As many of you know, I use DeMark indicators in my analysis. Sometimes tweets and posts come off a bit terse, as it is difficult to explain in depth each time I post an idea.

So today, I want to dedicate some time to explaining DeMark analysis via the following mini DeMark primer.

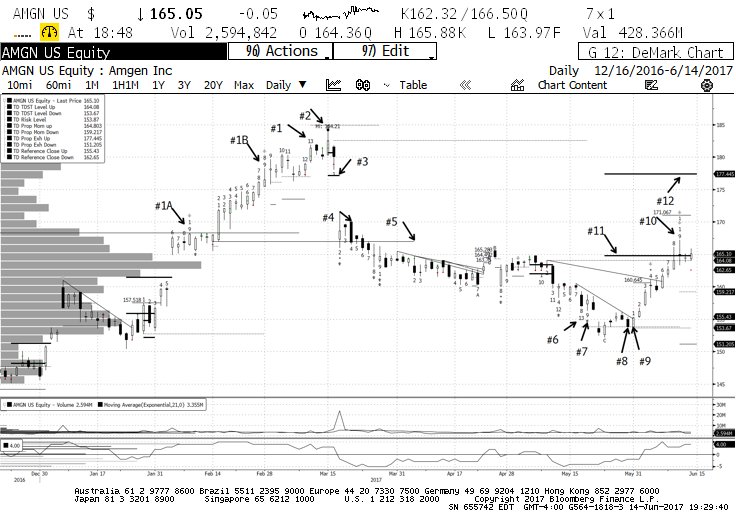

I’ll be using a “daily” candle chart for Amgen Inc. (NASDAQ:AMGN), a stock that I am long (see below). Note that you can find another primer on DeMark indicators that I wrote HERE.

Amgen (AMGN) daily chart with DeMark indicators

Okay, here we go:

A. Countdown Sell 13 (#1) based on a completed Sell Setup “9” (#1A), suggests buyers may be exhausted. However, another Sell Setup “9” has also completed (#1B) and with that comes the expectation that a new Countdown Sell “13” (taking price higher) will start and finish. Who wins this discrepancy? We don’t know, so the pattern is not actionable until…

i. The “Secondary Exhaustion Level” (#2) associated with Countdown Sell “13” (#1) is broken “on a qualified basis”; this would be shown by the line tagged as #2 being solid rather than dotted. If such break occurs, the Countdown Sell “13” has failed and the bulls are in control. In this case price gets close to “secondary exhaustion” but doesn’t break through it; AND/OR…

ii. We get a “Price Flip” to downside, i.e. bar “1” of a 9-count going down (#3)

B. If I enter a short once I get the “Price Flip” my stop is the “secondary exhaustion” level (#2), or I may get out if the Buy Setup count cancels, suggesting the bears are weak.

C. In AMGN’s case, the Buy Setup count continues and it breaks the TDST Level Down line while on bar “4” (#4). Once it completes on bar “9” there it creates an expectation that a Countdown Buy 13 will start and finish. To reinforce the fact that the bears are in command, at bar “2” of the Countdown (#5), the break of TDST Level Down qualifies (i.e. the line changes from dotted to solid). This confirms that the trend has changed from bullish to bearish.

D. Price continues to slide until the Countdown Buy 13 completes (#6). But here too, it’s unclear that the bears are exhausted because immediately after the Countdown Buy 13 completes, so does a new Setup Buy “9” (#7). This is a mirror image of what happened in paragraph A. above.

E. Once again, it pays to wait before covering a short or flipping long until we see if the “secondary exhaustion” level (#8) holds, AND/OR we get a bullish “Price Flip” (#9). In this case both happen. If I flip “long”, my stop will be the “secondary exhaustion level” (#8) and/or cancellation of the unfolding Sell Setup count.

F. The Sell Setup continues and completes at bar “9” (#10) creating an expectation that a Countdown Sell 13 will start and finish. That bar also closes above the TDST Level Up line, but the break of that level so far remains disqualified, i.e. the change of trend is not yet confirmed.

G. However, another DeMark indicator – TD Propulsion – comes into play. TD Propulsion has 2 components: the “Momentum” line (#11) and the “Exhaustion” line (#12). If the two lines are not qualified (i.e. they show as dotted), the “Momentum” line can be viewed as support if/when the price goes above it, and the “Exhaustion” line is the corresponding resistance. However, if the 2 lines are “qualified” (shown as solid lines in this case), the “Exhaustion” line becomes a target rather than justresistance. Given the completed Sell Setup “9”, and the price above TDST Level Up, I like my odds that the Propulsion target will be achieved. Should a new bearish “Price Flip” appear, it would be time to take some of the “long” off the table.

Hopefully this real life example of how to interpret DeMark indicators can take some of the mystery out of the often confusing jargon.

Thanks for reading!

Twitter: @FZucchi

The author has a long position in AMGN at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.