The past two years have been very good to Apple, Inc (AAPL – quote) shareholders. But if they want the momentum to continue to new highs over the near-term, then Apple stock will likely need to hold above a confluence of key price support around 120. Last week, the stock dipped as low as 119.22 before rallying to close the week at 123.28. That rally off last week’s lows put in weekly reversal candlestick. The question now is: Can Apple stock hold above last week’s lows?

So far, so good as the rally in AAPL has continued into Monday. But Apple stock isn’t out of the woods yet.

Let’s look at why the recent lows are shaping up to be an important price level for traders of Apple stock.

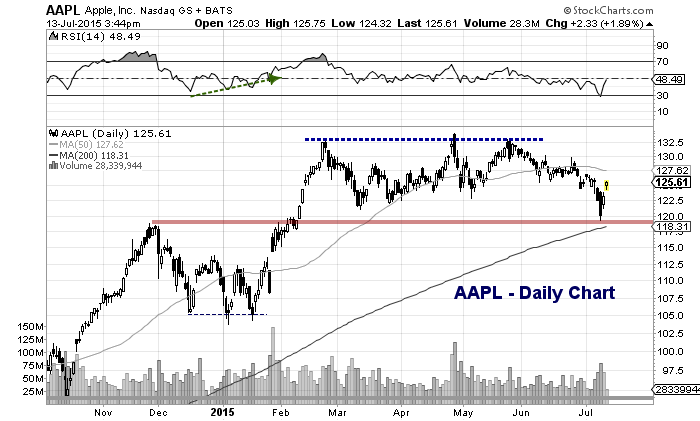

On the daily chart, you can see that the 200 day moving average is at 118.94 (and rising). This level likely provided support for the reversal higher last week. This level also coincides with the November 2014 highs (119.75) and February 2015 breakout level.

Note that the 50 day moving average rests at 127.62 – that serves at current resistance.

Apple (AAPL) Daily Stock Chart

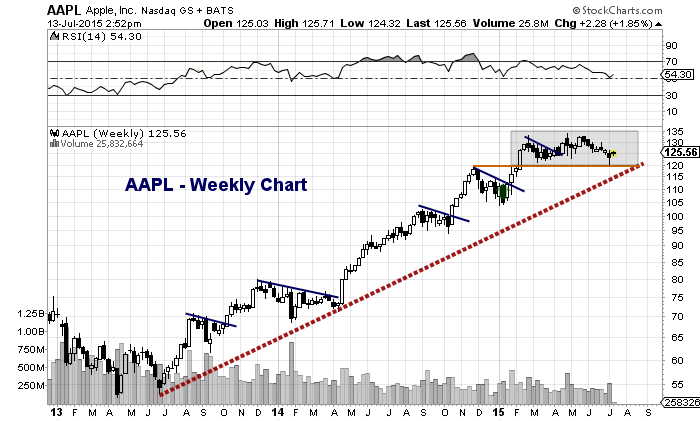

Turning to the weekly chart for Apple, we can see that the log trend line from the 2013 lows is just below as well.

Also pay attention to the series of breakouts during this run higher. Price consolidation is important (and necessary), but the latest breakout failed to produce a new leg higher (a concern) and the stock is going on 5 months of consolidation. If (a big if) the stock breaks down and heads lower, it would likely target the 105-110 level.

Apple is scheduled to report earnings next Tuesday – a highly anticipated earnings report. How the stock reacts, and whether it can rally are two important things to watch. The coming weeks should provide a better idea where Apple stock is headed next.

Twitter: @andrewnyquist

The author does not have a position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.