The Dow Jones Industrial Average (INDEXDJX: .DJI), S&P 500 Index (INDEXSP: .INX) and NASDAQ Composite (INDEXNASDAQ: .IXIC) stock market indices hit record highs last week.

Investors (and equity markets) are feeling encouraged by the agreement with China at the Japan G-20 meeting to resume trade negotiations.

The financial markets are also benefiting from anticipation that the Federal Reserve could lower interest rates in late July.

However, a better than expected June jobs report removes the likelihood of a 50-basis point cut in interest rates. The jobs report points to the fact that job opportunities and higher wages are encouraging people into the workforce and speaks to the resiliency of the U.S. economy that is faced with trade wars and ongoing weakness in overseas economies.

This will likely translate into consumer spending and continued growth and reduces the need for the central bank to add fuel to the economy by making a significant cut in interest rates.

The CME FedWatch tool is pointing to a 93% chance of a quarter-point interest rate cut by the Federal Reserve at its July meeting. Some clarity on the issue of interest rates will come when Fed Chairman Powell speaks to Congress this Tuesday.

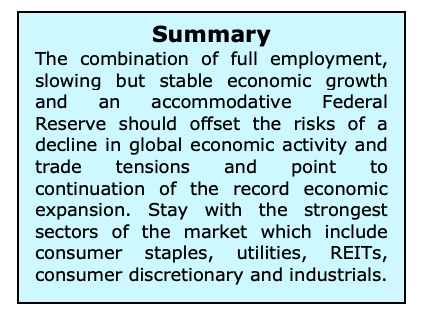

Entering the new week, investors will be focusing on earnings reports where, according to FactSet, S&P 500 companies are expected to report earnings decline of 2.6% for the second quarter, with a projected decline of 0.5% in the third quarter and projected earnings growth of 6.3% in the fourth quarter. While we cannot ignore the risks of a decline in global economic activity, the bottom line is that the combination of full employment, along with the distinct possibility of Fed easing, points to ongoing economic expansion.

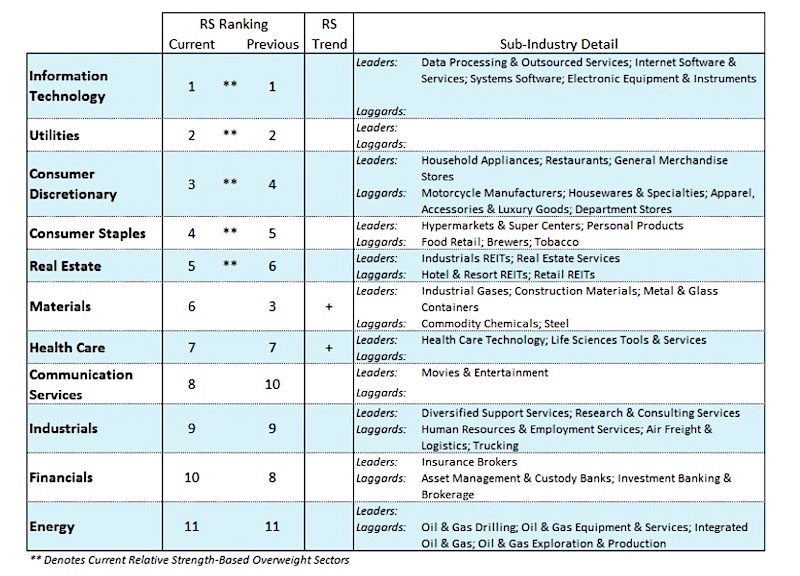

At this point in the economic cycle with low interest rates and decelerating earnings growth we continue to recommend defensive sectors including consumer staples, utilities and REITs.

We also suggest focusing on those areas that historically do well following an initial rate cut by the Fed. These include the consumer discretionary and industrial sectors. The financial sector has underperformed for nearly two years. We are encouraged by the fact that the Bank Stock Index moved above its 50- and 200-day moving averages last week.

Additionally, within the financial sector, the Broker/Dealer Index has made a series of higher lows the past few months and is also trading above its 50-and 200-day moving averages. It should be noted that the broker/dealer group has a good record as a leading indicator of the stock market.

From a technical perspective there has been ongoing improvement in stock market breadth. This is seen in the increasing number of NYSE and NASDAQ issues hitting new 52-week highs. Additionally, the percentage of S&P 500 stocks trading above the 200-day moving averages climbed to 75% last week, matching the level last seen at the September 2018 peak.

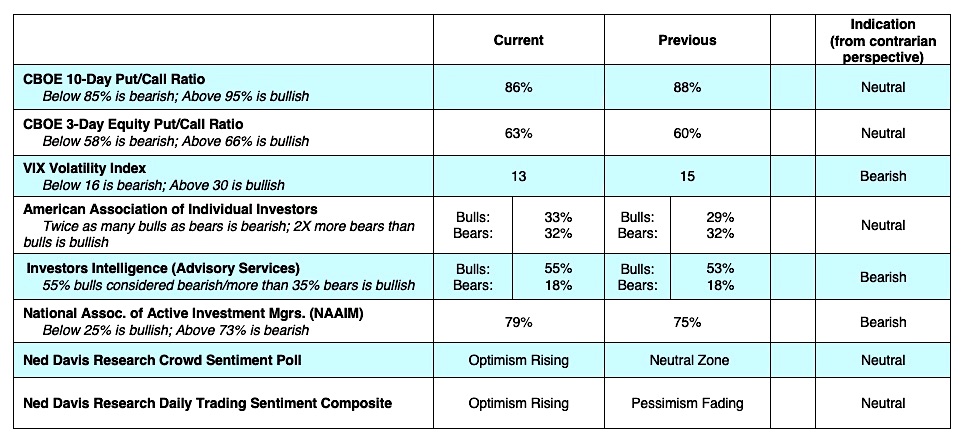

Last week produced confirmation of the new high in the S&P 500 Index by the Dow Industrials and NASDAQ hitting new highs. New highs by the popular averages have attracted an increased level of investor optimism as seen in the precipitous drop in the demand for put options (puts are bought in anticipation of a market decline) and the CBOE Volatility Index (VIX) falling to levels associated with investor complacency. We use investor sentiment as a contrary opinion indicator.

Although optimism is building with the rise in stock prices, most measures of investor psychology remain at a distance from showing the level of excessive optimism that often precedes a market reversal.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.