One of the most important functions in my research is tracking sector performance. It is deeply imbedded within my broader macro work, as I find that drilling down into each sector allows me to gauge the overall health of the financial markets. It also assists me in locating areas of the market that I want to focus my investment strategies on. For more on my approach and to read my other 2015 sector outlook posts, click here.

This post will focus on the Consumer Discretionary Sector and Consumer Staples Sector. As this is intended to provide a yearly outlook, the longer-term charts will drive my views as well as filter out some of the near-term noise. Lastly, the use of sector ETFs eases the implementation of any investment strategies one might see fit. Note that these consumer-centric sectors can also be tracked and traded via Consumer Discretionary Sector SPDR (XLY) and Consumer Staples Sector SPDR (XLP).

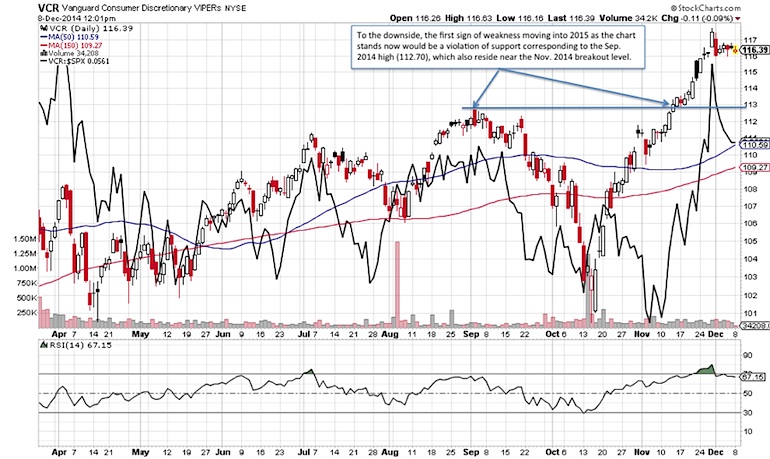

Consumer Discretionary Sector – Vanguard Consumer Discretionary ETF (VCR)

Historically, this sector has been used as a gauge to the overall strength of the consumer and therefore to a somewhat lesser degree, the strength of the overall economy. As such, this is one sector that has me on my toes as the 2009 relative strength rising wedge pattern looks to have resolved itself to the downside late in 2013. This has obviously not impacted the overall direction of the stock market yet, but that could be because the Relative Strength (RS) trend has been sideways has not turned down. That is why the April/September 2014 RS lows in the Consumer Discretionary sector could play a crucial role, not only to the longer-term strength of this sector ETF, but perhaps the broader market in general. Until then, it appears likely that trading ranges will be the shorter-term plays.

To the downside, the first sign of weakness moving into 2015, as the chart stands now, would be a violation of support corresponding to the September 2014 high (112.70), which also resides near the November 2014 breakout level.

Consumer Staples Sector – Vanguard Consumer Staples ETF (VDC)

As the Consumer Discretionary sector is more sensitive to the strength and weakness of the consumer/economy, the Consumer Staples sector is by definition more defensive to such changes. Nonetheless, this sector ETF has historically become a favorite (relative outperformer) during times of uncertainty, while underperforming during times of economic recovery. Therefore any major shifts in the relative outperformance should be taken seriously as it could allude to a weakening stock market even if prices continue to rise.

Note in the monthly chart below that the relative strength chart is not versus the S&P 500 like the other charts, but rather a relative strength study versus the consumer discretionary ETF (VCR) as I think that this is perhaps giving off some kind of warning signal. What is depicted here by the 3 downtrend line breaks is call a Fan formation and it is fairly rare, but at points it can be an alert to a significant change in trend. It is thought that the third trendline break is to be the final one and if this is the case here, then it could be suggesting that there has been a sustainable shift to a more defensive investment psychology. As this is a long-term chart that takes time to change and develop, then history will be the ultimate judge as to this pattern’s veracity.

As things stand today, I look for this support zone near 120-121 to be important as there are a number of technical indicators pointing here such as the October 2014 high, the November 2014 breakout level, and the 50% Fibonacci retracement of the October 2014 rally.

Let me leave you with a quick reminder about sector rotation: It occurs and we should be mindful of it. That said, rising and falling leaders will emerge and disappear, but until the dominant technical trends that I have highlighted here show signs of failing I will continue to follow the trend. Should signs of technical weakness/strength change the charts enough to alter my outlook, well, then my outlook will alter as necessary. That’s the great thing about technical analysis! Thanks for reading.

Follow Jonathan on Twitter: @jbeckinvest

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.