My last article on Microsoft (MSFT) discussed how its stock price was closing in on a cluster of “major” price objectives.

My blog has been following Microsoft’s stock price patterns since the low in 2009. If you click the link and read to the bottom you’ll find the pattern/geometry that ‘caused’ the low. At least in my opinion.

So where are we now?

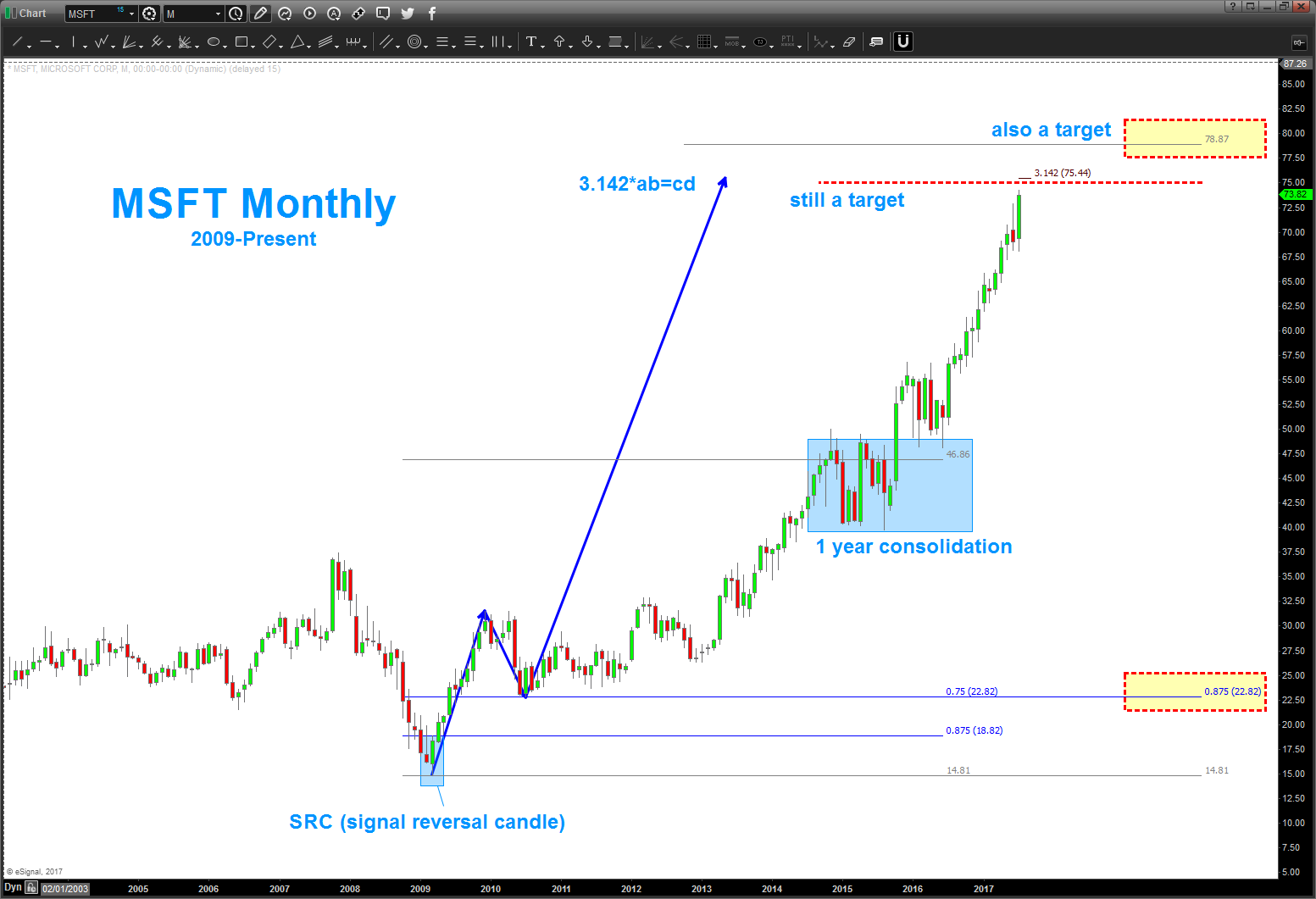

As you can see in the MSFT “monthly” charts below, the 1.27 monthly extension was respected but recent price action has blown thru that target. Yet, we do have the $75 level as a price target that’s been on the radar for a while.

I would watch this area closely. Note that a daily close below 68 would represent a “monthly signal reversal candle” and a reason to become defensive with this stock. It’s been an amazing run. It’s just a pattern and the size of the candle approaching this area begs of caution with regards to shorts… but I’ve learned to respect these types of patterns.

Also, note in the second chart a couple things:

- A technique of ‘bracketing’ the SRC w/ 1/8 increments. It’s a technique that was taught to me by my friend and mentor Michael Jenkins of www.stockcyclesforecast.com. As you can see, the first 1/8th projection hit around 46-47 and led to a year consolidation. We have another 1/8th projection around 78-79.

- Also, note the 3.142 projection we get from the first initial impulse move off the bottom … it’s smacks right into our 75ish projection level.

Microsoft (MSFT) “monthly” Stock Charts

So, in conclusion, if your long Microsoft (MSFT) I would definitely start monitoring this closely. At a minimum, the $75-$80 zone could usher in a long consolidation before continuing the bull run of MSFT. But it could also mark a top and the beginning of a big correction. Best to exercise discipline here.

Thanks for reading and let me know if you have any questions.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.