So last week the S&P 500 Index was up 3.26%, making it the best week of the year. Given this is pretty late in the year, you could argue there’s a decent chance this will end up as the best week of the year for stocks. Of course, we don’t know this for sure, but let’s just say for the moment that it will be.

So, what does this mean and what happens next?

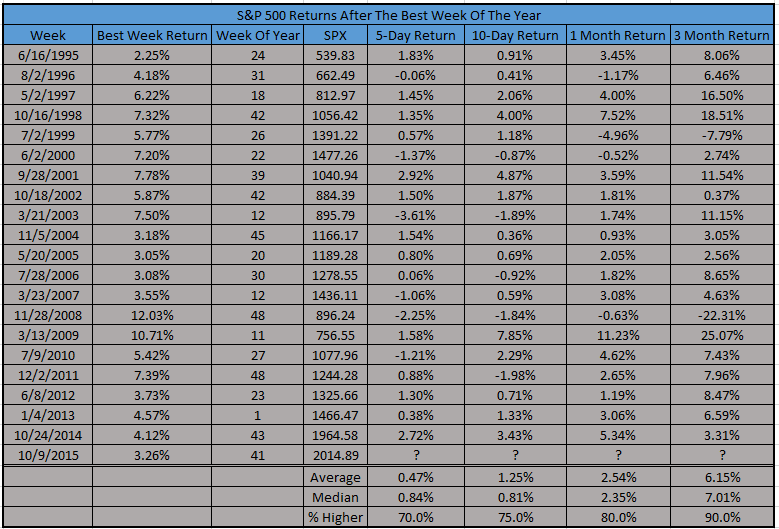

First off, if this stands as the best week of the year for stocks, it will be the ‘worst’ best week of the year in 10 years. In fact, the ‘worst’ best week of the year going back 20 years was 2.25% in June 1995. Of course, 1995 gained 34.11% for the year – making it also the strongest annual gain of the past 20 years.

This hammers home something I’ve long said:

The best and truly historic bull markets happen when things are calm.

Now getting to the returns, the five days after the best week of the year are higher 70% of the time. Last year, the week after the best week of the year in October gained a very impressive 2.72%. Two weeks out the average market return is 1.25% and up three out of four times. Not bad at all.

Going out further, incredibly the month after the best week of the year has been higher 13 of the past 14 years!

Given stock market seasonality is usually positive the next few months, if last week was indeed the best week of the year for stocks, this could be another bullet in the bulls pocket going forward.

S&P 500 Returns following The Best Week Of The Year (1995-2015)

Thanks for reading and have a great week.

Twitter: @RyanDetrick

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.