By Jon Boorman Having interviewed many of the greatest ever traders over many years in his Market Wizard series, many of whom expressed the important role personality plays in trading, Jack Schwager dedicated an entire chapter to the subject in his latest offering ‘The Little Book Of Market Wizards’, and even went so far as to say “if you get nothing else out of reading this book than the one following principle, it will still have been a very worthwhile endeavor: Successful traders find a methodology that fits their personality.”

By Jon Boorman Having interviewed many of the greatest ever traders over many years in his Market Wizard series, many of whom expressed the important role personality plays in trading, Jack Schwager dedicated an entire chapter to the subject in his latest offering ‘The Little Book Of Market Wizards’, and even went so far as to say “if you get nothing else out of reading this book than the one following principle, it will still have been a very worthwhile endeavor: Successful traders find a methodology that fits their personality.”

To illustrate his point he contrasted the frenetic style of Paul Tudor Jones with that of the studious Gil Blake, but perhaps the simple yet profound contribution from Colm O’Shea was what stood out the most, as Schwager surmised here:-

“Traders must find a methodology that fits their own beliefs and talents. A sound methodology that is very successful for one trader can be a poor fit and a losing strategy for another trader. Colm O’Shea, one of the global macro managers I interviewed, lucidly expressed this concept in answer to the question of whether trading skill could be taught:

‘If I try to teach you what I do, you will fail because you are not me. If you hang around me, you will observe what I do, and you may pick up some good habits. But there are a lot of things you will want to do differently. A good friend of mine, who sat next to me for several years, is now managing lots of money at another hedge fund and doing very well. But he is not the same as me. What he learned was not to become me. He became something else. He became him.'”

I could list at least a dozen other quotes from notable traders who have recognized the role of personality and expressed similar findings, but I think it’s fair to say most people who have been in markets either trading or managing money for any length of time have come to realize this as being self-evident, and very often reached that conclusion the hard way. But when relaying this kind of information to newer traders, the responses I often see are along the lines of: “Everyone says that and I accept it to be true, but no-one ever tells you specifically how to do it. How do you find out exactly what your personality is and what trading styles or methods suit it?”

It’s a great question, and the fact that it can take successful traders many years of trial and error to discover what really works for them I think demonstrates there perhaps hasn’t been a straightforward answer, until now that is, as I recently discovered.

At the MTA Symposium in 2013 I was fortunate to attend one of the breakout sessions hosted by Jason Williams, MD, a Johns Hopkins trained psychiatrist, who also just happens to be the son of veteran futures trader and systems developer Larry Williams. Dr. Williams gave an overview of the world’s foremost personality test, the NEO PI-R. He related how together with his father they hit upon the idea of having a number of successful traders take the test. The results were fascinating and revealed to them a number of attributes successful traders had in common, but just as notable, also revealed differences in trading style that were consistent with their individual personality traits. The project became the subject of Dr. Williams’ book “The Mental Edge In Trading” which begins with a brief overview of the brain and the mind, before moving onto the individual personality facets and how they relate to trading. He also gives a detailed analysis of a handful of the participants who are interviewed and reflect upon their test findings, among them Larry Williams, Dan Zanger, Kelly Angle, Linda Raschke, Andrea Unger, Ralph Vince, and Scott Ramsey, all of which produce notable insights.

Needless to say, as someone who enjoys self-work and trading psychology, and having myself taken the long route to my chosen path, this made enough of an impression on me to warrant further investigation. So, taking advantage of an offer made to MTA Symposium attendees, in addition to reading Dr. Williams’ book, I took the NEO PI-R test and a consultation afterwards. Before I share those findings as well as some from traders highlighted in his book, let me first provide an overview of the test and its attributes.

The ‘Revised NEO Personality Inventory’ to give it its full title is also known as the NEO-AC, and is the most researched, reliable, and validated personality test available today. This is not your pop psychology test that helps you find your preferred career or ideal love match. I have taken tests like a Myers-Briggs MBTI in various forms (I’m an ISTJ by the way, the S is marginal, sometimes N), and while the attributes described are scarily accurate for me, they are still very broad and generic in nature with only 16 possible personality combinations to describe the human race. Additionally they aren’t something a trained psychiatrist will rely upon. The NEO-AC is.

The NEO-AC is composed of 240 self-report questions answered on a five-point scale and takes roughly 40 minutes to complete. The acronym NEO-AC comes from the five major personality domains, also sometimes referred to as the five-factor model (FFM), as follows:

N – Neuroticism

E – Extraversion

O – Openness

A – Agreeableness

C – Conscientiousness

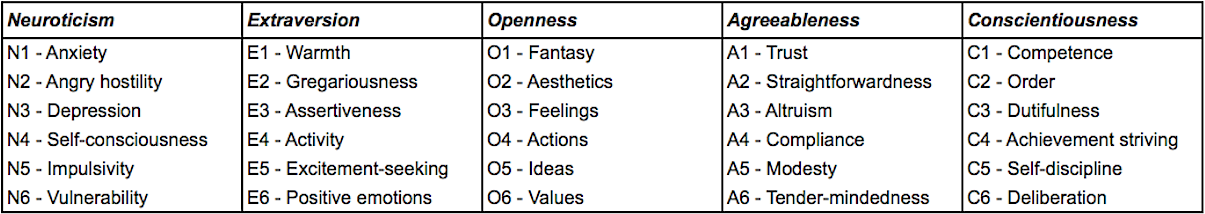

For any one of the five domains you can be measured as being either ‘average’, ‘high’, ‘very high’, ‘low’, or ‘very low’, determined by how far away you are from the mean. Each of the above factors N, E, O, A, C is composed of six separate facets or sub-factors, resulting in thirty distinct personality traits. Below is a table highlighting the factors and underlying sub-factors:

The important thing to note here is the NEO-AC is multi-dimensional. As Dr. Williams writes “a dimensional trait is something that every living person has to one extent or another. It’s not whether you have it or not, but how much of it you have in comparison to everyone else.”

Once you’ve taken the test the first thing to observe is the pervasive trends in the five major domains which ‘pull rank’ over the individual facets. In my case my Neuroticism (N), Extraversion (E), Openness (O), Agreeableness (A) were all low, but my Conscientiousness (C) was high, bordering on very high.

The individual facets each have a scale of 0-32, so as you can imagine there are a vast number of potential combinations across the 30 different facets that give a much more insightful reading to an individual on where you fit on the scale than the broad labeling a one-dimensional test would provide. This helps you identify the real areas of interest, the outliers. These will provide you with the areas of greatest insight. For example, my N6 (Vulnerability) was very low at just 1, while my C2 (Order) was very high at 26, and as we will see later, these particular facets have important considerations in trading and trading style.

So now that we have our results, let’s refer back to Dr. Williams’ book to help identify the two main areas that interest us. First, the personality attributes successful traders have in common, then, the differences in style that were attributable to their individual personality traits so we might attempt to interpret and align ours also. I want to avoid reproducing too much of the book here, which has numerous examples for you to discover yourself, but I will give you a couple of the key findings in each area.

When identifying the common attributes of successful traders by far the most important area was within the Neuroticism (N) domain.

Neuroticism is “the tendency to experience negative emotions especially under stressful circumstances.” Dr. Williams discovered that although overall N scores were average among the traders they studied, there were two specific facets where they consistently had very low readings – N1 (Anxiety) and N6 (Vulnerability). I was delighted to see my own scores matched this, with average readings in the N2-N5 facets but with very low scores of 5 in N1 and just 1 in N6. So, what does this mean? As Williams describes it, simply that successful traders compared to the average man in the street experience far less anxiety and feel far less vulnerable to failure and defeat when they are placed under stress. Williams’ top traders reported the anxiety they did experience would stem from the fear of losing money, and the fear of feeling embarrassed by being wrong. One of the traders even described it to a further degree by saying he ‘does not fear having anxiety.’

When identifying areas of differences in style that can be attributed to personality traits, the facet that stood out the most to me was C2 (Order) within the Conscientiousness domain.

Dr. Williams found among their group of traders, those with high C2 were associated with systematic trading styles, while those low in C2 were largely discretionary traders. This is undoubtedly a key area to understand which methodology you would be most suited to. As I mentioned earlier, this was one of my outliers with a very high reading of 26 so clearly I am well suited to trading mechanical systems. As we all know and appreciate, there is no right or wrong in this area, systematic or discretionary is clearly a case of doing whatever suits you. That said, it’s also something that can take investors years to discover, and sometimes at great expense. In this respect I feel this facet of the test is a valuable shortcut to knowing how you are already wired. And who knows, it might even reveal something that explains a previous area of conflict for you, as it did for Larry Williams who reveals, despite the fact he is a prolific developer of systems, he struggles to follow them himself and is largely a discretionary trader.

Other areas that can be helpful in determining trading style and suitability are E5 (Excitement-seeking), clearly an area where someone who scores high could be at risk of over-trading, especially if combined with high C1 (Competence) which is also a measure of self-confidence. Dr. Williams also reports other studies have shown “traders who are high in O5 (Ideas) or O6 (Values) seem to be especially motivated to get involved in futures trading, not for a rush or thrill, but for a deeper psychological need, that is, they truly enjoy the challenge of learning and mastering something very difficult.” Could that be you?

So what other insights did I glean for myself?

That even from my scores at the domain level it was clear I was already trading a methodology which suits my personality. Just look at these descriptions of personality styles from the combination of high or low domain readings:- for someone low in E and N – “Neither good news nor bad has much effect on this people. They maintain a stoic indifference to events that would either frighten or delight others.” High in C and low in E – “…methodical workers who concentrate on the task at hand. They work slowly and steadily until the job is completed… they can be counted upon to finish whatever tasks they are assigned.” Low in O and N – “they do not dwell on threats or losses, turning instead to concrete actions to solve the problem at hand or simply to distract themselves.” And low in O, high in C – “these individuals are diligent, methodical, and organized, and they abide by all the rules.” Trend following, anyone?

It’s made me realize that my low N1 and N6 possibly explain why although I’m largely systematic and use end-of-day signals, I’m perfectly happy to sit there during the day and watch the market even though I don’t need to, and not get stressed out about it. Not being high in E5 (Excitement-seeking) or N5 (Impulsiveness) obviously helps that too. Also, that while I might consider my very high C6 (Deliberation) as being a positive for developing and sticking to a rules-based process, on a personal level it could also be a hindrance, making me prone to excessive pondering or ruminations. I’ve possibly been guilty of that in this post (!) but more seriously in getting to this stage of my career and having to remind myself to just start, take the first step, that the time will never be just right. Finally, my high C1 means I need to pay attention to when I’m on a roll so my over-confidence doesn’t make me get sloppy. That’s a danger many traders can relate to, but it’s one I might be more susceptible to than most.

The real takeaway for me personally was that it served as an excellent confirmation for much of the hard work and discovery process I had already been through over the years in determining what methodology I was suited to, and that I should make my single area of expertise. Also, in seeing I have a personality profile very similar to many of the successful traders in the study, it was confirmation that I have what it takes, but that poignantly, until recently I possibly hadn’t truly believed that myself. It certainly gave me the personal validation for knowing who I am and reaffirming I’m on the right path, personally and professionally.

For all that I’ve covered here, I’ve also had to skim over so much for what is an immense subject. To take a deeper dive into it I recommend reading Dr. Williams’ book “The Mental Edge In Trading” and taking the NEO PI-R test. Then you will be in a position to fully determine how your own trading can be aligned with your personality, and perhaps discover underlying reasons for areas in which you have had conflicts or concerns. Hopefully I have given you an opportunity to think more about who you are and how that fits into your trading style.

——————–

As mentioned before, the NEO PI-R isn’t a test you can take online. There may be short-form variations that exist but the scores they generate will not be commensurate with anything discussed here. The full-length NEO can only be administered by an accredited psychologist or psychiatrist who is trained in giving, scoring, and interpreting it.

If this is something you would like to do, Dr. Williams has kindly agreed to extend a special offer similar to that enjoyed by MTA Symposium attendees in 2013. There is no website to visit, this is something Dr. Williams does in his own time in addition to his work as a licensed psychiatrist. You will need to contact him directly at emaildoctorj@yahoo.com and mention this post to receive a special discounted offer of $175 for the NEO personality test alone, or $450 for the personality test and a 1-hour consultation. There will be extra cost for postage for those outside the US. This offer is expires December 31st 2014.

——————–

About Jon Boorman: – Jon is President & CEO of Broadsword Capital, LLC, a Registered Investment Advisor in North Carolina, and the author of the Alpha Capture blog. He is also a Chartered Market Technician (CMT) and member of the Market Technicians Association. You can follow him on StockTwits or Twitter: @JBoorman.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.