The tension on the tape is building. Like it or not, many active investors are bracing for the reaction to the FOMC statement today (set to release at 2pm ET). Bulls and bears are in an epic stare down, and for this reason it’s probably best for traders to sit this one out. Especially if you’re losing sleep over your positions.

The tension on the tape is building. Like it or not, many active investors are bracing for the reaction to the FOMC statement today (set to release at 2pm ET). Bulls and bears are in an epic stare down, and for this reason it’s probably best for traders to sit this one out. Especially if you’re losing sleep over your positions.

The build up is pretty typical, but today’s release holds a bit more emotional weight. This can be said for a few reasons:

1) Equities are hanging out near all-time highs. The resilient nature of stocks is starting to play mind games with equity bears (and the bulls are relentless in reminding them). This means that emotions are larger than life, and that will add volatility (and confusion) to the marketplace in the hours after the Fed statement release.

2) OPEX. Options expiration will likely influence short-term movements. Perhaps even exacerbate them.

3) Fed Policy. Lastly, the Fed statement could provide a new wrinkle. Inflation fighters are now advocating for a potential rate hike. And higher Crude Oil is adding to their argument. Although this is unlikely, more tapering appears to be in the cards. The expectation is for the Fed to stay the course and announce another $10 billion cut in bond purchases. Either way, this particular statement is garnering attention and that will produce a strong reaction.

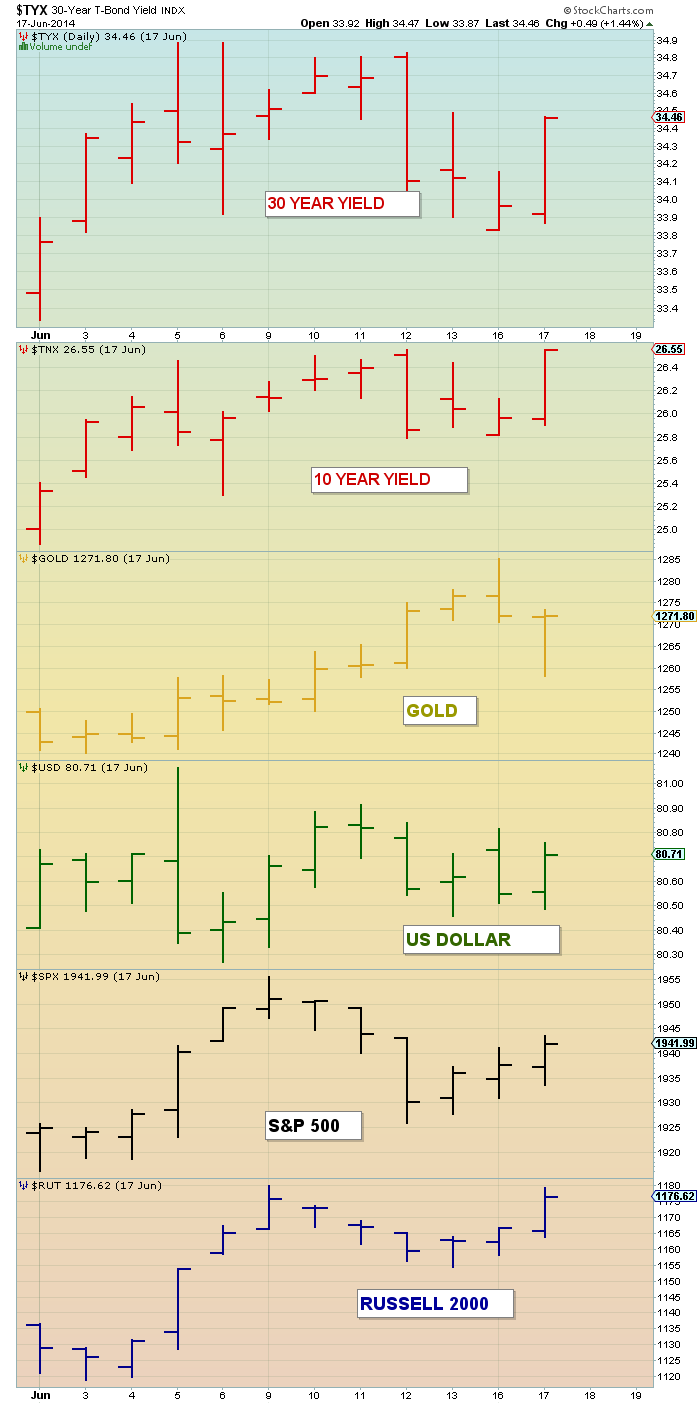

Below is a chart highlighting some key intermarket variables and how they have performed in the buildup to the Fed statement. As you can see, treasury yields are pricing in more tapering. Even more interesting, though, is the fact that Gold has moved higher with equities (and yields). Something should give soon…

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.