The last two years of the U.S. stock market’s relentless bid has been, to say the least, at thing of wonder – especially for traders who have been around for more than a couple of decades. From the vantage point of many fundamental/macro analysts, it has repeatedly pushed the upper bounds of value and has yet to take time to even catch its breath. One can argue that the fundamentals looking forward combined with a very low interest rate environment and reduced share float through buybacks have efficiently discounted the risk premium.

The last two years of the U.S. stock market’s relentless bid has been, to say the least, at thing of wonder – especially for traders who have been around for more than a couple of decades. From the vantage point of many fundamental/macro analysts, it has repeatedly pushed the upper bounds of value and has yet to take time to even catch its breath. One can argue that the fundamentals looking forward combined with a very low interest rate environment and reduced share float through buybacks have efficiently discounted the risk premium.

That said, it’s hard to reconcile the momentum of this market in the context of 2% – 2.5% economic growth with virtually flat median household income and shallow consumer credit growth. The market has also walked straight through any and all geopolitical risks as “noise”. I cannot remember a market performing so strongly with such a backdrop. To the extent it is or is not supported by fundamentals, it seems appropriate to look to other theories which support the market’s recent momentum.

The basis of The General Theory of Reflexivity

Although Reflexivity Theory is widely attributed to George Soros, it was originally developed as a sociological construct by William Thomas in the 1920s, known as the Thomas theorem, and built upon by sociologist Robert Merton in the late 1940s. The outcome of their work was to define the idea of the “self-fulfilling prophecy” where in predictions often lead component actors to behave in ways that make the “prophecy” become true. As defined in Wikipedia:

“…that once a prediction or prophecy is made, actors may accommodate their behaviours and actions so that a statement that would have been false becomes true or, conversely, a statement that would have been true becomes false – as a consequence of the prediction or prophecy being made. The prophecy has a constitutive impact on the outcome or result, changing the outcome from what would otherwise have happened.”

In the 1950s, philosopher Karl Popper took up the idea in his treaties on fallibility (the uncertainty of knowledge) where the act of studying a scientific phenomenon can affect the outcome. That is where a young George Soros was introduced to the construct while Popper acted as his mentor at the London School of Economics.

Here is how Soros explained it in his speech at the Central European University in 2009:

“I can state the core idea in two relatively simple propositions. One is that in situations that have thinking participants, the participants’ view of the world is always partial and distorted. That is the principle of fallibility. The other is that these distorted views can influence the situation to which they relate because false views lead to inappropriate actions. That is the principle of reflexivity. For instance, treating drug addicts as criminals creates criminal behavior. It misconstrues the problem and interferes with the proper treatment of addicts. As another example, declaring that government is bad tends to make for bad government.”

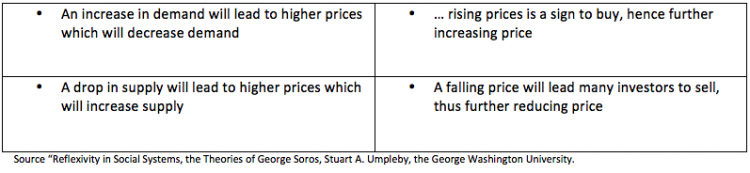

The influence of Popper was profound on Soros’ thinking about economics putting into question the General Equilibrium Theory (GHT) that price is determined to move to equilibrium at the intersection of supply and demand. In modern finance, GHT is the underpinning of the Efficient Market Hypothesis and as well as the foundation of Modern Portfolio Theory. Conventional economics views markets as generally efficient in price discovery. Soros’ theory of economic reflexivity sees quite the opposite.

Equilibrium vs. Reflexivity

Feedback loops – the basis of all market reflexivity.

Soros defines both positive and negative feedback loops but the names are somewhat misleading. Positive loops work in moving prices both up and down. The defining characteristic is that they work to amplify disequilibrium. That is to say they move prices further from intrinsic value. Negative feedback loops are, as one can guess, actions that bring prices closer to intrinsic value or reality. Soros believes the common state of feedback is in positive loops.

There are several parts of human activity which contribute to positive feedback loops:

- Humans act on imperfect information (fallibility.)

- Bias reinforces bias and effects the course of events (bias can change the fundamentals.)

- Positive feedback loops continue until such time as the deviation from the fundamentals are no longer tenable (causing instability before collapse.)

Soros often cites these historic phenomenon as his best examples:

- The conglomerate boom of the 1960s and 1970s

- The venture capital boom of the 1990s

- The high tech bubble of 2000

- FX markets over several time frames

- The mortgage and housing bubble of 2006

There is a certain simplicity and common sense to all of this and, one can suppose, that trading strategies have been built upon this construct since the Buttonwood Agreement. The notion of fading a “crowded trade” is old and time tested. On the other hand, our human nature tends for us to ignore this in the heat of the market. So even with its simplicity it’s both hard to do and harder to replicate.

From an investing strategy it probably makes more sense to apply reflexivity principles to individual sectors since, usually, there are constant rotations.

In follow pieces I plan to look at reflexivity implications in other behavior models such as the shift from fundamental analysis to technical analysis, the notion of central banks effect on share values, the current “buyback” boom and the commodities markets.

In the meantime, it’s of great interest to me (and I hope others) where traders/investors think we might be in the overall stage of the broad market reflexivity cycle. I have created an ongoing poll that I plan to re-run each week to see if a trend can be established. For lack of a better description I think of it as a first derivative sentiment survey (but let’s understand the irony of the reflexivity of the survey itself.) The sample sizes have thus far been too small to be very meaningful but, if participation grows we may learn something from it.

You can find the survey here. I’ll also post periodic updates on my Twitter feed @davebudge.

Trade ‘em well this week.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.