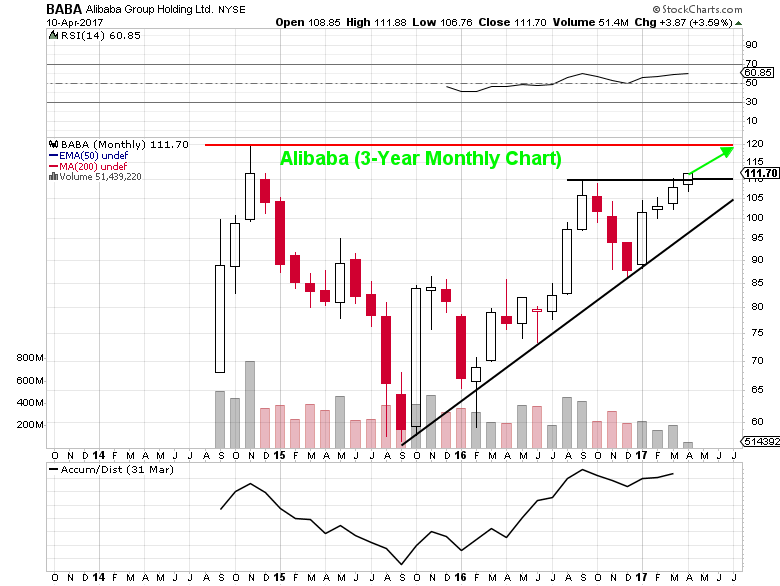

Alibaba Group (NASDAQ:BABA) had a successful start after going public in late 2014, pricing at $68 per share and quickly soaring to $120 by November.

However, the IPO honeymoon phase quickly turned sour at the start of 2015 as shares fell below $90 in January. And close to the 1-year IPO anniversary, shares of Alibaba stock (BABA) were trading sub-$60 per share.

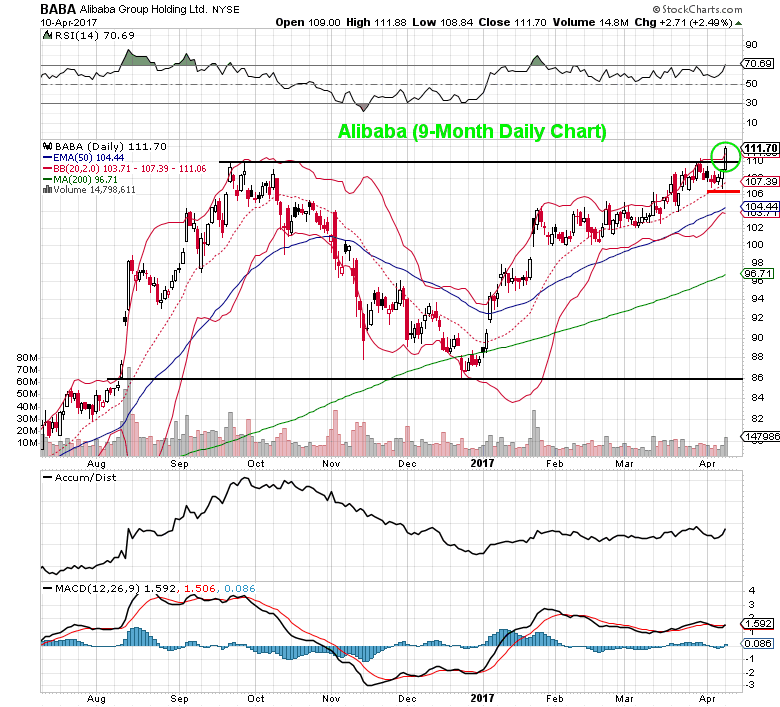

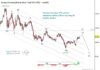

Since then the stock has been steadily trending higher. It’s first milestone during its recovery rally came in August of 2016 when it successfully broke out above the $85-$86 resistance level. And just yesterday (April 10th), Alibaba’s stock price reclaimed the $110 level for the first time in over two years, closing above the recent trading range (see the daily and monthly charts below).

On a measured move basis, the stock could see a move to $135-$136 in the longer-term. However, the $120 life-time high could create some intermediate-term resistance later in the year as investors look to take profits. For those looking to take a long stock position, consider you a stop loss just under the recent lows of $106.50 in the event of a bearish reversal.

Alibaba Group – Fundamentals

The $269B Chinese e-commerce company trades at a P/E ratio of 26.10x, 13.36x sales, and 7.24x book value. Looking ahead to the next fiscal year, revenue is expected to rise 31%+ to nearly $30B in sales as earnings grow north of 20%. Wall Street analysts currently have an average price target of $124.35. Earlier this month, Bernstein upped their price target to $130 from $117 and Raymond James set their target of $138 after meeting with the company’s head of investor relations.

Analysts at Raymond James see cloud growth topping $1B in FY17, strong organic growth, margin expansion, and an attractive core commerce valuation as reasons for making the stock a top pick at their firm. Q4 earnings are due out in the first week of May.

Alibaba Group (BABA) Options Trade Idea:

If you’re bullish on the company you could consider a bull call spread. An example would be buying the May 12 2017 $112/$120 bull call spread for a $2.75 debit or better.

This involves buying the May 12 2017 $112 call and selling the May 12 2017 $120 call, all in one trade.

By putting on a trade like the one above it allows you to hold over earnings with a defined risk ($2.75 per spread). A close at or above $120 on options expiration would result in a gain of 191%; the breakeven point is $114.75, if held through expiration.

Thanks for reading and have a great week!

Twitter: @MitchellKWarren

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.