Folks, if you’re reading this blog it’s assumed you have some interest in the financial markets and, to a certain extent, the art of “technical analysis.” In order to lighten up the technical aspects of looking at a chart I’ve included a couple of pictures to describe my personal feeling of the world (and markets) we have entered.

This is WAY beyond a camera that you put on your surfboard with GoPro (GPRO) or a nice thick milk shake from Shake Shack (SHAK) or pictures of the narcissistic selfie world on Facebook (FB) No, this is about “juggling dynamite in a cage with gorillas” and the twists and turns of the global flow of funds.

Cliff Notes for this post: We are in unchartered territory. Things are going to explode up and explode down in the financial markets.

The world that is addicted to Twitter (TWTR) and the “must have now” won’t like this post. Why? If you try to slow down and simply imagine 6 months, 1 year or 2 years from now you’ll realize we are truly in unchartered territory.

- According to Martin Armstrong, we are at a 5000 year low in interest rates.

- P.S. – follow him!

- There are roughly 1.2 quadrillion derivatives out there …yes, I said quadrillion…waiting to explode.

- Definition: 1,000,000,000,000,000

- Context:

- 40 times the WORLD’s stock markets

- 10 times the value of every stock and bond ON THE PLANET

- 23 times the WORLD’s GDP

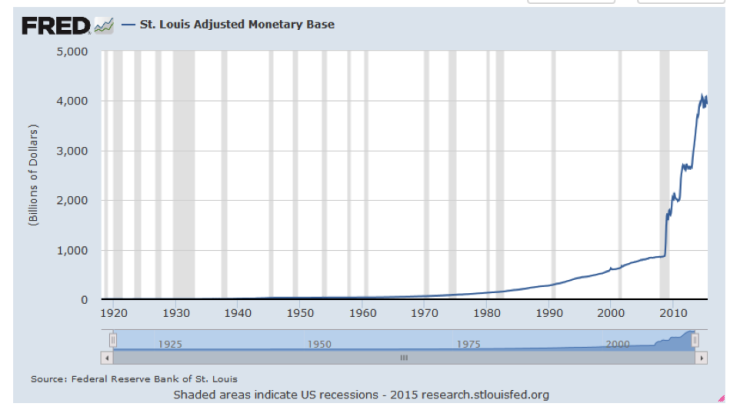

- Then we have this “wonderful” chart below …can you say experiment and parabolic?

So, in the coming days, weeks, months you’re going to hear at the neighborhood party, workplace, financial TV pundits, your “financial advisor”, etc. say that we need to “stay the course” and that this is a “momentary blip”. Quite frankly, they all might be completely correct. But here’s the deal – none of us have a clue as to what’s going to happen.

If you’re following me, you know I’m going to use PATTERNS and a STOP.

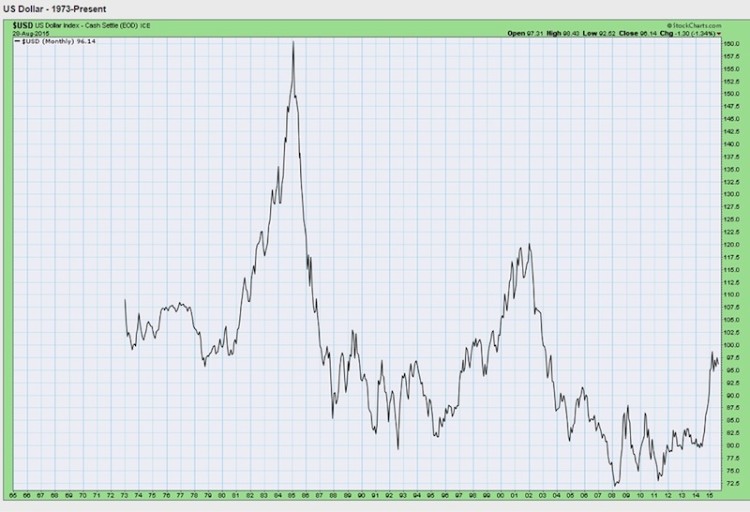

Now, with the above as context, one of the main drivers of change (i.e. stay the course, get in, or get out) is the currency markets and the VERY important US Dollar Index. So, in order to prepare for the world outside of $SBUX or $TWTR it is IMPERATIVE to understand the longer term horizon. Especially that of the Dollar. Here’s what I see:

- All time high in February 1985

- Lower tops

- Conclusion = downtrend

- Lower tops

- Rally into July 2001

- KEY – after that TOP we had a “pretty clear” 5 wave move down

- Conclusion = 5 waves in the direction of the trend signifies trend in-tact.

- Trend remains down.

- KEY – after that TOP we had a “pretty clear” 5 wave move down

- Move from March 2008 is carving out a 3 wave correction labeled a-b-c.

- As of last week, we have started the 5th and final wave up into the levels shown

- Conclusion = USD to strengthen – strongly – in the coming months.

- ***NOTE – 30 year anniversary of Plaza Accord is September 2015 ***

- As of last week, we have started the 5th and final wave up into the levels shown

- Targets for this move are 106/108/110

A MORE BULLISH CASE FOR THE US DOLLAR ….

Note in the chart below that a case can be made that the low in 2008 very well could have been the end of a LARGE A-B-C correction and another “large” A-B-C correction is on hand … if that is the case then a more bullish case is shown below.

***Either way, believe we have started or are very near starting a BIG MOVE for a strong dollar into the ranges shown above. At that point, it will really get interesting.***

One last note: this analysis will be wrong (or off) if we close below 94 on a weekly basis. If so, I’ll revisit and update.

Here’s the “long term” look of the US Dollar.

Folks, it’s going to be Mr. Toad’s Wild ride … you can embrace the ride or be scared to death. In the immortal words of Jim Morrison we are all “Riders on the Storm.”

Cheers and thanks for reading.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.