Key Stock Market Takeaways:

– Knowing the ride keeps investors leaning in the right direction

– Consolidation could provide breadth leadership and renewed skepticism

– Copper suggest progress could come even with economic challenges

You sit down, fasten your seatbelt, listen to some warnings about keeping arms and legs inside the car at all times, and feel a swell of excitement as the car rolls away from the station.

It’s a scene played out many times a day in amusement parks around the world (pre-coronavirus, that is). If you are looking for a roller coaster ride, the ups and downs, twists and turns, and finishing where you began is generally fine, even if the ride was bumpier than you signed up for.

If your expectation, however, was a road-trip journey toward certain life and financial goals, gliding back into the station at the end of the ride can provide a feeling of regret and disappointment. Investors are generally prepared for the ups and the downs of the market, though the experience of 2020 has likely left stomachs churning and nerves frayed.

There is, however, an expectation that the bumpiness will yield progress and not just a return to the starting point.

A tumultuous first half of 2020 is coming to a close. A 20% decline in the first quarter has been followed by a rally of similar magnitude that has left the S&P 500 in close proximity to where it began the year.

The question for the second half is whether 2020 has been (and remains) the roller coaster ride of a lifetime, with a big drop and huge rally now yielding to further twists and turns, or a road trip that got off to an unexpectedly bumpy start but is now making meaningful progress. Regardless of whether 2020 ends up being a roller coaster ride or a road trip, seat belts are strongly encouraged.

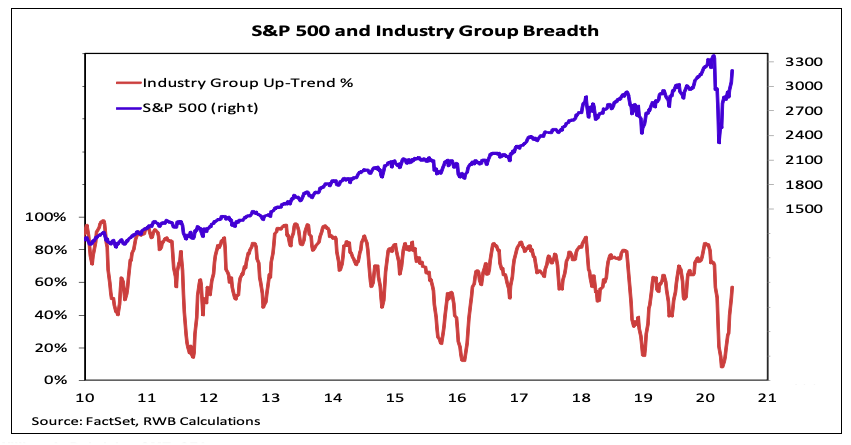

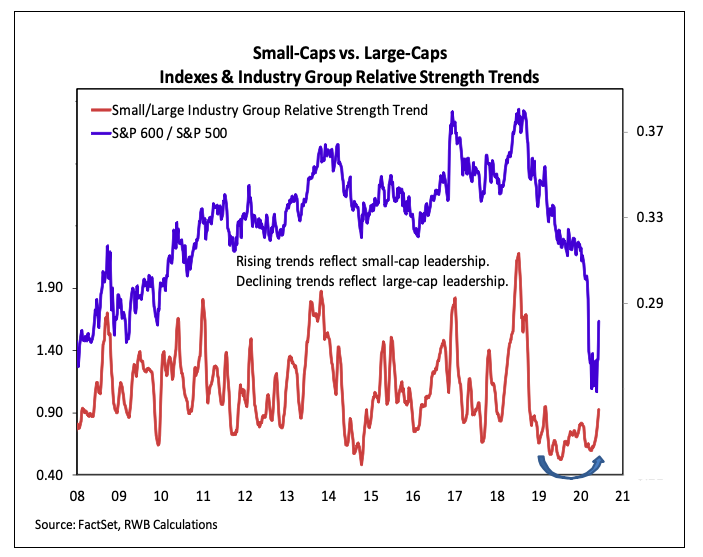

Evidence of progress can often be seen beneath the surface. Continued broad market strength (including a further expansion in the percentage of industry groups in up-trends) and leadership from small-caps versus large-caps would help confirm bullish message being sent from the weight of the evidence. While there is certainly room for some near-term consolidation, failure to see follow-through in the second half of the year would raise concerns that recent strength is just a reaction to remarkable early-year weakness (a possibility raised in a past market commentary).

The best environment for stocks to make progress is one of healthy skepticism on the part of investors. While pockets of excessive optimism have emerged as stocks rallied off of their March lows, it has not been widespread enough to suggest sentiment overall has become a headwind.

Evidence of complacency can be seen in data on options trading. The put/call ratio has dropped to levels that in the past have been associated with if not outright weakness, at least an interruption of strength.

A rebuild in skepticism across the suite of sentiment indicators would be an encouraging development if stocks are going to make progress in the second half.

Supporting the view that 2020 is not just a roller coaster ride is the rebound in the price of copper. As with stocks, the rebound in copper may have gotten ahead of itself, but the strength is encouraging. Copper has moved back above the breakdown level (near 2.50), its 200-day average (near 2.55), the downtrend line off of the mid-2018 highs, and the level at which the February bounce faded (2.60). The test of this recovery will be seeing which, if any, of these levels provide support when upside momentum cools.

Over the longer term, there is a reasonably strong correlation between the absolute performance of the economy and the direction of the stock market. In real-time, however, the market responds not to absolutes, but relative to expectations. Whether incoming data is strong or weak matters less than whether it was better or worse than expectations. The economic surprise index shows that relative to expectations, data has moved from never this bad to rarely this good.

If the economy can continue to provide upside surprises and earnings estimates can start to recover, what has felt like a roller coaster ride for stocks may actually head out on the road rather than return to the station.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.