large cap stocks that are holding up the broader market.

This can only happen in a cap-weighted universe. However, when we look at equal-weighted indices and sectors we can find out just how healthy the broader selection of stocks are.

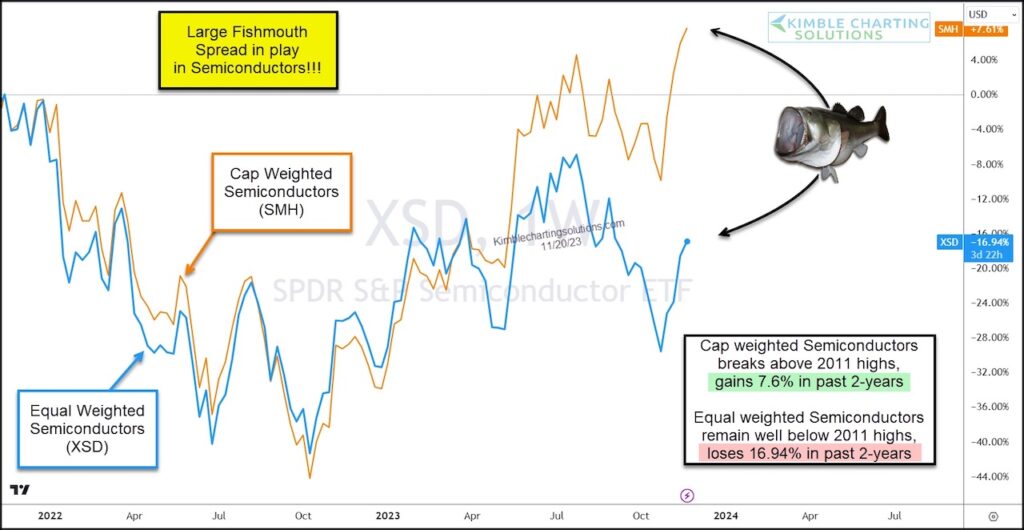

An example of this in the Semiconductor space and ETF ticker SMH. Below we can see a chart comparing the cap weighted sector ETF (SMH) and the equal weighted sector ETF (XSD).

As you can see, the spread between the cap and equal weighted sectors is the largest in years! Apparently, the largest semiconductor stocks are pulling the sector higher. Time for some mean reversion?

Mean reversion could see the broader sector begin to perform better (catch up) while the largest cap stocks take a breather. Stay tuned!

Semiconductors – Cap Weighted vs Equal Weighted Performance Chart

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.