Stocks rallied for the eighth straight week due mostly to a patient Federal Reserve, the avoidance of a government shutdown and easing concerns regarding a trade war with China.

Economic news has been mixed with a surge in job openings offset by a decline in retail sales, industrial production and capacity utilization.

However, the technical condition of the S&P 500 Index (INDEXSP: .INX) and broader stock market has changed in the past few weeks. Most notable in the current rally in the market is the outperformance by the broad market the past several weeks.

This is vastly different from 2018 when stock market breadth (number of stocks advancing relative to the number of stocks declining) narrowed during the course of the year, particularly in October, when the stock market averages peaked.

Since the December lows, there have been two uninterrupted daily sessions where upside volume exceeded downside volume by a ratio of 10-to-1.That is unusual and a bullish signal.

Additionally, the NASDAQ (INDEXNASDAQ: .IXIC) and NYSE weekly advance/decline lines have hit new highs and on Friday 92% of S&P 500 stocks were trading above their 50-day moving average. This is a rare statistic and significant in that, according to Ned Davis Research, when breadth is this strong, the stock market is always higher one year later. There will undoubtedly be volatility and corrections as investors watch the U.S. and China wrestle with negotiations.

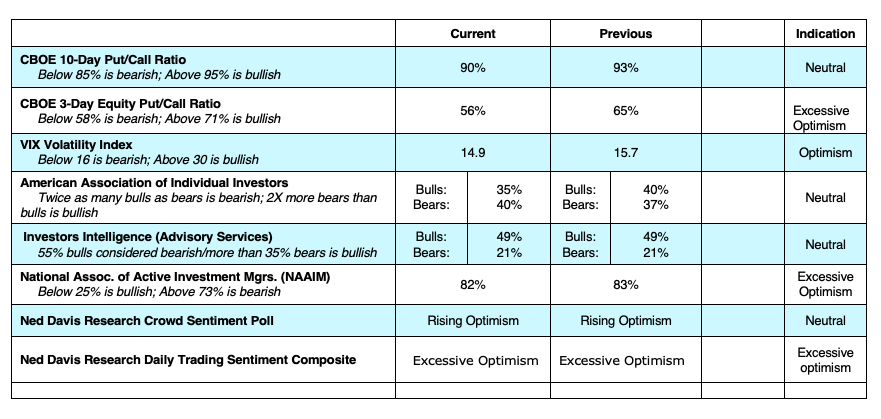

Stocks also face the prospects of earnings downgrades in the first quarter and growing evidence that investor sentiment is moving toward optimism but not yet excessive. The long-term record of the current breadth statistics, however, cannot be ignored.

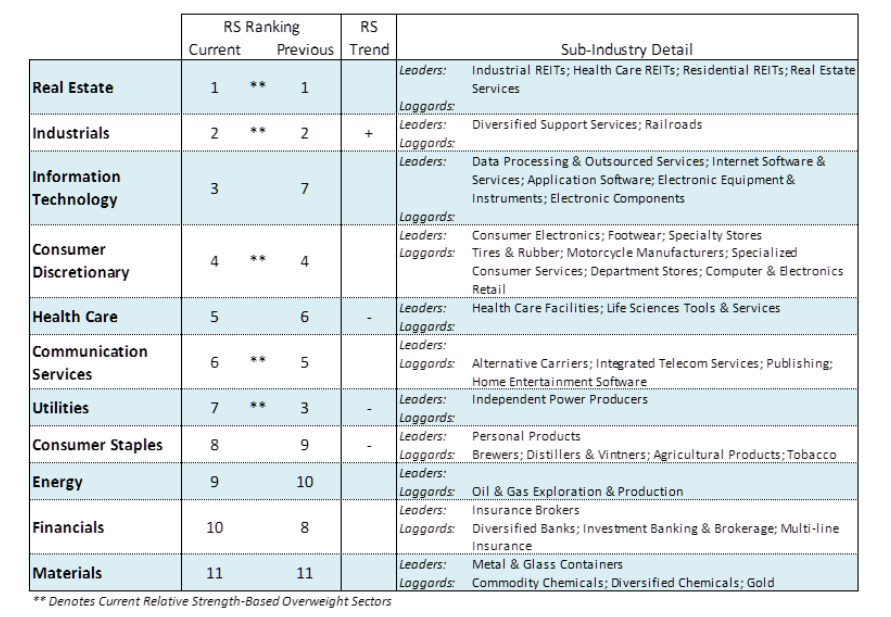

There has been a rotation in recent weeks toward sectors that are more closely aligned with the economy. Opportunities are most plentiful within the strongest sectors in our work which include a mix of defensive sectors as well as those tied to the economy. With low unemployment and strong wage growth, consumer discretionary and real estate sectors have risen to the top of our work. Health care is considered a defensive play, as an aging population continues to grow. Additionally, industrials could benefit from a positive agreement with China.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.