The S&P 500 Index and broader U.S. equities market declined last week with trade war concerns, mixed economic news as well as political concerns.

The U.S. economy grew more slowly in the second quarter according to revised figures, due largely to the trade war with China.

The trade war, a strong U.S. dollar and a weaker global economy have hurt U.S. manufacturing, exports, farming and business investment. We are looking out for signs that trade uncertainty and further coming tariffs may hurt consumer sentiment.

However, consumer spending continues to drive the economy. The latest employment data shows jobless claims near a 50-year low, wages rising at the fastest pace in 10 years and more job openings than applicants.

Additionally, low inflation and widespread interest rate easing by central banks around the globe add to a positive scenario for the balance of 2019.

On Tuesday, House Speaker Pelosi announced a formal impeachment inquiry against President Trump accusing him of unlawfully urging the Ukrainian president to investigate former vice president Joe Biden. An impeachment would require a 2/3rds majority vote in the Senate where Republicans maintain control, making the chance of a conviction unlikely and is the reason we have not seen major volatility in the stock market.

We anticipate there may be swings in the market due to the political headlines but we expect the market to continue to be driven by the U.S. consumer and their ability to grow this economy.

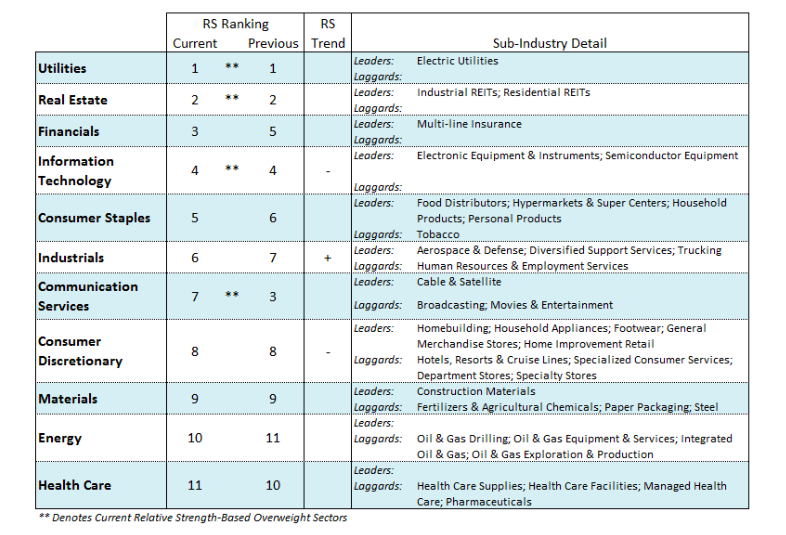

Defensive sectors reign at the top of the relative strength leaderboard. The utilities and consumer staples sectors hit a new record high last week while REITs are a fraction from a record high. Information technology and the financial sector remain in the top five of the 11 S&P 500 sectors. Volatility in the equity markets is anticipated to remain elevated considering October’s history of being one of the most volatile of the year.

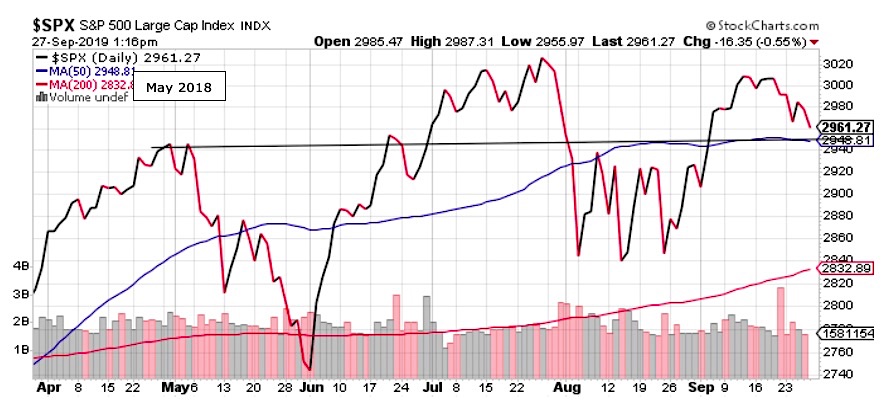

The technical indicators for the stock market are mixed suggesting the consolidation phase we addressed last week remains in force. Stock market breadth, that had shown signs of improvement, stalled last week. Small- and mid-cap stocks along with the Dow Transportation average that had shown signs of improving trends fell back to levels last seen in August and early September.

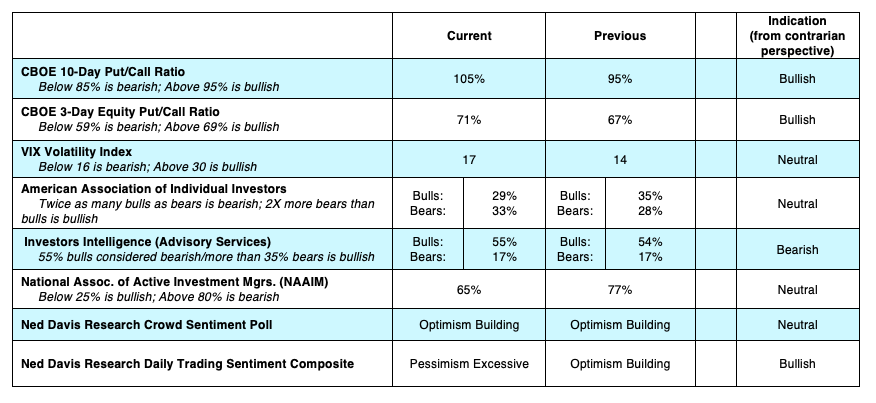

As a result, the negative divergences which have handicapped the market since May remain an anchor on overall stock market performance. The excessive investor pessimism we pointed to last week as a potential short-term headwind for the market eased back to neutral. Longer-term measures of investor psychology, however, suggest the near-term upside is limited. The bottom line is that the technical underpinnings of the stock market support the prospects the market, over the short term, will remain in a wide-swinging trading range that has been in effect since the July peak.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.