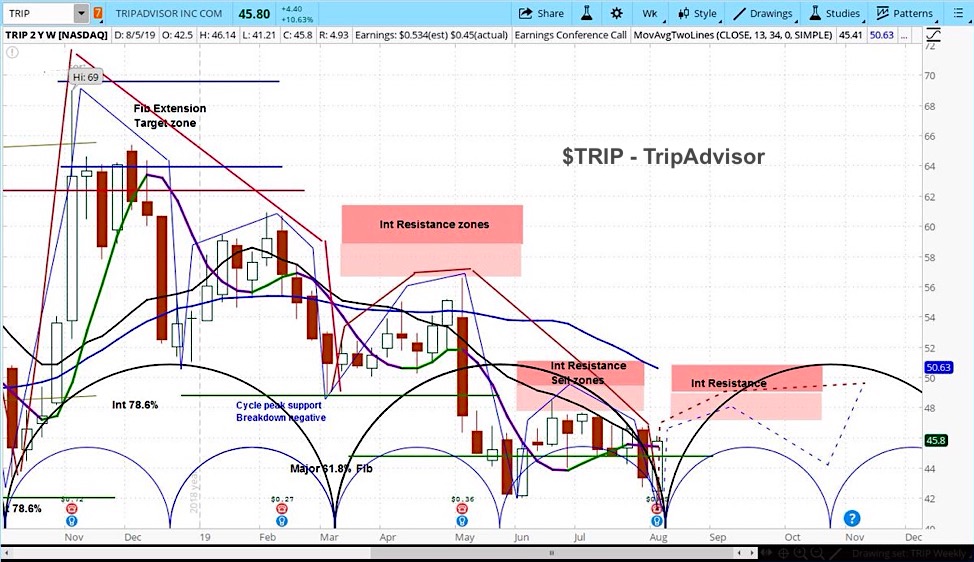

TripAdvisor NASDAQ: TRIP Stock Weekly Chart

Trip Advisor’s stock (TRIP) rallied on Thursday, even after the company posted earnings that missed Wall Street expectations.

Based on its market cycles, we believe the stock is forming a bottom, with higher prices likely in the coming weeks.

Our approach to stock analysis uses market cycles to project price action.

We believe the stock is now in the rising phase of a new cycle. Our analysis shows a bottom forming, with a likely move near $49 in coming weeks.

Trip Advisor Earnings Report and Outlook

The company reported earnings per share of $0.45 and total revenue of $422 million, compared to analyst estimates of $0.51 and $446 million. Yet revenue increased by 28% in its priority experiences and dining category.

Trip Advisor’s CEO Steve Kaufer explained that, “We delivered strong profitability amid ongoing investments aimed at future growth. We are operating with increased customer focus, and we are laying the foundation to deepen customer relationships with our platform.”

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.