The scare in the global equities markets last October marked a pivot point for European equities in particular. Following the low in the German DAX of 8354 in mid-October, the financial markets decided to get serious. The ailing Euro Zone economy was becoming alarming and investors could finally sense a more serious effort to stimulate.

Whether that stimulus (now known as European QE) is effective economically remains to be seen (my guess is not so much). And it’s been politically toxic. But that’s neither here nor there for active investors (at least over the short-term). It has been, however, quite effective in devaluing the Euro and driving capital into European equity markets such as the German DAX. In short, low-to-negative interest rates plus cheap paper equals little to no choices.

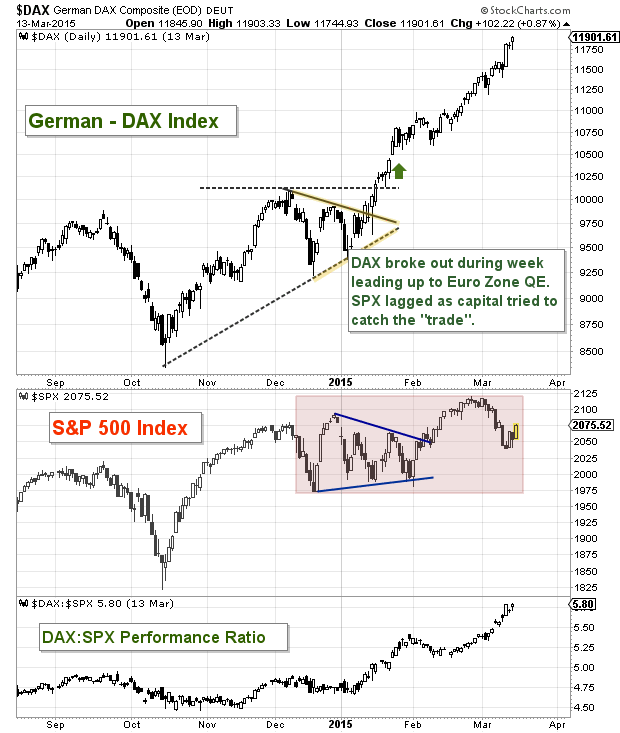

Earlier this morning I tweeted out a couple statistics on the German DAX. Since the October lows, the DAX is up 45 percent. And although it’s RSI is at 80 and overbought, the “march” higher has been orderly. Below are charts of the German DAX vs the S&P 500 (SPX), as well as the DAX to SPX ratio (to show relative strength performance).

As you can see, the DAX has outperformed the S&P 500 by a wide margin since October. Money has consistently rotated into EU equities, but particularly Germany. The French CAC40 and FTSE MIB (Milan – Italy) are up just over 30 percent and the Spanish IBEX is up about 18 percent. And the Greek market is still making new lows. This performance picture makes it difficult to assess if European QE is working (or will work) for all.

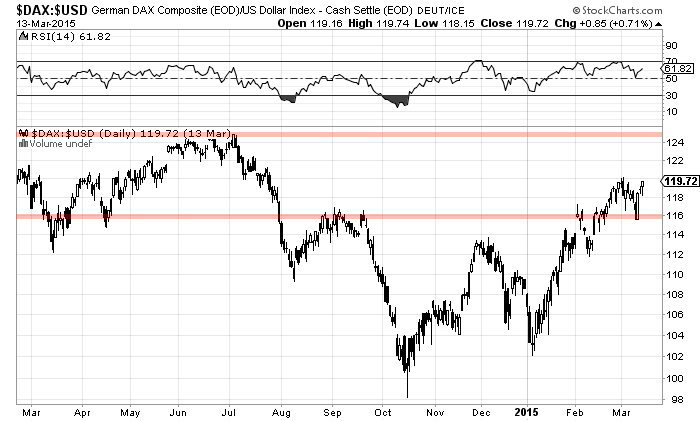

As well, if we look at the German DAX in terms of the US Dollar, we can see that the move has been of greater import to EU investors (hinting that it is likely internal flows).

It’s easy to say that this is simply because Germany is the strongest/largest economy and market – and that’s probably true – but it also reeks of the difficulties in stimulating the economy (and equities) in a broader more meaningful way.

Thanks for reading.

Follow Andy on Twitter: @andrewnyquist

No position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.