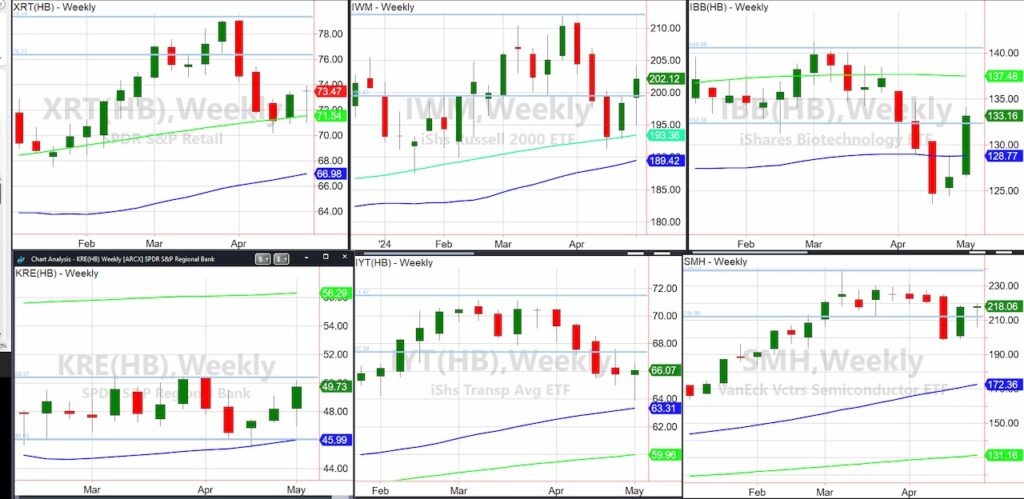

This is the 5th weekend in a row I have covered the Economic Modern Family of important stock market ETFs as my weekend update.

From 5 weeks ago when the Retail Sector ETF (XRT) and the Russell 2000 ETF (IWM) sold off hard after failing to take out the weekly channel highs-

To

3 weeks prior when both held key weekly moving averages-

To

2 weeks ago, when the Semiconductors Sector ETF (SMH) took the lead again as the only member ETF to clear back through the weekly channel lows.

To

This past week when ½ the ETFs cleared back through the weekly channel lows.

The Family of ETFs got us cautious, prepared us for a correction, then a bounce, then follow-through and now??

How do we prepare for this week?

Starting with the Retail Sector ETF (XRT), last weekend I wrote:

“This pop you see off the 200-weekly moving average is a great start. But is it enough? Keep $75.00 in mind as XRT MUST clear that level to continue the march higher.”

Looking at the weekly chart, 73.50 is last week’s high price. This past week, XRT closed below that level.

Yes, XRT held support, but considering that the four indices could not clear the 50-day moving average, Granny is a key to watch this week. She could lead, or she could be telling us the rally was nothing more than a rally into major resistance.

Which leads me to the index in our Family, the Russell 2000 ETF (IWM).

Last weekend I wrote,

“The Russell 2000 IWM also had an inside week, holding the 200-WMA and finding resistance at the weekly channel bottom.”

This past week, IWM is one of the 3 Family members that cleared back over the weekly channel low.

That makes 200 pivotal and 205 the next hurdle. Under 200, we maintain more caution and warnings of market chop.

The Biotechnology Sector ETF (IBB) was a big story this past week.

I wrote, “If IBB can clear the 50-WMA (blue) that would be a positive.”

It did and it was.

I hope my readers followed the breakout. This coming week, we will watch 132 as the key to hold up.

The Regional Banks ETF (KRE) held key support 3 weeks ago. Now, it has the weekly channel low to contend with.

I will keep my eyes on it. Over 50.00 we see upside.

The red flag coming into this past week was the Transportation Sector ETF (IYT).

I flagged this sector as our biggest concern.

This week, the best I can say is IYT looks indecisive. IYT barely closed higher for the week making this and Retail XRT still troublesome.

Finally, the Semiconductors (SMH) contended with lots of earnings from the misery of Advanced Micro Devices (AMD) to the ecstasy of Taiwan Semiconductors (TSM).

This coming week, we want to see SMH hold the weekly channel low.

To remain bullish, we also need to see SMH clear this past week’s high (around 220) and continue higher.

If you want to know whether we are headed further into stagflation, which could mean a sell-off and then more chop in equities, accompanied by a further rally in commodities, then keep the Family on your screens!

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.