The U.S. equity markets have started the final quarter of the year with a broad-based rally.

Stocks are being supported by a growing confidence that the economy can produce sufficient profit growth to overcome valuations that are seen to be high by many historical measures. And investors have agreed with that thus far as the S&P 500 Index (INDEXSP:.INX) is up nearly 14%.

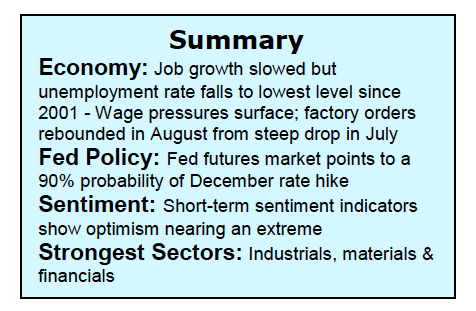

Despite distortions to the weak September employment numbers, there are clear signs that the economy is gaining momentum. The concern is that a stronger economy will translate into higher interest rates. The yield on the benchmark 10-year Treasury note would likely need to rise toward 3.00% (currently 2.30%) to provide sufficient competition to impact the equity markets. In terms of short-term rates, the fed funds futures market now gives a 90% likelihood that the Federal Reserve will raise interest rates before year end.

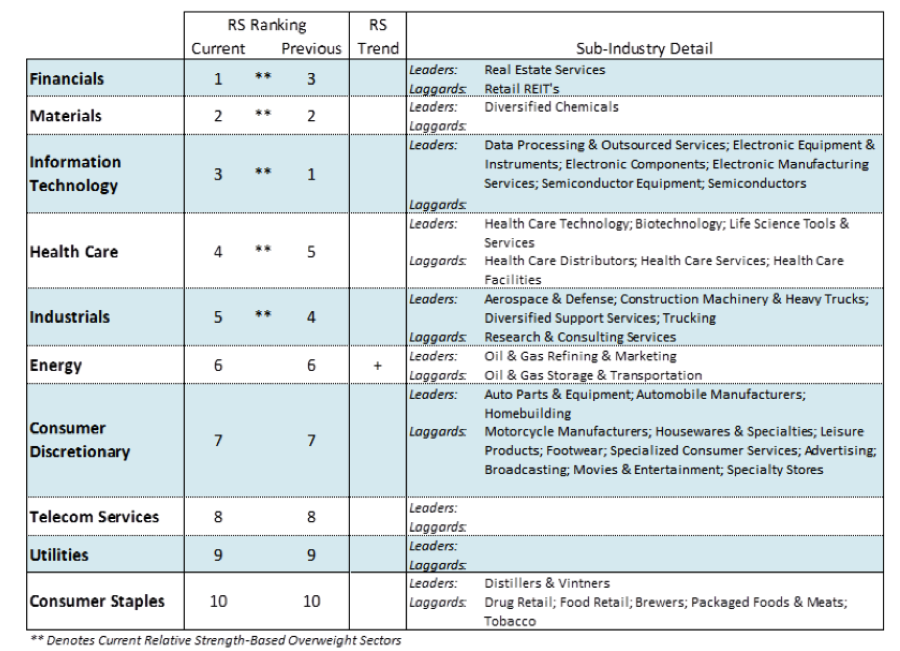

Fed Chief Janet Yellen has provided sufficient advance notice of a December rate increase and it should be assumed that fed funds rate of 1.5% is already built into current prices. Investors should focus on the strongest sectors that include the material, industrial and financials. The fact that defensive areas of the market continue to lose relative strength is seen as a bullish signal that the path of least resistance is to the upside.

Technical Indicators

Below we take a look at key technical indicators including trend analysis, stock market breadth, and seasonals point to the likelihood for higher prices in the fourth quarter.

Trend indicators are bullish with most equity indices hitting new highs. This is also true globally as more than 80% of world stock markets are at new highs. This is important because bull markets are almost always global in nature. This is very different than the 2015 experience when foreign markets were in downtrends while the U.S markets were at new highs, which eventually led to a correction in our equity markets. Historically, the stock market becomes vulnerable when divergences are present as some indices are falling while others are rising. In the present example nearly all global indices are in uptrends.

Breadth improved significantly with 75% of S&P 500 issues trading above their 50-day moving average, up from 68% the previous week. The percentage of S&P 500 stocks trading above their 200-day moving average was unchanged last week at 74%. The NYSE advance/decline line hit a new record high last week and the NDR Global Composite A/D is also at new highs. Additionally, the percentage of industry groups within the S&P 500 in defined uptrends jumped to 73% last week from 68%. A rise in the percentage of groups in uptrends above 75% would be a bullish intermediate-term signal indicating most sectors and groups are in gear with the primary trend.

Seasonally, the stock market is entering the strongest three months of the year. The fact that stocks traded higher in September, the weakest month of the year, is an indication of good underlying strength.

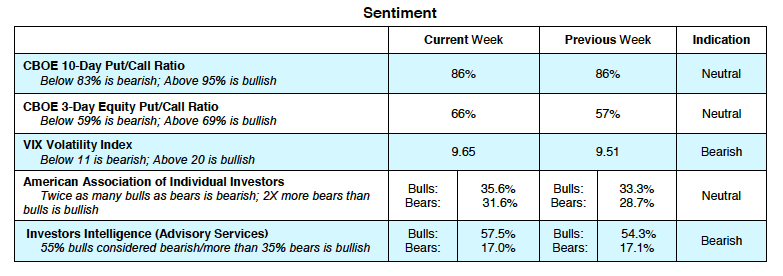

Sentiment indicators have moved into the excessive optimism zone offering the potential for a short-term pullback before stocks move into the year-end rally phase that is expected to carry the averages to new highs. Investors Intelligence (II) reports a jump in bulls to 57.5% from 47.1% two weeks ago. Historically, readings above 60% argue for defensive measures. The bearish camp fell to 17.1%, remaining in the confines of this year’s range of 16.5% to 18.3%. A new low in the percentage of bears would also be a signal of a potential correction. The National Association of Active Investment Managers shows an unusually high allocation to stocks above 90% indicating unusual optimism. The CBOE reports a continued reduced demand for put options. The CBOE 10-day put/call ratio closed at Friday at 86%. A drop to 83% would trigger a short-term sell signal.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.