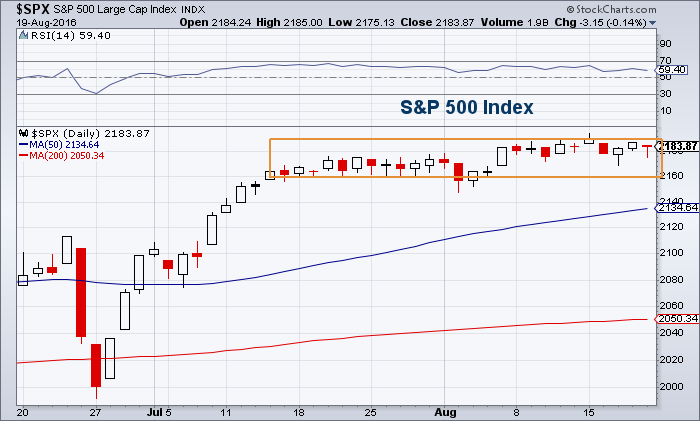

From a macro perspective, it was another uneventful week for stocks. The market continued to churn sideways with the S&P 500 Index (INDEXSP:.INX) ending up mostly flat for the week.

You’ve probably heard the phrase “never short a dull market”. Perhaps… or will the sideways action give weigh to a pullback?

Something’s got to give. Look at that trading range!

Crude Oil surged higher by double digits. A bottom in crude oil is debateable, and bulls and bears will soon figure out if this is a fast and furious bear market rally, or a larger leg higher. OPEC meets in early September, so crude traders will need to get “technical” in the days ahead.

Elsewhere, gold is bumping up against major resistance and treasury yields are trying to show that they have a heartbeat. There’s lots of good reads this week so let’s dig in!

MARKET INSIGHTS

How to survive a melt up – Ben Carlson

Technology earnings revisions are looking strong – Brian Gilmartin

How effective is Twitter advertising – Capital Market Labs

Ask this question before you sell a stock – David Fabian

Welcome to the real bull market – Michael Gayed

Zombie ETFs are running rampant – Bloomberg

The promise of the connected home – McKinsey

What you need to know about IPOs – Stocktwits

The IPO pricing problem – Mattermark

PERFORMANCE ENHANCEMENT

The value of facing reality – Farnham Street

The positive power of negative thinking – Tony Isola

The power of touch – Barking Up The Wrong Tree

Stop spending so much time in your head – Darius Foroux

Simple vs Complex – Josh Brown

Patience, patience – Adam Grimes

The four keys to emotionally intelligent trading – Brett Steenbarger

What Nick Saban can teach us about being focused – Andrew Thrasher

Thanks for reading.

Be sure to check back next weekend for more links to the best investing research and trading blogs. Thanks for reading “Top Trading Links”!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.