Homebuilding stocks have seen heavy selling this year as economic uncertainty, inflation, and rising interest rates have dominated the headlines.

So, is the worst over? Most investors know that the economy suffers when the housing market is struggling. And with interest rates around 7%, it’s hard to make a case for a recovery just yet.

Today, we take a look at the “daily” can “weekly” charts of the Homebuilders ETF $XHB (made up of the most relevant homebuilder stocks).

The past few months have seen a weak relief rally that recently sparked some hope… but recent action may be dashing those hopes. Let’s take a closer look…

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

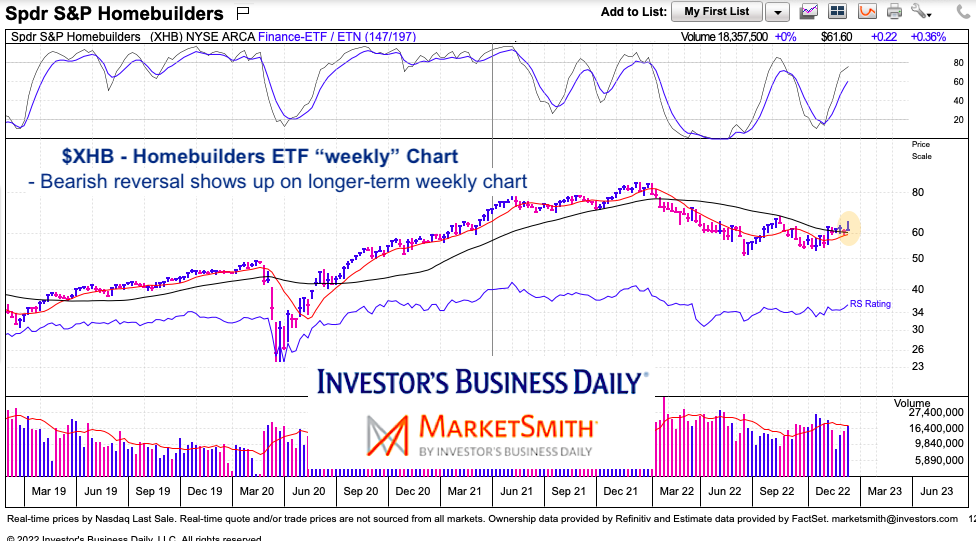

$XHB Homebuilders ETF “weekly” Chart

On the longer-term “weekly” chart, we can see that the latest price action created a bearish weekly reversal candle. Looking closer, the latest week was filled with a surge followed by selling that created a long bearish wick. The closing price was right at the 40-week and 10-week moving, so there is still hope for a broader rally, but the long wick leaves overhead supply.

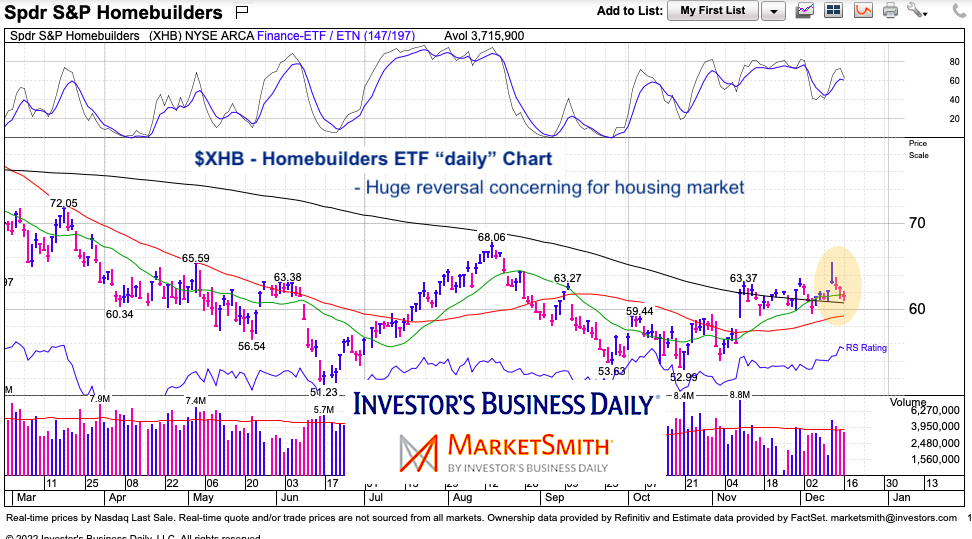

$XHB Homebuilders ETF “daily” Chart

Zooming in on the short-term “daily” chart, we can see the price reversal more clearly. Here again, price is testing key moving average support. So while it is still completely possible to see price firm up here (and move higher), bulls are under pressure due to the reversal. AND should we see selling resume below the reversal high, then it could get ugly… stay tuned.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.