The equity markets registered modest gains last week against a difficult backdrop of weak economic data, ongoing trade uncertainty and deteriorating geopolitical events.

Nevertheless, the markets found traction in better-than-expected earnings from the large-cap banks and some areas within the health care sector.

The S&P 500 Index INDEXSP: .INX and the NASDAQ Composite INDEXNASDAQ: .IXIC gained about 0.5% but the Dow Industrials fell for the fourth week of the last five.

The best performance was found with the S&P mid-cap average gaining 1.0% and small-caps jumping 1.5%.

Foreign markets also gained despite a downgrade to global economic growth in 2019 by the International Monetary Fund (IMF). The IMF, however, expects growth to rise to 3.4% in 2020 and does not see an imminent recession. The equity markets in Germany, France, Italy, Taiwan and the Japanese Nikkei Average all hit new 52-week highs last week.

The fact that more global markets are making new highs (10%) versus new lows (0%) tends to be bullish for U.S. stocks.

The focus of attention, as we move deeper into the fourth quarter, will be on the Federal Reserve, corporate earnings and expectations for the traditional year-end rally in stocks. The Fed is widely anticipated to lower interest rates by 25-basis points at the end of the month. Although much of this is likely already built into current prices there is anticipation that Fed Chief Powell could get more aggressive with an additional rate cut in December.

Last week a key indicator of consumer health, retail sales, fell for the first time in seven months. This decline was offset by revised August sales growth which was up to 0.6% from a strong 0.4% the previous month. We believe that a healthy labor market, consumer spending and continued stimulus from the Fed will support the U.S. economy which has slowed due to trade disputes and manufacturing weakness.

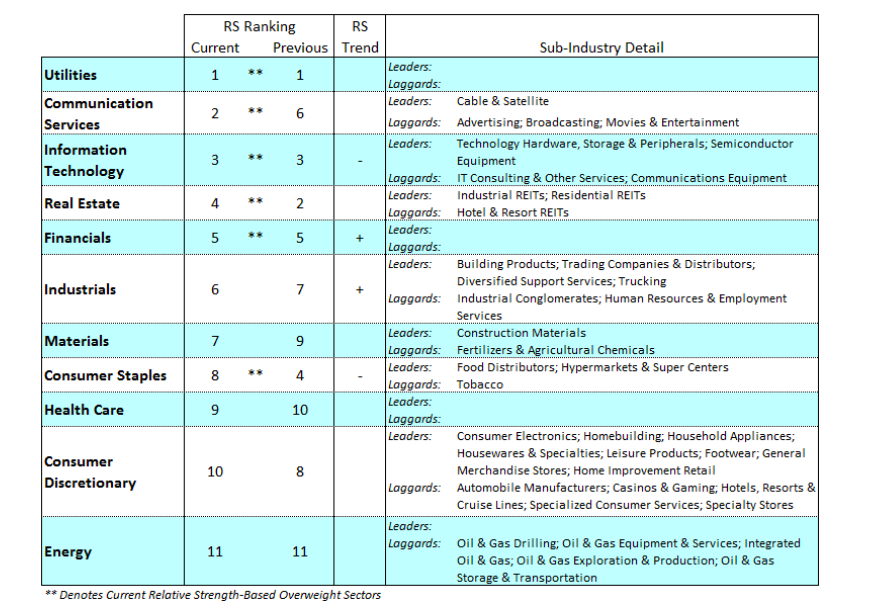

The latest S&P sector rankings show utilities and real estate investment trusts remain at the top. Areas of the market that are more closely tied to the business cycle, however, are showing relative strength improvement.

These include the financials and industrials, technology and communication services. Last week we recommended the financials and information technology and we would now add the industrials to the mix. Considering that the latest economic data is soft and stock market volatility is expected to remain elevated, investors should use corporate bonds (three- to five-year maturity) to cushion potentially wide-swinging markets in the fourth quarter.

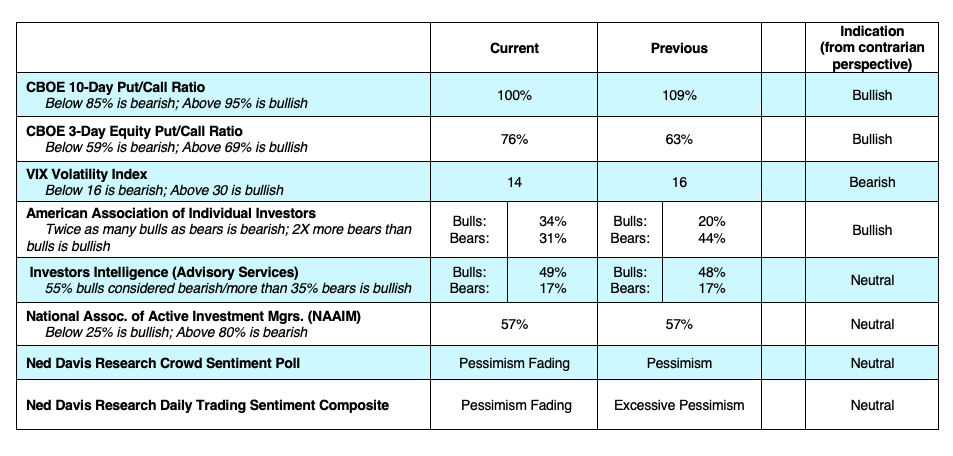

The technical indicators showed modest improvement last week. Short-term sentiment measures including put/call ratios and the low number of bulls in the survey by the American Association of Individual Investors (AAII) indicate that many are skeptical and cautious. This is offset, however, by the relatively low VIX reading that indicates investors are complacent rather than fearful.

Additionally, the fact that there are only a small number of bears found in the Investors Intelligence numbers makes it difficult to argue that pessimism is pervasive or excessive enough to trigger an outright buy signal using contrary opinion. The broad market is offering evidence that a wider array of stocks is participating in the current rally, which is a favorable development. Over the very near term, the weight of the technical indicators suggests a continuation of the current trading range with support at 2840 and resistance at 3020 using the S&P 500 index.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.