With the market taking a breather this week, I wasn’t surprised to see the Utilities Sector (NYSEARCA:XLU) at the top of the daily returns list.

One of my favorite ways to break down a sector is to start with the largest stocks and “bucket” them by chart patterns. This process helps me identify leaders and laggards within the group, gauge breadth within the sector, and find opportunities in stocks that are outliers.

Reviewing the Utilities Sector today, I am impressed to see that most of the stock charts are in the buckets I labeled “long and strong” (established uptrends) and “breakout” (recently broke above a key resistance level).

With an average dividend yield of around 3%, these utilities stocks could be a very attractive way to diversify into a traditionally underappreciated sector with emerging outperformance.

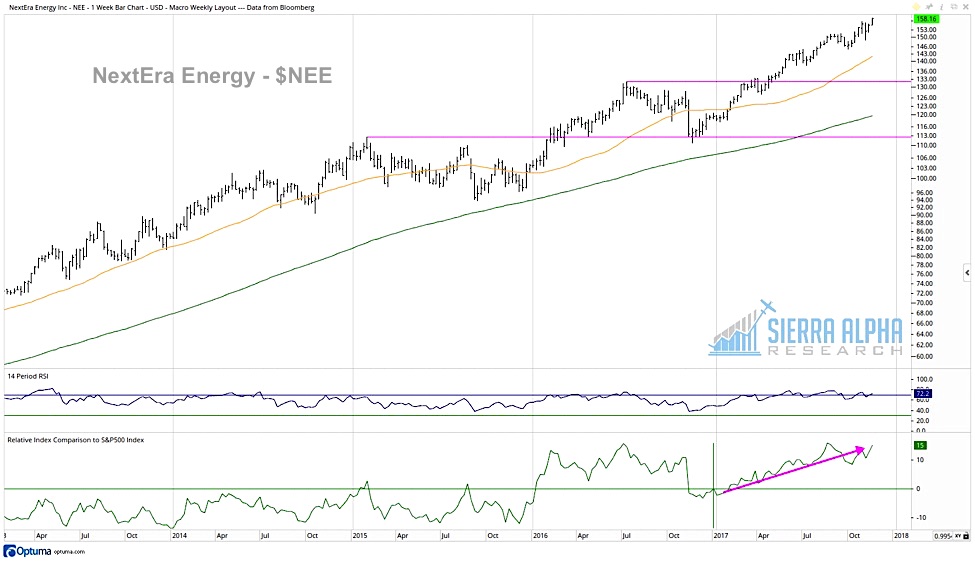

In the Long and Strong bucket, you’ll see names like NextEra Energy Inc (NYSE:NEE) that have outperformed the S&P 500 year-to-date.

You’ll also find stocks such as Public Service Enterprise Group (NYSE:PEG) and American Water Works (NYSE:AWK) that have rallied well after breaking above significant resistant levels. These stocks have been market performers for much of the year, but recently started to outperform after the breakout.

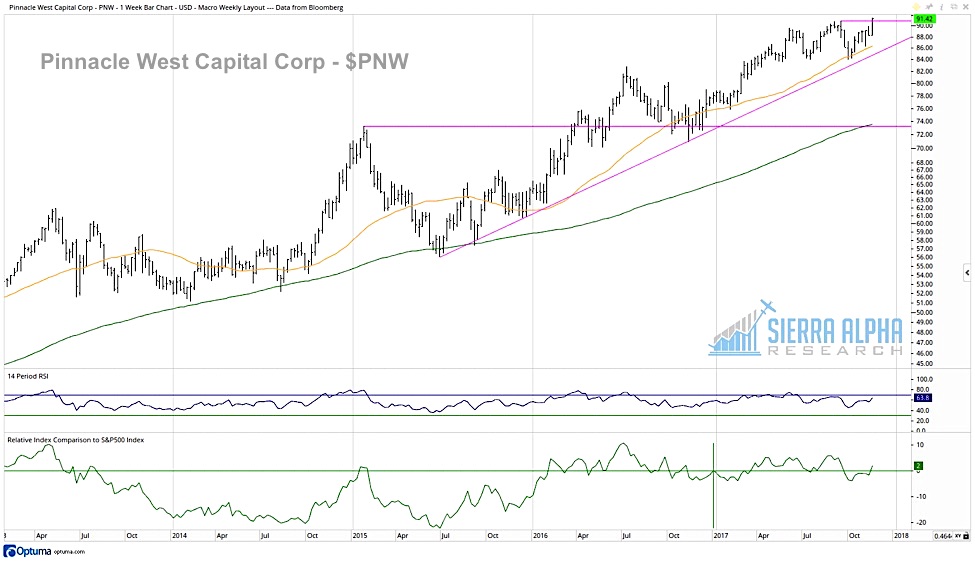

In the Breakout bucket, you’ll notice charts that are in the process of breaking above key resistance levels. Stocks include Nisource Inc (NYSE:NI) and Pinnacle West Capital Corp (NYSE:PNW).

86% of the S&P utilities stocks are above their 50-day moving average, driving home the positive breadth within the group. Also, only three of the 28 names in the sector are in established downtrends.

As much as we love to pay attention to stocks making headlines, sometimes a thorough review of the charts can identify good opportunities in unlikely places.

You can gain deeper insights and more meaningful analysis over at Sierra Alpha Research.

Twitter: @DKellerCMT

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.