The market took another turn for the worse this past week, with four weeks in a row in the red and the DOW futures dropping, testing significant support from the summer.

With the upcoming Fed meeting and higher rates coming to control inflation, we are watching a few themes.

Here are Five Themes to Trade Next Week:

1. Stock or Bonds? Or both? Neither? Not only have stocks lost significant value, but the long bonds TLT performed just as poorly. But maybe that is about change?

The long bonds, or TLTs, are potentially bottoming, and investors tend to buy TLTs to avoid losses in their portfolio. If so, what does this mean for the US dollar? Duration? Growth?

2. Commodities continue to outperform the SPY (silver outperforms gold, and gold is already outperforming SPY).

This means that although silver and gold prices may be volatile, they are to retain more value for your dollar. Could commodities be waking up and precious metals leading the way?

3. Food prices remain high, and the cost of groceries continues to increase rapidly. Food inflation can have far-reaching consequences for both individuals and economies. Inflation is the silent killer of your wealth.

The value of money is eroding almost daily, so essential to invest in inflation hedges, specifically in areas of food, and there are several ways to trade, protect, and profit from inflation.

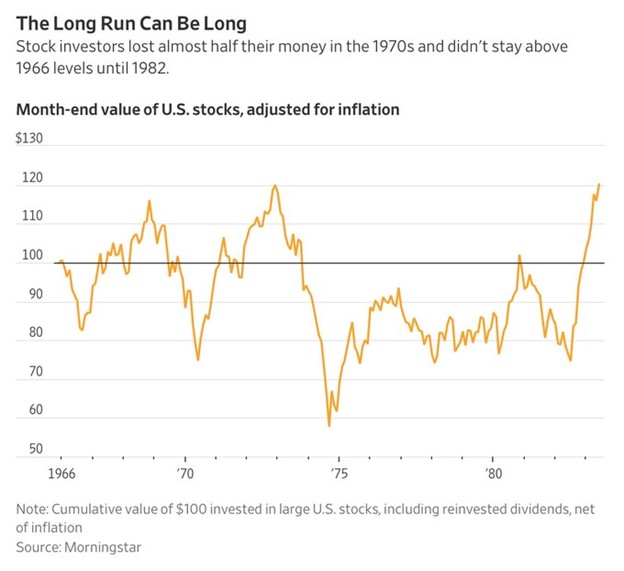

4. The 1978-1980 trading range in the indices supplants the fears of a major crash. A trading range is when the prices of an asset become restricted within upper and lower limits for a sustained period of months or even years. In other words, trade price and not fear.

5. China waking up or potentially going back to sleep. Investors and CEOs alike are worried about the future of the Chinese economy. With a slowing economy, growing unemployment, and an impossible ZERO COVID policy, China is wobbling right alongside their property market.

There are a lot of factors weighing on the market and these five themes are important to watch and more importantly to trade them as the Fed meets next week.

As always, watch the price charts.

Mish’s Upcoming Seminar

ChartCon 2022 Stockcharts October 7-8th Seattle.

Join me and 16 other elite market experts for live trading rooms, fireside chats, and panel discussions

Stock Market ETFs Trading Analysis and Summary:

S&P 500 (SPY) Confirmed bear phase 382 support with resistance at 396

Russell 2000 (IWM) Support at 176 and resistance 180

Dow (DIA) Confirmed bear phase 305 support and 309 resistance

Nasdaq (QQQ) support at 285 and resistance at 292

KRE (Regional Banks) Support at 62 resistance at 63.25

SMH (Semiconductors) Confirmed bear phase and support at 200 and resistance at 206

IYT (Transportation) 214 support and 217 resistance

IBB (Biotechnology) Support at 121 and 124 is resistance

XRT (Retail) Support at 61 and 64 is resistance

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.