Investors continue to carry a sort of worried optimism with them. Meanwhile, market strategists are dealing with the difficult task of balancing election uncertainty, 3Q20 earnings rollouts, and the economic implications of a second wave of global COVID-19 cases.

Yes, it’s a crazy time for investors.

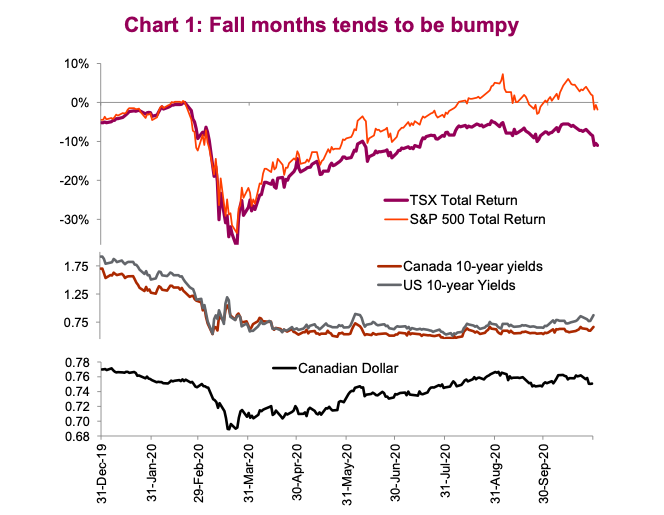

Yet, despite decent earnings performance and a better-than-expected 3Q20 U.S. GDP, what seemed like a balanced environment took a sharp turn last week, with equities contracting, yields whipsawing, and oil prices moving decidedly lower.

U.S. stocks posted monthly returns that were worse than September’s, with the S&P 500 Index down -2.5%. Global markets also fell, with the MSCI World Index falling -2.8% for the month. The VIX Volatility Index rose considerably too last week, touching up over 40.

Elsewhere, the loonie strengthened then weakened throughout the past month, finishing flat at the end of October. Shorter-dated U.S. treasuries are trying to rally with investors ditching longer-dated notes and bonds in favor of parking cash ahead of the election results. The energy complex is in rough shape, with WTI Crude Oil futures falling -11% in October to US$36/bbl, marking its largest monthly drop since March.

This last-minute asset class volatility has been driven in large part by subpar earnings results from big tech companies and a growing number of global coronavirus cases. In the U.S., big tech stocks led losses, with Facebook and Twitter both missing their user growth estimates; by the end of the month, the Nasdaq 100 index was down -2.99% for the month. In Europe, several countries are re-instituting full lockdowns to curb the spread of coronavirus, sparking doubts about the true trajectory of a global economic recovery.

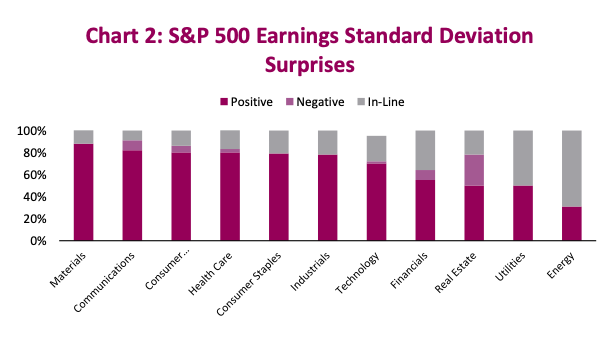

3Q20 earnings aren’t too bad. Three weeks in, 68% of S&P 500 companies have beaten consensus earnings estimates by a standard deviation or more (Chart 2). Companies continue to manage through these troubled times better than analysts give them credit. Valuations have come down as prices fell this month and forward expected earnings continue to recover. The P/E ratios based on the next 12-month consensus estimates for the TSX and S&P are 16x and 20x, respectively.

We are 10 months into the year and uncertainty around the world has only seemed to grow; it goes without saying that these conditions are far from ideal. Undoubtedly, there will be more tumultuous headlines to come. It’s certainly worthwhile remembering here, however, that investing shouldn’t be a short-sighted endeavor; there is much to be gained by sticking to a process grounded in unemotional reason, long-term thinking, and tactical adaptability.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.