There has been an interesting development in the S&P Retail Index (XRT) in recent weeks. Namely, it’s been severely underperforming the S&P 500. This is pretty important, because the XRT underperformance could be signaling a slowdown in consumer spending. And any slowdown in spending could effect far more than just the retailers comprising the XRT. For example, consumers may cut back on purchases of tablets which could have a ripple effect on storage stocks like Sandisk (SNDK).

There has been an interesting development in the S&P Retail Index (XRT) in recent weeks. Namely, it’s been severely underperforming the S&P 500. This is pretty important, because the XRT underperformance could be signaling a slowdown in consumer spending. And any slowdown in spending could effect far more than just the retailers comprising the XRT. For example, consumers may cut back on purchases of tablets which could have a ripple effect on storage stocks like Sandisk (SNDK).

Here are a few charts that highlight recent weakness in the Retail sector. Click on charts to enlarge.

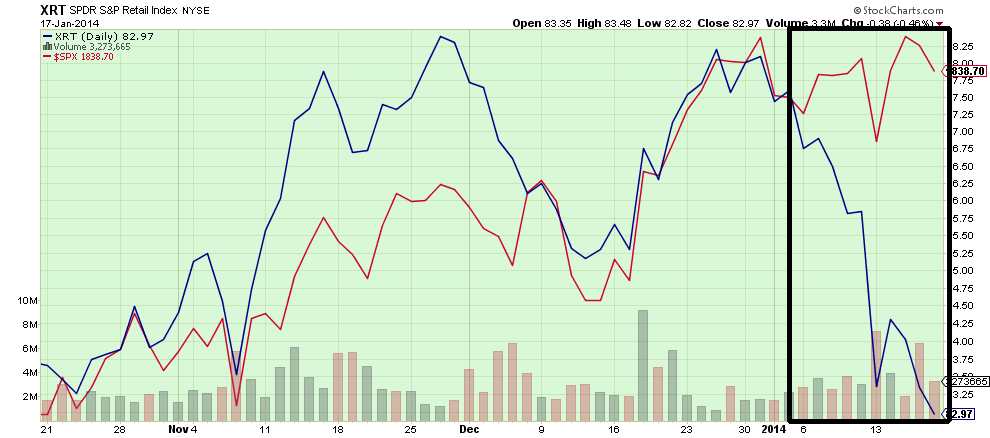

1. S&P 500 (Red) vs XRT (Blue)

XRT underperformance is notable in recent weeks.

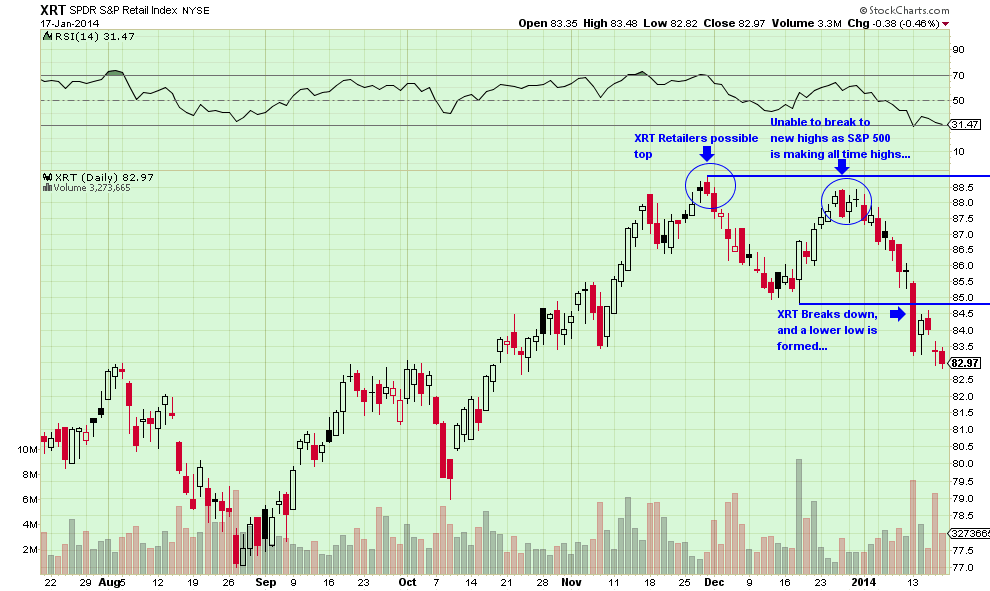

2. XRT Trend in Jeopardy

The XRT could be in the early stages of a pretty significant change of trend.

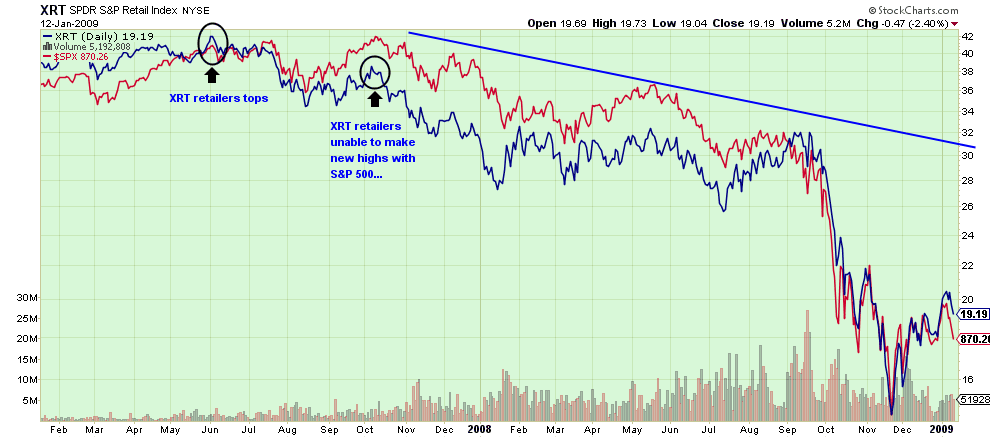

S&P 500 (Red) vs XRT (blue) 2007-2009

The final chart shows why it’s important to monitor the retail sector and XRT underperformance.

Time will tell whether this is just a short-term decline or something more severe. Keep an eye on XRT’s performance over the next few months, as I believe this could be a “tell” for the markets. Thank you for reading.

Author is short JWN and SPY via put spreads, and long VFC via call spreads at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.