The U.S. equity market suffered a modest decline last week with virtually all the important stock market indices losing less than 1.00%. The S&P 500 Index closed down -0.3%.

The weakness was attributed to uncertainty over the U.S. and China trade deal and a report that showed a branch of the Federal Reserve had downgraded fourth-quarter GDP to 0.4% from 1.00%.

Can the stock market uptrend continue with this being the 10th year of the economic expansion?

At this late stage, another 20% plus gain in the coming year would be unlikely. The U.S. economy is set to grow by just 0.4% during the fourth quarter, so the risks are there.

However, there are reasons to believe that going into 2020 there is more room on the upside due mainly to a potentially improving U.S. China trade deal and easing monetary policy. I believe most investors think it likely that the Federal Reserve will step in should the economy falter.

Additionally, the consumer remains strong. The National Retail Federation expects retail sales during November and December to increase between 3.8% and 4.2% over 2018 levels. This indicates a strong retail season and that the U.S. economy will continue to grow.

Lastly, the Global Manufacturing Purchasing Managers Index has climbed in each of the past three months. If there are no further tariff issues, it is possible that global growth may improve.

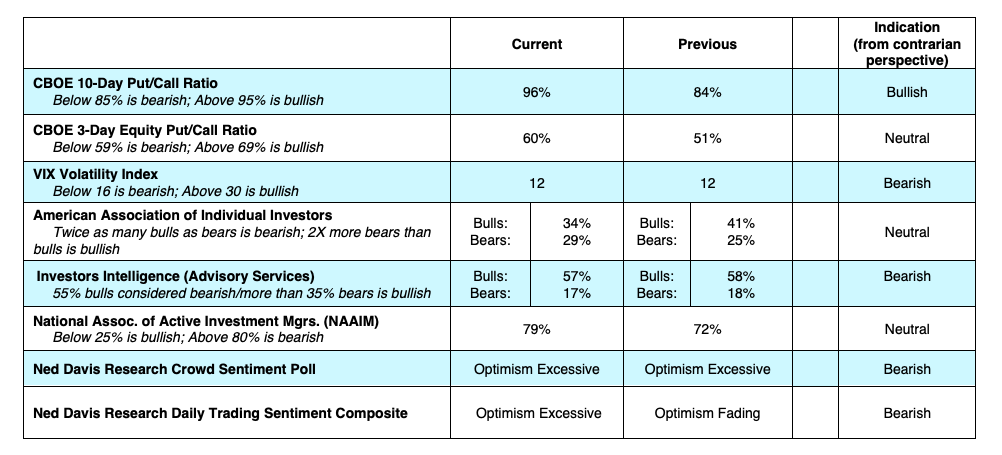

Are record stock market highs and investor exuberance concerning?

Research from Strategas points out that there is currently $3.6 trillion in money market mutual funds today, up from 22% year over year and that the current cash levels suggest that we are far from the euphoric state that signals a significant reversal in the market. At an important peak in the stock market, optimism is typically widespread and deep seated and we are not currently seeing that.

What could derail this stock market?

Two possible threats would be a stalemate in the U.S. China trade deal or a recession. The continuing risks of a geopolitical disorder could also impact the markets. There is widespread unrest ranging from turmoil in the Middle East to mass protests in Chile, Ecuador, France, Spain, Hong Kong, Bolivia. A militarized response to any of these situations could upset the financial markets.

Additionally, a delay in the United States Mexico Canada Agreement would be unsettling for the markets considering that a delay would cost 200,000 new jobs and be a major disappointment to Wisconsin dairy farmers.

I think this agreement will pass by early next year as it will become important for constituents to see that something got done (besides you know what) in Congress this year.

I am thankful for family and friends (and the S&P 500 up 25% year to date).

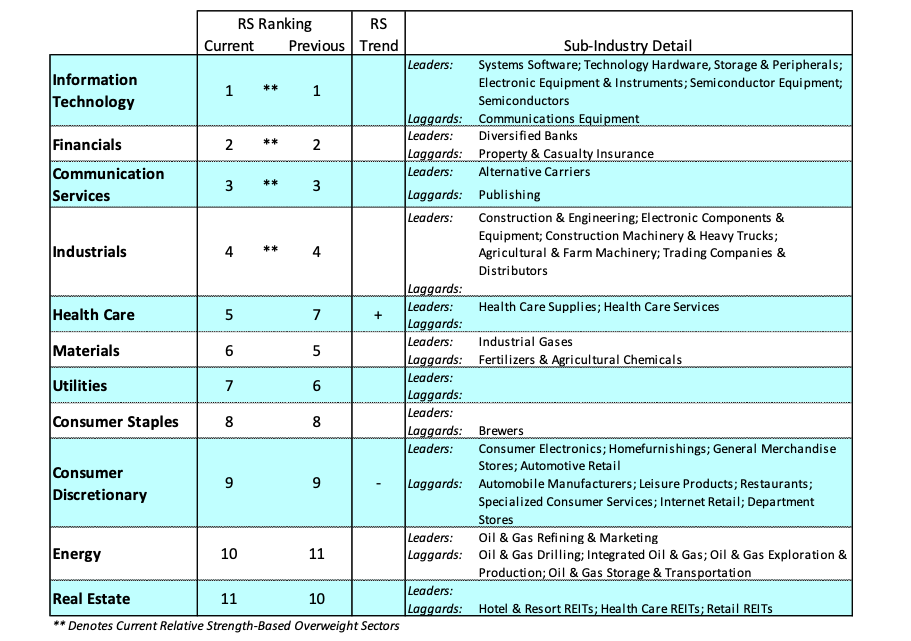

Sector Performance Chart:

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.