Stock Market Futures Trading Considerations For November 30, 2017

The S&P 500 (INDEXSP:.INX) and Nasdaq (INDEXNASDAQ:.IXIC) are rallying again on Thursday as buyers press the action higher yet. Check out my futures trading commentary and key price levels below.

Note that you can access today’s economic calendar with a full rundown of releases.

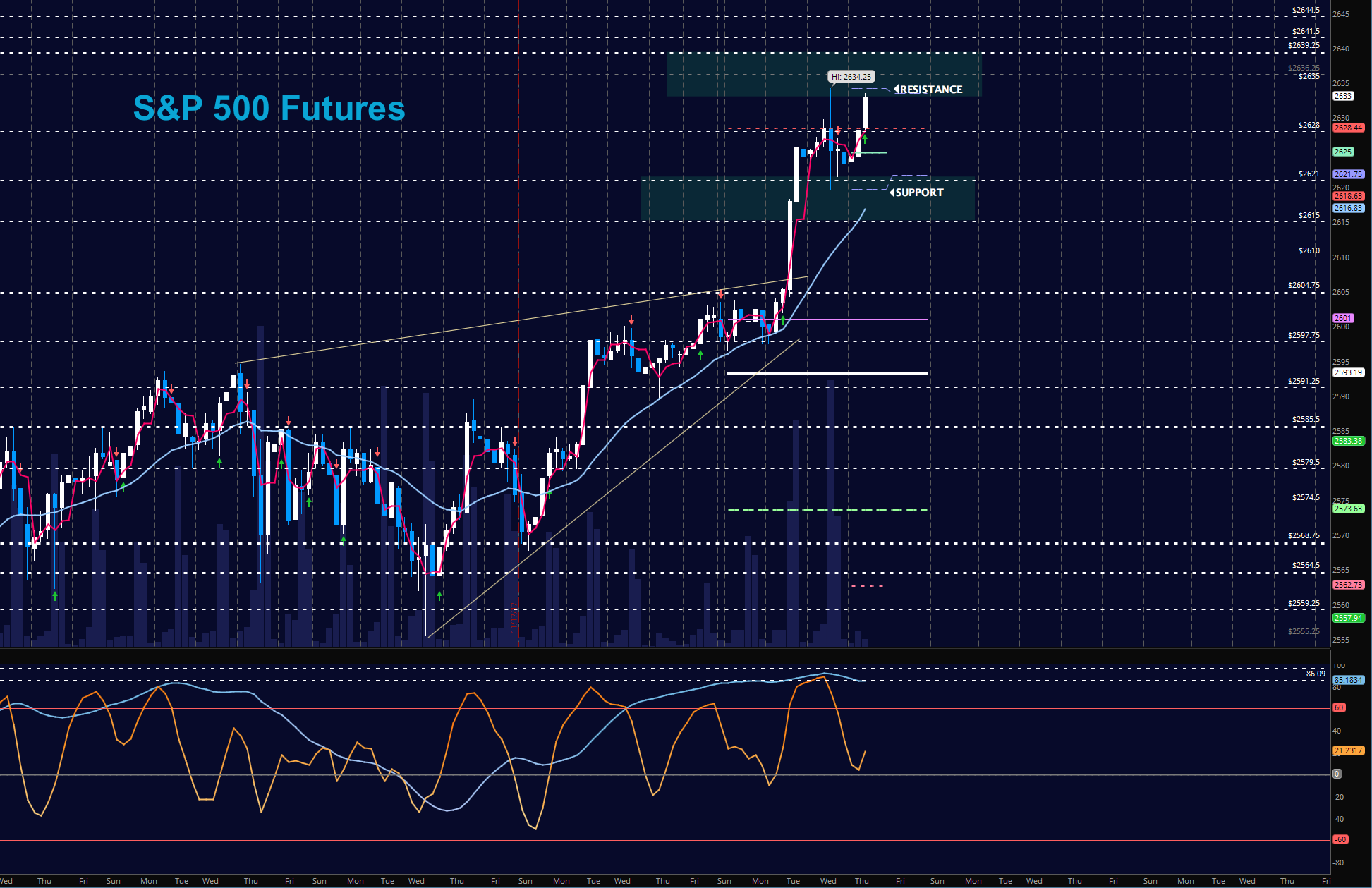

S&P 500 Futures

Our e-mini chart here dipped slightly as the tech sector sold off sharply, creating divergent price patterns in the broad look across markets. The SPX straddle expiring Friday suggests near 12 points of motion in either direction. Breakdowns should bring value buyers to the table once again, but patience intraday is required. As long as new support holds near 2622, we should have bullish action continue intraday. Below 2615, intraday strength could shift into bearish formations, but not before buyers fail to hold the likely bounce. The bullets below represent the likely shift of trading momentum at the positive or failed retests at the levels noted.

- Buying pressure intraday will likely strengthen above a positive retest of 2628.75

- Selling pressure intraday will likely strengthen with a failed retest of 2620.5

- Resistance sits near 2634.5 to 2636.5, with 2639.5 and 2644.25 above that.

- Support holds between 2615.5 and 2609.5, with 2597.5 and 2591.5 below that.

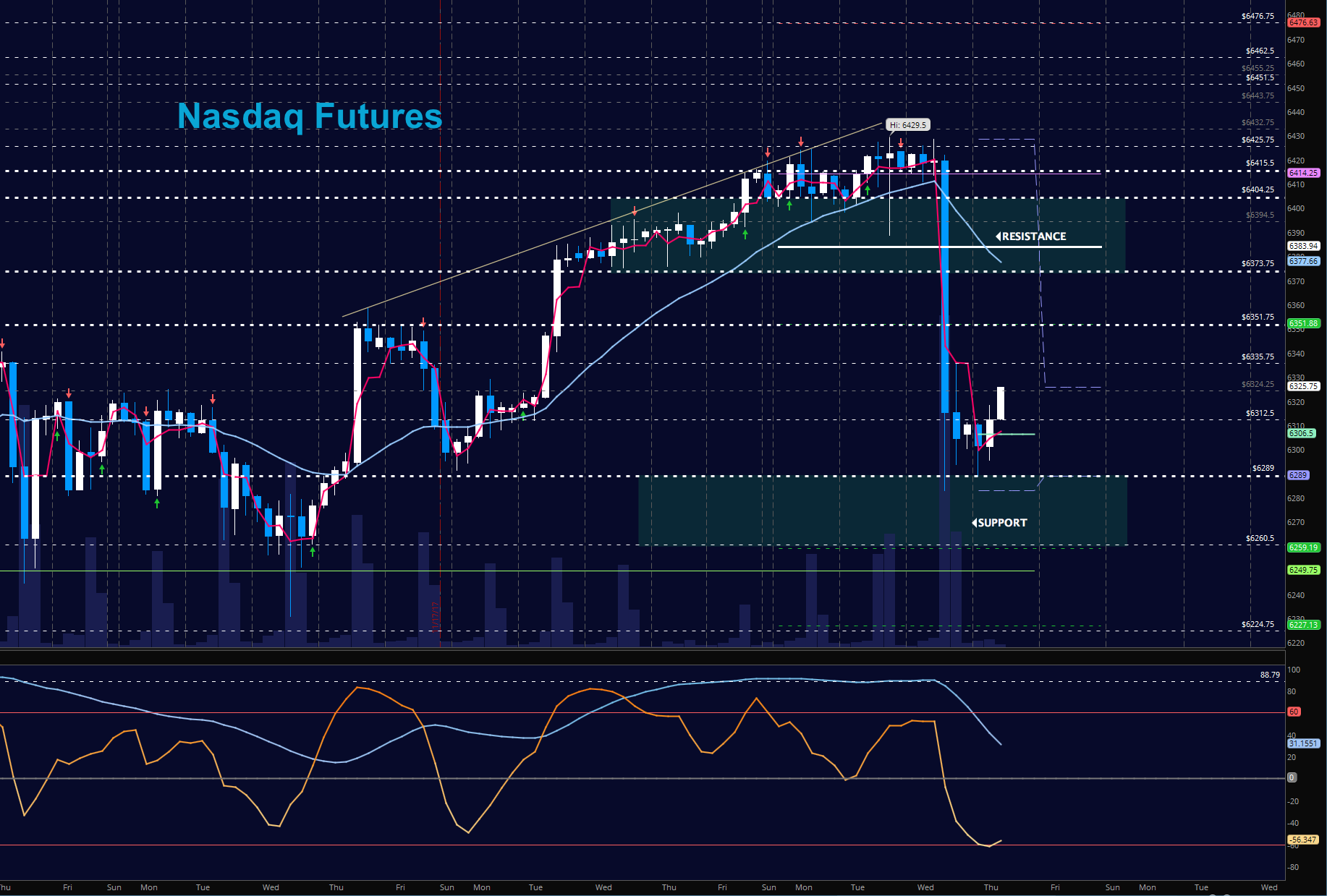

NASDAQ Futures

The NQ_F had yet to break higher yesterday morning in a telegraph of the weakness that came later in the day in a profit-taking space. Bullish undercurrents remain strong but recent weakness and the failure to recover might be an indicator of things to come. Support tests will tell the tail as well as a failure to return to highs. Patience is required to avoid the most risk. The bullets below represent the likely shift of intraday trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 6335.75

- Selling pressure intraday will likely strengthen with a failed retest of 6302.5

- Resistance sits near 6335.75 to 6351.5 with 6373.5 and 6402.5 above that.

- Support holds near 6312.5 and 6298.75, with 6289.75 and 6265.75 below that.

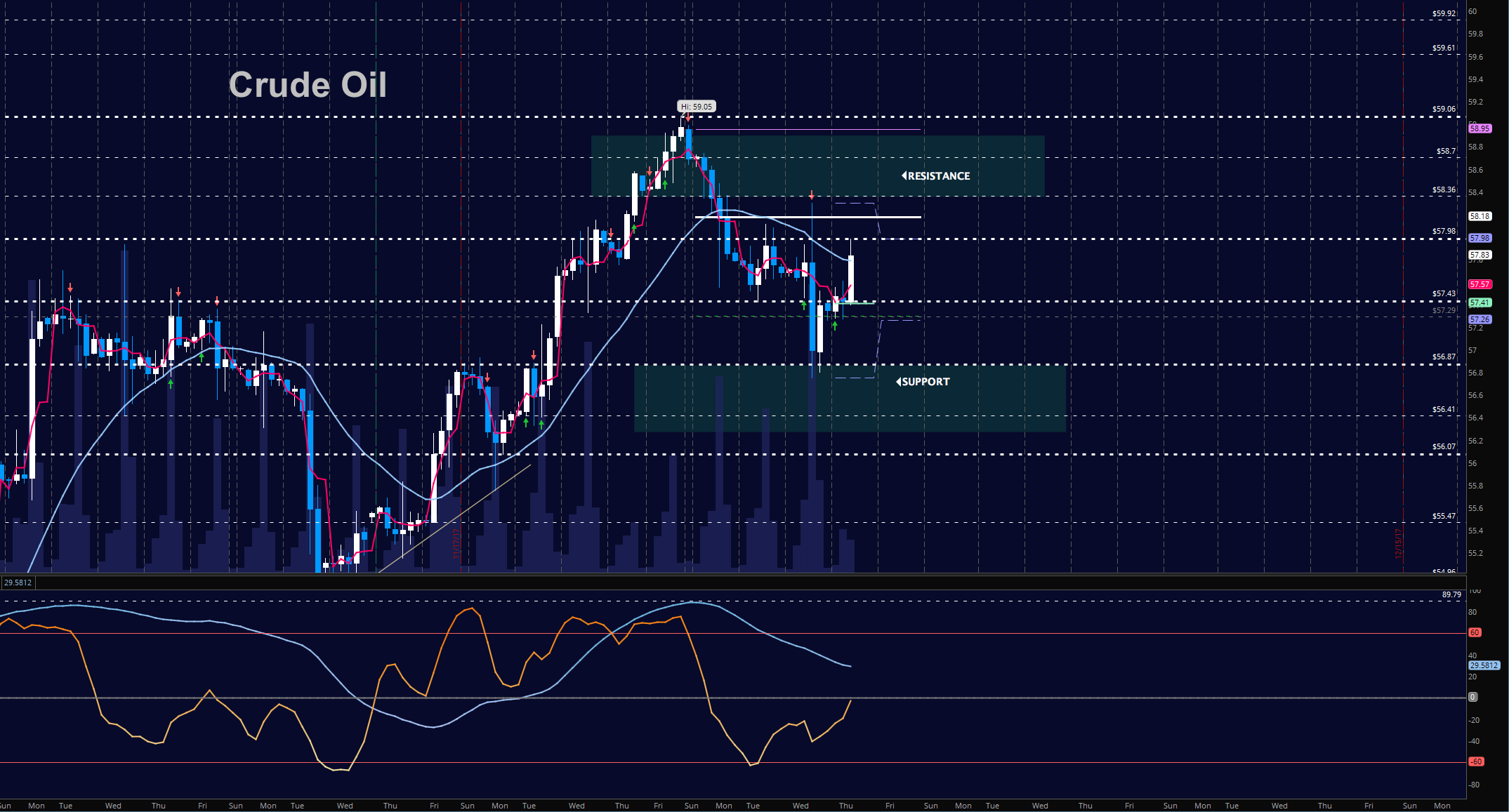

WTI Crude Oil

Yesterday’s final target for support near 56.74 was tested and held twice before bouncing and now we sit near resistance around 58 to 58.36 -momentum remains mixed. The bigger undercurrent is still bullish. The bullets below represent the likely shift of trading momentum at the positive or failed tests at the levels noted.

- Buying pressure intraday will likely strengthen with a positive retest of 58.18

- Selling pressure intraday will strengthen with a failed retest of 57.38

- Resistance sits near 57.98 to 58.18, with 58.36 and 58.74 above that.

- Support holds near 57.26 to 56.87, with 56.42 and 56.07 below that.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.