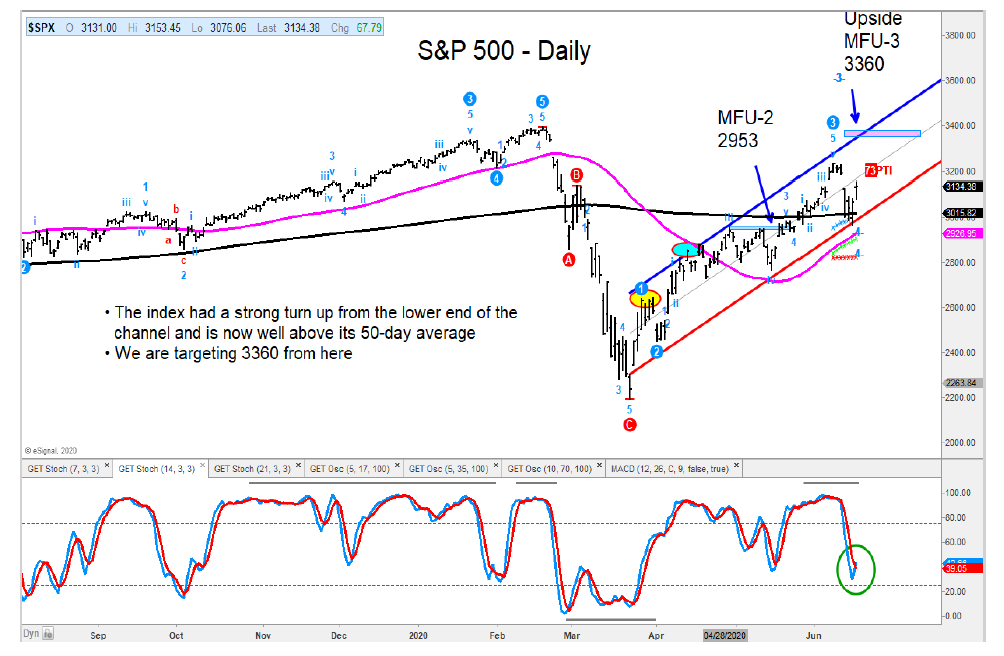

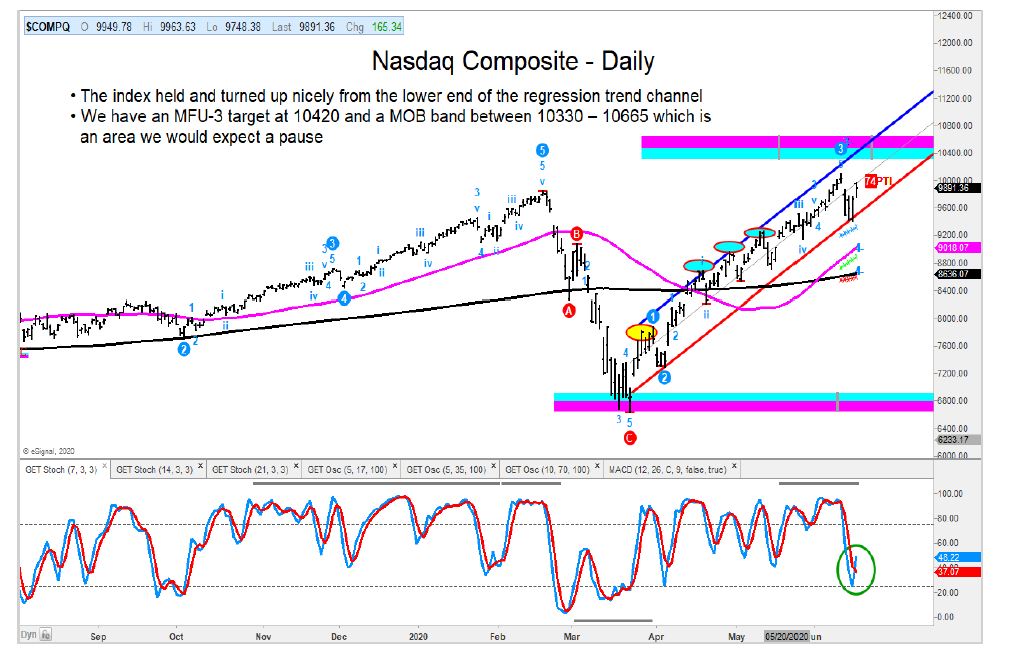

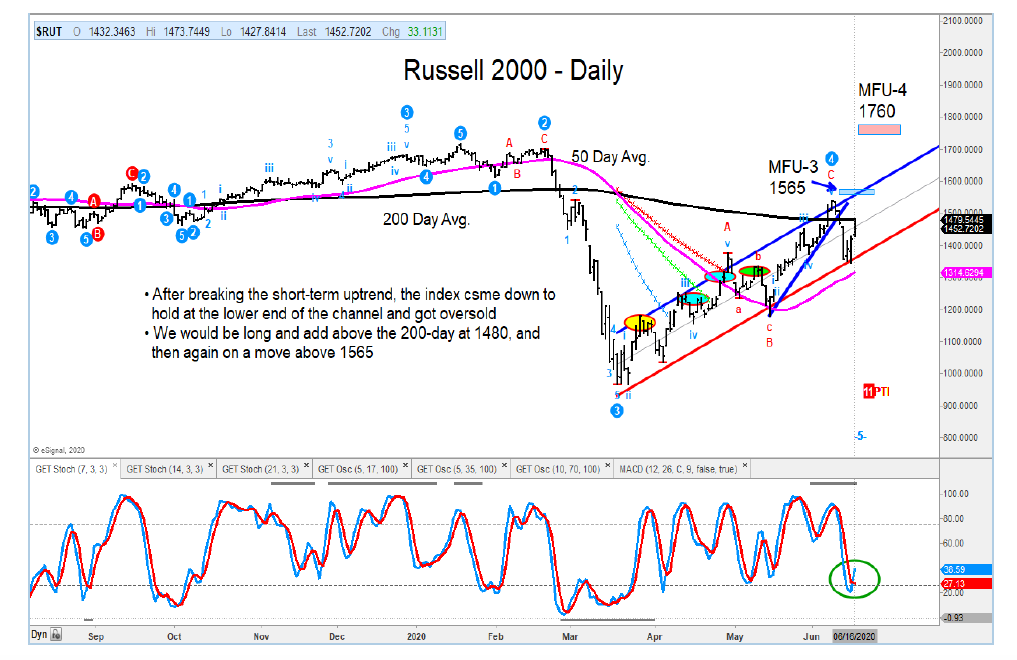

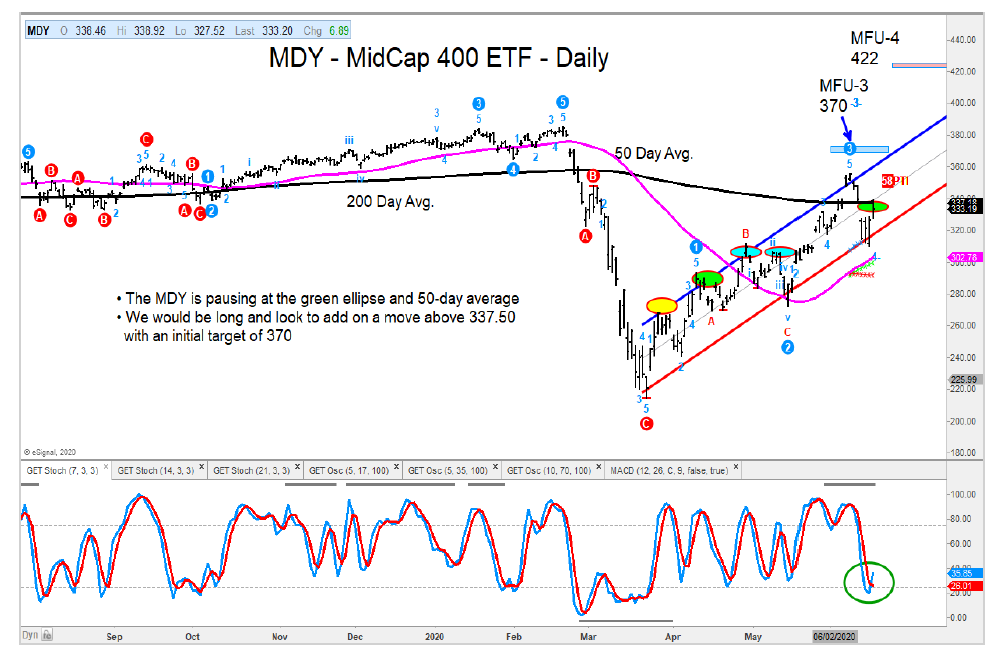

On Friday, the S&P 500, Nasdaq Composite, Russell 2000, and the Mid-Cap Index all rallied strongly off their respective regression trend channels.

Upside momentum is picking up as these stock market indices rally from oversold levels.

The momentum factor ETF (MTUM) did inflect higher vs. the S&P 500 Low Vol. ETF (SPLV) (as was expected).

We believe the upward slope of that relative ratio may not be as strong as it was in the prior two months, and the value side of the equation gains ground.

We highlight the Financials ETF (XLF), which triggered a buy on May 28. This is an area to fish for trading values (with stops).

We also want to mention WTI Crude Oil as we feel the recent pullback is a tradable buy (with a stop). As with all trends… follow them until a major reversal (or trend break). Due to recent volatility, it’s wise to remain cautious and use stops.

The author may have position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.