Last Friday the Bank of Japan (BOJ), Japan’s central bank, surprised the markets and enacted a negative interest rates policy.

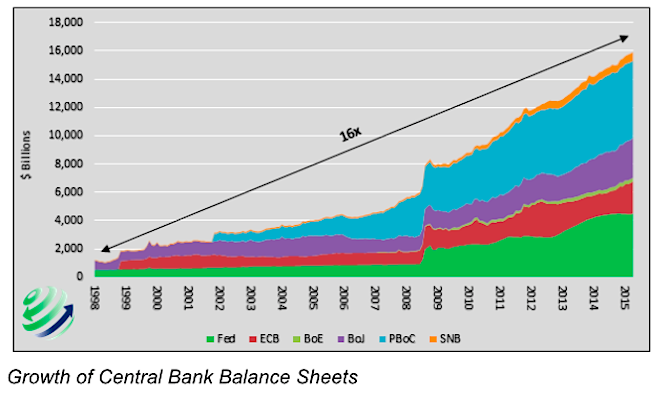

This stunning action follows on the heels of the European Central Bank (ECB), which took similar actions last year. Both regions, along with most of the world’ s leading economies, are dealing with excessive debt loads, anemic economic growth and falling productivity growth.

Faced with the growing risk of deflation and default, they have decided to keep playing the game and pray that more debt is the answer to their debt problem. It isn’t!

In 2015, we shared why we thought gold was an asset that investors should hold. We wrote two articles (you can find both links below) which discussed its value and history as an insurance policy against economic and currency mischievousness. On the heels of the Bank of Japan’s actions to enact negative interest rates, we believe it is appropriate to remind investors that monetary policy is broken and, in such times, financial insurance assets/plays should be considered.

You do not have to have a PHD in economics to understand that when negative interest rates are required to help generate economic growth something is wrong.

More From Michael:

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.