Timing the market can be a daunting task. Some even claim it’s impossible. However, at Market Inflections we would tend to disagree. By employing a series of market timing algorithms, we are able to measure with some degree of accuracy when major market trends are most likely to begin and end.

We call these algorithms Euclid — and they have recently been flashing a number of warning signals which suggest the recent run up in technology stocks may be coming to an end.

Let’s review a few charts to provide a clearer picture of why our indicators are pointing to a reversal of fortune. The following analysis below was put together by Larry Footer of Market Inflections.

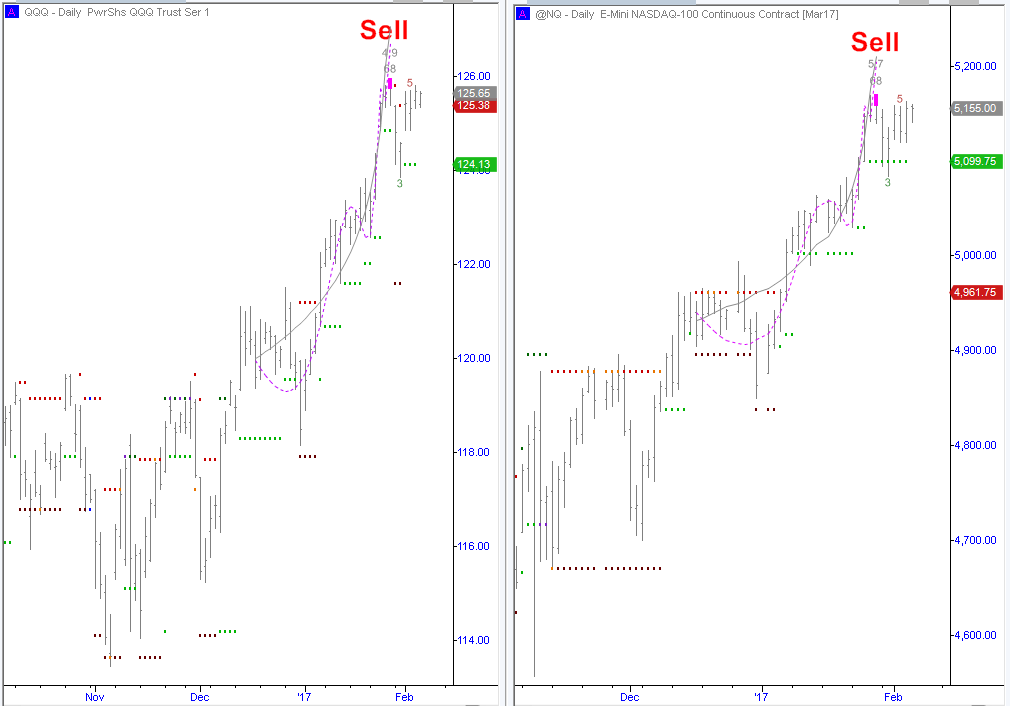

Top Signal on the Daily Chart of the Nasdaq

In late January, Euclid generated top signals on the daily charts of the PowerShares QQQ Trust ETF (NASDAQ:QQQ) as well as the E-Mini Nasdaq-100 Futures Contract (NQ). These top signals are statistically significant through late April.

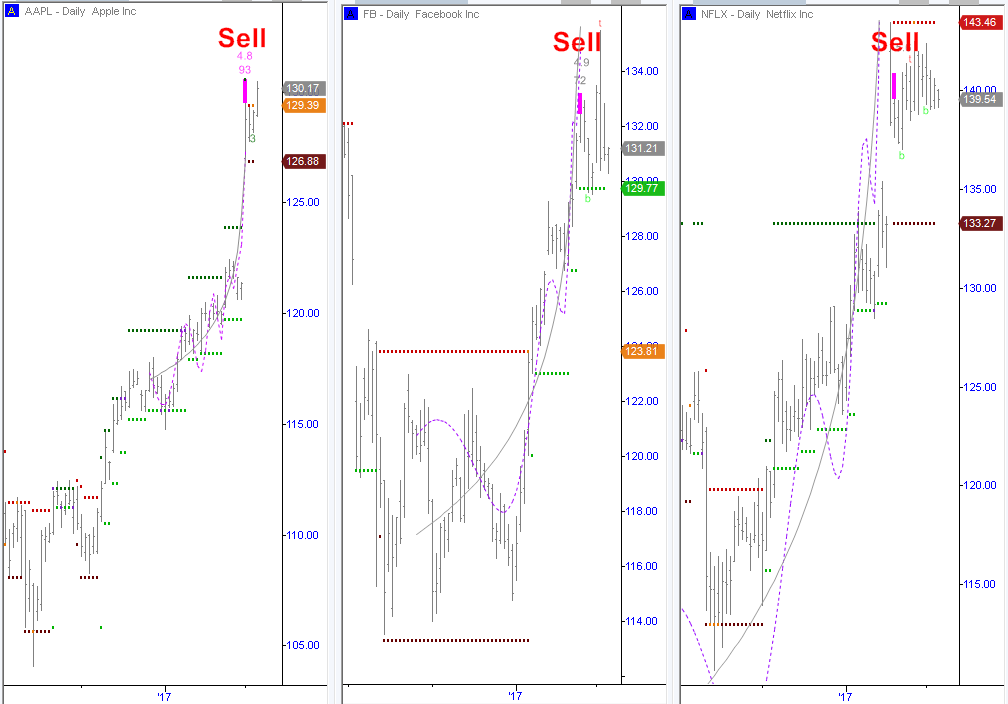

Tech Stocks – Sell Signals

Top Signals on the Daily Chart of Leading Technology Stocks

The evidence of a top in tech is mounting as Euclid has also generated top signals on a number of the largest Nasdaq Index component stocks. Here, we’ll look at Apple (AAPL), Facebook (FB), and Netflix (NFLX).

Apple (NASDAQ:AAPL)

Last week Euclid generated a top signal on the daily chart of Apple (AAPL). This top signal is statistically significant through the middle of March. It is also worth noting that our Price Wizard valuation neural nets now show Apple as being overvalued for first time in years. While this overvaluation is not extreme (valuation estimates for Apple are currently $117.91), the last time this happened was early 2015 and Apple subsequently traded sideways to lower (with a maximum peak-to-trough drawdown exceeding 30%) for the next year before recovering.

Facebook (NASDAQ:FB)

Two weeks Euclid also generated a top signal on the daily chart of Facebook (FB). This top signal is also statistically significant through the middle of March. Euclid’s valuation estimates on Facebook are currently at $47.08, a whopping 68% lower than Friday’s close.

Netflix (NASDAQ:NFLX)

In January, Euclid generated a top signal on the daily chart of Netflix (NFLX). This top signal is statistically significant through April 2017. Netflix is extremely overvalued at current prices, as Euclid’s valuation estimate is currently at $26.14.

If you would like to learn more about how our algorithms might be able help your trading or investing strategies, please visit our website over at Market Inflections.

Thanks for reading and have a great week.

Twitter: @larryfooter

The author is short the Nasdaq Futures Contract and owns AAPL, FB and NFLX puts at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.